C4: Regional roadway-generated transportation

funding for transit

September 26, 2023

Executive summary

• Dedicating a portion of new or increased roadway-generated revenues to transit is a

potential solution to address structural operating budget challenges.

• Shifting roadway-generated revenues to transit aligns with ON TO 2050’s congestion

management goals and the plan’s call to match the costs of the transportation system to

those who benefit from its use. ON TO 2050 also aims to incentive transit use and grow

ridership. By making strategic investments in the transit system, the region can provide

substantial co-benefits to roadway users by lessening congestion and support

greenhouse gas reduction in the region.

• Some of the road revenues identified could be useful to meet transit’s imminent fiscal

cliff but should not (or cannot) be part of a long-term solution. Other, more durable

sources make sense as part of an overall transit funding structure wherein

transportation revenues are a primary resource for addressing transportation needs.

• Roadway-generated revenues can not only provide additional funds for transit, but also

incentivize more people to switch from driving to transit, thereby increasing ridership

and supporting climate goals.

• The RTA Act currently provides the RTA with the powers to levy either a regional sales

tax or select regional transportation fees (such as a motor fuel tax) to support transit.

Any decision to use roadway-generated revenues to support transit would require the

Illinois General Assembly (ILGA) to amend the RTA Act to allow the use of multiple or

new revenue mechanisms.

• To use tolling or cordon pricing to fund transit, the ILGA would need to authorize

implementation.

PART recommendations on

Page 2 of 24 roadway-generated revenues

• There is a strong connection between parking and transit, particularly in transit-rich

areas. Commercial parking taxes are already imposed by various jurisdictions in the

region, and an increased fee could be dedicated to fund transit.

Overview of roadway-generated transportation

revenues

Transportation funding in northeastern Illinois is generated from a variety of sources, including

federal, state, local, and system-generated revenues. Funds are used to construct, operate,

administer, and maintain the current roadway and transit system, as well as improve and

enhance the system to meet present-day and future transportation needs. Within the larger

transportation funding process, roadway-generated revenues are those funds created by

imposing fees to use roadway assets or to own and operate vehicles.

In Illinois, the main roadway-generated transportation revenues are the state motor fuel tax

(MFT) and state motor vehicle registration fees.

a

These revenues are principally used to support

transportation capital investments in the state. Other roadway-generated transportation fees

collected in Illinois include parking taxes on commercial garages and tolls collected on Illinois

Tollway assets.

b

Motor Fuel Tax

In 2022, the state collected $2.5 billion in gross MFT revenues.

c

After deductions for specific

transportation-related funds (i.e., Grade Crossing Protection Fund) and operating funds for the

Illinois Department of Transportation (IDOT), as well as allocations to other state departments

(i.e., Illinois Environmental Protection Agency), most net MFT revenues are allocated to

counties, local governments, and IDOT’s Road Fund and State Construction Account. Following

reforms in 2019, a small portion of MFT funds is now allocated to the RTA and the Downstate

a

Motor fuel taxes and registration fees are also levied by counties, townships, and municipalities to support local

transportation needs, but these have been excluded from this discussion.

b

Other transportation fees that have been excluded from consideration at this time include automobile renting

taxes (ARTs) and fees on transportation network companies (TNCs). Although the RTA Act provides the RTA with

the power to impose an ART, the service of renting automobiles will be captured in recommendations to expand

the sales tax base to include additional services. For a discussion of these recommendations, see the companion

memo on the PART webpage (https://www.cmap.illinois.gov/programs/regional-transit-action

). Also, while the

City of Chicago taxes TNC rides, there are challenges to scaling up a TNC fee further. First, TNC data is proprietary

and largely unavailable for most of the region. Stronger data sharing requirements for TNCs and similar private

transportation providers are needed to better understand and manage their activity. Second, the private funding

model behind these companies traditionally works to offset the true costs of transportation for consumers. Given

that the pandemic has changed market conditions for TNCs, and more of these costs are being pushed to

consumers, it has become unclear how reliable a fee on TNCs would be for the transit system.

c

MFT collection and allotment statistics are provided for December 1st through November 30

th

of the following

year. 2022 figures are the most recent annual figures available, and reflect collections and allocations from

December 1, 2021, to November 30, 2022.

PART recommendations on

Page 3 of 24 roadway-generated revenues

Mass Transit District for capital improvements (Table 1). The Road Fund and State Construction

Account principally support roadway-related investment activities across Illinois, while transit

capital improvement funds support transit-related capital investments in their respective

regions.

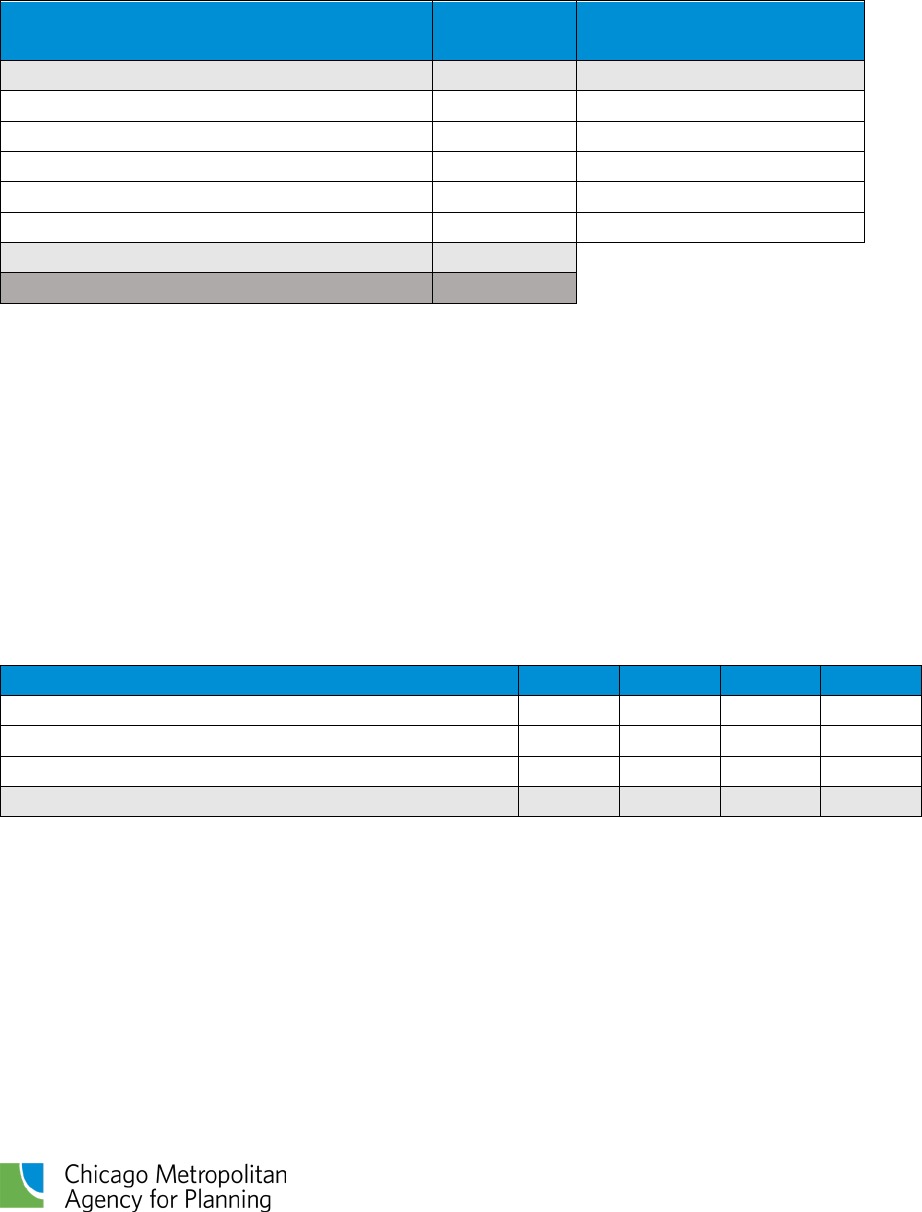

Table 1: Illinois Motor Fuel Tax deductions & allocations, 2022

Fund category

Figures

(in millions)

Allocated funds as a

percent of net collections

Total funds for allocation

$2,179.8

100%

Road Fund & State Construction Account

$1,023.3

46.9%

County & local governments

$912.0

41.8%

Transit capital improvement funds

$244.5

11.2%

Regional Transit Authority

$220.1

10.1%

Downstate Mass Transit District

$24.5

1.1%

Total deductions

$288.1

Gross collections

$2,467.9

Source: CMAP analysis of IDOT data

Motor vehicle registration fees

In fiscal year 2023 (FY23), the state collected $1.6 billion from motor vehicle and operator’s

license fees. These fees, which include driver license fees, personalized and specialty license

plate fees, and motor vehicle registration fees, are deposited into the Road Fund to directly

support roadway capital projects across the state. On average, between fiscal year 2020 and

2023, motor vehicle registration fees and electric vehicle surcharge fees respectively

contributed $18.5 million and $9.2 million annually (Table 2).

Table 2: Illinois motor vehicle registration fee revenues, fiscal years 2020-2023

Revenue source (in millions)

FY2020

FY2021

FY2022

FY2023

Vehicle registration fee

$17.2

$20.0

$18.4

$18.0

Vehicle registration surcharge on electric vehicles

$8.6

$10.0

$9.2

$9.0

Registration title transfer fee

$12.4

$12.2

$10.3

$9.5

Total vehicle registration fees

$38.3

$42.2

$37.9

$36.5

Source: CMAP analysis of Illinois Comptroller data

Commercial parking taxes

The State of Illinois, Cook County, and the City of Chicago all currently impose a tax on

commercial parking lots and garages within their respective geographies. The state and Cook

County charge 6-9 percent of the parking cost depending on whether the parking is paid on a

daily, weekly, or monthly basis.

1

Meanwhile, the City of Chicago parking tax rate is 22 percent

for weekday parking, including weekly or monthly passes, and 20 percent for weekend

parking.

2

While many communities in the region can directly impose fees on public parking

PART recommendations on

Page 4 of 24 roadway-generated revenues

spaces, the City of Chicago’s long-term lease agreement with Chicago Parking LLC precludes

them from adding any surcharges to the price charged by the private operator of the city’s

public street parking. Therefore, Chicago’s parking tax on commercial garages is the main

mechanism the city possesses to collect revenues from parking moving forward. In 2019, the

tax generated $144 million for Chicago. Although revenues dropped to $65 million during the

height of the pandemic (in 2020), revenues from the city’s commercial parking tax are

projected to be $136 million in 2023 (94 percent of the pre-pandemic level).

Illinois Tollway tolls

The Illinois Toll Highway Authority (the “Illinois Tollway” or “Tollway”) is self-funded using

revenue from tolls which constitute the transportation fees levied on vehicles using the nearly

300-mile, 12-county tollway system that spans portions of Interstates 80, 88, 90, 294, and 355.

Tolls are levied based on vehicle type (passenger or commercial) and the number of axles. The

revenues primarily support maintenance and operation of the Tollway system’s infrastructure

via direct expenditures, debt service payments on revenue bonds used to fund system

expansion, system reconstruction and improvements, and contributions to capital investment

accounts. In fiscal year 2019 (FY19), tolls generated $1.46 billion in revenues for the Tollway.

Despite a decline in 2020, toll revenues are projected to be $1.52 billion in FY23.

Recommendation: Leverage roadway-generated

revenues for transit

The current transit operating funding crisis does not exist in a vacuum. Statewide and regional

transportation systems are also facing significant challenges; decades of underinvestment have

created a significant backlog of capital projects. As a result, poor roadway and transit system

conditions continue to be a primary driver of capital needs and expenditures across Illinois and

the Chicago metropolitan region. Rebuild Illinois directed some incremental revenues to transit

capital projects — which has helped provide system enhancements and prevent the capital

backlog from growing — but significant transit capital needs remain. Despite this progress,

nearly all the roadway-generated revenues outlined above are currently directed to roadway

projects.

A strong and well-operated transit system benefits roadway users and advances state and

regional multimodal strategies to improve mobility, regional economic competitiveness, climate

resilience, and overall quality of life. New and existing roadway-generated revenues present

opportunities to provide greater support to transit, and to ensure transportation revenues are a

primary resource for addressing transportation needs.

To better support the state and region’s multimodal goals, several opportunities exist to

leverage roadway-generated revenues to support transit needs in northeastern Illinois. Some of

the road revenues identified could be useful to meet transit’s imminent fiscal cliff but should

PART recommendations on

Page 5 of 24 roadway-generated revenues

not (or cannot) be part of a long-term solution (see below, Option 1). Other, more durable

sources make sense as part of the overall transit funding structure (Options 2-6). Given the

clear nexus between roadway and transit systems (i.e., congestion management, greenhouse

gas emission mitigation), road revenues can and should provide solutions to a range of regional

transportation issues.

Road revenue options for transit

The following options for road revenues in northeastern Illinois are based on expanding or

adjusting existing transportation user fees (for transportation revenue options pertaining to

federal or state capital funds, see the companion memos on the PART webpage).

3

In addition to the policy rationale behind matching transportation user fees with the costs of

the transportation system, these options align with guidance around the Illinois Transportation

Taxes and Fees Lockbox Amendment (the “Transportation Lockbox Amendment”), which states

that any taxes or fees collected in relation to the transportation system can only be used to

fund transportation costs.

d

Although thoughts may differ over the specific use of these

resources and their role in supporting either annual transit operations or transit capital

investments, the sources discussed below lack any inherent restrictions that preclude one use

over the other. As such, this memo discusses funding options in the context of the overall PART

focus on operating funding for transit.

4

Future work will be needed to determine how specific

funding sources should be aligned with specific uses.

• Option 1: Impose a motor fuel tax surcharge in the RTA region and dedicate the new

funds to transit. This will require the ILGA to amend the RTA Act provision that

precludes the use of a regional transit motor fuel tax alongside the existing RTA sales

tax.

• Option 2: Impose a vehicle registration fee surcharge in the RTA region and dedicate

the incremental revenues to transit.

• Option 3: Increase existing commercial parking taxes and dedicate the additional

revenue to transit.

• Option 4: Increase existing Illinois Tollway tolls and dedicate a portion of the increment

to transit.

• Option 5: Add new tolls on currently un-tolled IDOT expressways and dedicate a

portion of the increment to transit.

• Option 6: Implement cordon pricing around the Chicago central business district.

d

The Transportation Lockbox Amendment was passed via state ballot measure in 2016. The legality of the

amendment was later affirmed in 2022 when the Illinois Supreme Court ruled on Illinois Road and Transportation

Builders Association et al. v. the County of Cook.

PART recommendations on

Page 6 of 24 roadway-generated revenues

Option 1: Impose a MFT surcharge in the RTA region for

transit.

The MFT is a critical piece of the state’s transportation funding strategy. However,

improvements to vehicle fuel efficiency and the uptake of electric vehicles (EVs) are increasingly

eroding the MFT’s sustainability as a revenue source. The ILGA began addressing this dynamic

in 2019 with the passage of Rebuild Illinois, the state’s most recent capital investment program.

Rebuild Illinois included changes to the MFT and provided MFT revenues to support transit

capital expenditures. Specifically, the program doubled the base MFT rate to 38.0 cents per

gallon, tied future annual increases of the rate to inflation, and directed incremental MFT

revenues to a newly established Transportation Renewal Fund (TRF). The TRF provides capital

funds for state and local transportation investments like previous funding structures, as well as

the newly established Regional Transportation Authority and Downstate Mass Transit District

capital improvement funds.

Despite these changes, the existing state MFT does not fund transit operations. Imposing a MFT

surcharge within the RTA region could provide a secure, dedicated revenue source for

additional transit capital investments and/or transit operations. CMAP estimates that every

additional $0.05 per gallon surcharge imposed in the RTA region is estimated to generate an

additional $135 million in annual revenues.

A MFT surcharge could be implemented in the RTA region quickly using the RTA’s taxing

authority and existing MFT collection mechanisms. However, improvements to vehicle fuel

efficiency (including growing uptake of electric vehicles) and anticipated changes in travel

behavior are expected to continue eroding MFT revenues over time. In fact, statewide MFT

revenues are only projected to continue growing due to the now-indexed rate and analytical

assumptions that vehicle miles travel will continue to increase indefinitely. MFT revenues are

also unlikely to keep pace with transportation costs, which persistently grow at a faster rate

than inflation. Other revenue tools will ultimately be needed to replace the MFT and support

the transportation system, such as a road usage charge or a vehicle miles traveled tax.

PART recommendations on

Page 7 of 24 roadway-generated revenues

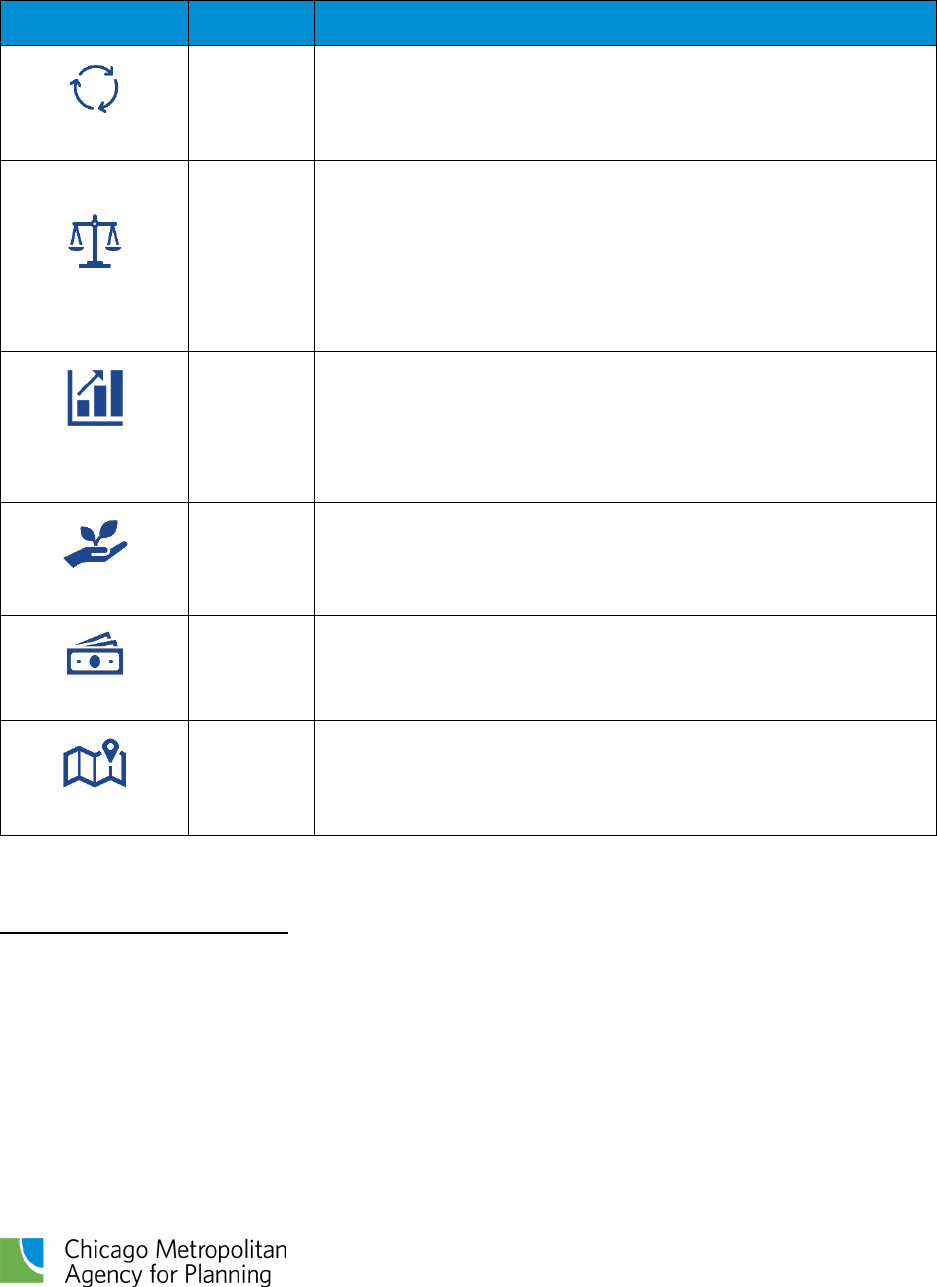

Evaluation

e

Policy

Category

Rating

Rationale

Mobility

Medium

Increasing vehicle fuel costs in the RTA region could

encourage mode shift to transit and thereby reduce

congestion.

Equity

Low

The MFT is a factor of vehicle fuel efficiency and is therefore

more regressive than other road fees based only on miles

traveled. Charging a MFT surcharge, regardless of ability to

pay, places a greater cost burden on vulnerable populations

that drive in the region, who are more likely to have older,

less fuel-efficient vehicles.

Revenue

sustainability

Low

MFT revenues are eroding due to improving fuel efficiency

and fleet electrification. This is not a sustainable funding

solution in the long-term.

Environment

High

Imposing a regional MFT surcharge will likely result in a net

reduction in greenhouse gas emissions because it

disincentivizes vehicle miles traveled.

Economy

Medium

A regional MFT is unlikely to have a significant impact on

aggregate economic growth or access to economic

opportunities.

Regional benefit

Regional

A regional MFT would increase the region’s contributions to

transit funding.

e

To evaluate different recommendations, CMAP developed a rubric for both policy impact and process difficulty.

Policy evaluations are ranked from low to high. "High" means the recommendation would lead to significant

improvements in the policy outcome (e.g., greater mobility or additional access to economic opportunities);

"Medium" means the recommendation would have a neutral or minimal impact (e.g., no significant impact on

transit ridership); and "Low" means the recommendation would worsen policy outcomes (e.g., having a

disproportionate impact on low-income communities). For the "Regional benefit" category, the options are

"Urban," "Suburban," and "Regional," designating where benefits are concentrated. For all process evaluation

categories except timing, the scale ranges from "Low" (difficult) to "High" (easy or relatively straightforward). For

"Timing," the options are "Near" (implementation could happen between now and 2026), "Medium"

(implementation could occur between 2026 and 2028), and "Long" (implementation would likely be beyond 2028).

PART recommendations on

Page 8 of 24 roadway-generated revenues

Process

Category

Rating

Rationale

Administrative

feasibility

High

A regional MFT surcharge can easily be administered using

current mechanisms and distributed to the RTA/transit by the

state.

Political

feasibility

Medium

There is the potential for opposition to an increase to the MFT

on the heels of recent Rebuild Illinois adjustments to the rate.

Additional opposition may come from the proposed use of a

funding source that has traditionally been limited to capital

funding for transit operations. Nevertheless, support – and

statutory precedence – exists for using transportation

revenues to meet the need for transit funding.

Timing

Near

Given the ease of implementation, revenues from a MFT

surcharge could likely be realized by the end of 2025.

State span of

control

High

To enact a regional MFT, the ILGA would need to amend the

RTA Act provision that precludes the RTA from levying a

regional transit MFT alongside the existing RTA sales tax.

Implementation steps

State legislative action

The ILGA would need to amend the RTA Act provision that precludes the RTA from levying a

regional transit MFT alongside the existing RTA sales tax. Alternatively, the ILGA could levy a

regional surcharge that is administered at the state-level and direct the funds to RTA.

State agency action

Regardless of the legislative action taken, the Illinois Department of Revenue (IDOR) would

collect the revenues generated from the additional regional MFT rate and distribute the

regional share to the RTA to fund transit operations.

Challenges

Given that the state MFT was increased in 2019 and inflationary pressures have raised the price

of gasoline in recent years, it may be politically challenging to further add to the costs of motor

fuel.

PART recommendations on

Page 9 of 24 roadway-generated revenues

Option 2: Impose a regional vehicle registration fee for

transit.

As previously noted, vehicle registration fees, or “wheel taxes,” are currently levied by the State

of Illinois, as well as county and municipal governments. Within northeastern Illinois, 159

municipalities impose vehicle registration fees on residents, ranging from $5-90 per vehicle. As

transportation user fees that increase the costs of driving and therefore encourage mode shift

to alternate forms of travel, registration costs have a strong nexus with the transit system and

could be used to provide direct support for transit.

In addition to modernizing the MFT, Rebuild Illinois also changed state motor vehicle

registration fees in 2019. As a result, the annual Illinois vehicle registration fee is a flat fee of

$151 per registered vehicle with electric vehicles paying an additional annual $100 surcharge

because they do not pay state motor fuel taxes. Registration costs in Illinois are considered

relatively high compared to some neighboring states, including Wisconsin, Indiana, and

Missouri, but are lower than others (Minnesota, Iowa, and Michigan).

f

Using historic vehicle

registration data and population forecasts, CMAP estimates the region could generate between

$60-70 million for transit operations from every $10 levied on top of the existing state fee.

Although Illinois is not the only state that imposes a flat registration fee (which is charged

regardless of vehicle value or income), this fee structure is more regressive than other state

fees that are calculated according to factors such as vehicle weight, value, and age (which are

more likely to correspond to a vehicle owner’s income and ability to pay). Were the vehicle

registration process modernized to assign costs according to vehicle characteristics, the system

could lead to more equitable taxation outcomes.

Evaluation

Policy

Category

Rating

Rationale

Mobility

Medium

Increasing vehicle ownership and operation costs in the RTA

region could encourage mode shift to transit and reduce

congestion.

f

States with lower registration costs might be coupled with higher registration costs at the municipal- or county-

level.

PART recommendations on

Page 10 of 24 roadway-generated revenues

Equity

Medium

While any increase to the state’s flat rate registration fee is

potentially regressive, the cost of vehicle registration will

remain a small share of the total cost of owning a vehicle,

which is itself significantly greater than the cost of traveling by

transit.

5

Additionally, lower-income households own fewer

vehicles than higher-income households, and therefore will

not be as negatively impacted by this option. As seen in other

states, registration solutions that assign costs to vehicle

characteristics could further reduce inequitable impacts.

Revenue

sustainability

High

A regional vehicle registration surcharge is likely sustainable in

the long-term, although the number of vehicle registrations in

the RTA region has declined slightly in recent years.

Environment

High

A regional vehicle registration surcharge will likely result in a

net reduction in greenhouse gas emissions because increasing

the cost of vehicle ownership incentivizes mode shift.

Economy

Medium

A regional vehicle registration surcharge is unlikely to have an

impact on economic growth.

Regional

benefit

Regional

The regional vehicle registration fee would increase the

region’s contributions to the overall transit funding strategy.

Process

Category

Rating

Rationale

Administrative

feasibility

High

A regional vehicle registration surcharge could easily be

administered under existing processes. Since registration fees

are collected by the state, funds would need to be distributed

to the RTA region.

Political

feasibility

Medium

The 2019 increases to the state vehicle registration fee may

make this option unpopular. Efforts to tie the registration fee

to factors such as vehicle weight, value, and age could reduce

some fees and improve political feasibility.

Near-term

Given the ease of implementation, revenues from a MFT

surcharge could likely be realized by the end of 2025.

PART recommendations on

Page 11 of 24 roadway-generated revenues

Timing

State span of

control

High

The ILGA would be required to authorize this regional revenue

option by amending the RTA Act.

Implementation steps

State legislative action

The ILGA would need to authorize a regional vehicle registration fee for the RTA region and

could do so by amending the RTA Act. In doing this, the state should not preclude the use of a

motor vehicle registration fee alongside the RTA sales tax. Alternatively, the ILGA could levy a

regional registration fee surcharge administered by the state and directed to the RTA.

State agency action

Regardless of the legislative action taken, if implemented, the Secretary of State would need to

administer and collect both the state vehicle registration fee and RTA regional surcharge.

Incremental revenues for transit would need to be distributed to the RTA.

Challenges

Given that the state raised the vehicle registration fee in 2019, from $101 to $151, additional

increases may be politically challenging.

There are important equity implications for increasing a flat fee. To assuage concerns about

increasing the burden on vulnerable populations within the region, the state should explore

more equitable implementation options like calculating vehicle registration costs according to

the value, weight, or age of the vehicle.

Option 3: Increase parking taxes for transit.

There is a strong nexus between parking and transit, particularly in transit-rich areas. Taxing

commercial parking in targeted ways can incentivize users to shift from single-occupancy

vehicles to transit and other transportation alternatives (e.g., micromobility, active modes),

thereby reducing congestion and emissions. The City of Chicago, Cook County, and the State of

Illinois all already impose taxes on commercial parking in their respective geographies.

An additional commercial parking tax could be implemented in several ways. The monies could

be generated through either an increase to any of the existing tax rates or an additional flat fee

(e.g., $2.50 per parking transaction). Geographically, the increased cost could be levied across

the entirety of the RTA region, only within the Chicago central business district (CBD), and/or

PART recommendations on

Page 12 of 24 roadway-generated revenues

other transit-rich areas, or a combination. A tiered rate or fee could be charged on parking

located within or outside of these designated geographies.

Evaluation

Policy

Category

Rating

Rationale

Mobility

High

Increasing the cost of parking has the potential to reduce

vehicular trips within and to areas with high concentrations of

commercial parking, like the Chicago CBD. This is expected to

shift some travelers to transit reducing congestion and driving

an increase in transit ridership.

Equity

Medium

Increasing the cost of parking does not account for ability to

pay and could unduly burden low-income drivers. However,

vulnerable populations are less likely to drive and park within

transit-rich areas like downtown Chicago, which shifts the

burden onto travelers with the ability to pay more for parking.

A tiered structure that imposes higher fees on designated

geographies based on transit availability than on other portions

of the region would improve the equity of outcomes.

Revenue

sustainability

Medium

A commercial parking tax has moderate revenue potential. For

example, rate increases that achieve 50% of Chicago’s

budgeted 2023 revenues could provide $60-70 million in

transit funding. At the same time, parking tax revenues from

the transit-rich areas like the CBD are also susceptible to

changing travel patterns and economic trends.

Environment

High

Mode shifts (from vehicular travel to transit) driven by

increased parking costs will have a net positive impact on

emission mitigation.

Economy

Medium

Decreased travel to transit-rich areas driven by increased

parking costs could impact businesses in the short-term.

Improved transit service is anticipated to offset these impacts.

Long-term, fewer cars in transit-rich and business-rich areas

would not only make them more friendly to users of active

transportation but may lead to more local tax revenue from

real estate appreciation and business activity.

PART recommendations on

Page 13 of 24 roadway-generated revenues

Regional

benefit

Urban/

Regional

A parking tax for transit would increase the local and/or

regional contributions to the overall transit funding strategy.

Process

Category

Rating

Rationale

Administrative

feasibility

High

Increasing the commercial parking tax rate could leverage

existing implementation mechanisms.

Political

feasibility

Medium

Consensus building among stakeholders where this policy is

implemented would be required to advance additional tax on

commercial parking.

Timing

Near-term Revenues can be realized by the end of 2025.

State span of

control

Medium

An increase in commercial parking taxes could be implemented

several different ways. If desired, the state could maintain

control by increasing their own commercial parking tax and

dedicating incremental funds to transit. The ILGA could also

amend the RTA Act to remove the restriction regarding levying

a regional parking tax alongside the existing RTA sales tax and

to focus the regional tax on commercial facilities (rather than

public).

If not implemented by the state, a single entity (Cook County

or Chicago) should implement the additional commercial

parking tax to support transit and ensure consistent and

transparent application.

Implementation steps

Local action

The state, Cook County, and/or the City of Chicago would need to pass a rate increase or an

additional fee to their existing commercial parking tax to implement this proposal. Revenues

generated from the parking tax increase should be earmarked for funding transit operations.

PART recommendations on

Page 14 of 24 roadway-generated revenues

Challenges

The pandemic’s impact on travel behavior has called the long-term reliability of parking fees

into question. While some parking garages have benefitted from increased tourist activity,

remote work, among other issues, continues to impact overall usage of commercial parking

facilities and parking tax revenues have not yet surpassed pre-pandemic levels.

6

If these trends

continue, parking fees could further erode over time. This is especially true of the Chicago CBD,

which has the highest concentration of commercial parking in the region.

Changing the attractiveness of parking by imposing greater fees may ultimately depress the

availability of future parking fee revenues. However, the potential of mode shift to advance

many of the region’s broader policy goals related to congestion management and emissions

reduction – while also providing revenues for transit – should be thoroughly considered when

weighing tradeoffs.

Option 4: Increase existing tolls and dedicate a portion

of the increment to transit.

The Illinois State Toll Highway Authority, or “Illinois Tollway”, is the agency charged with

building, operating, and maintaining toll roads in the state. Compared to roadways that are

operated by IDOT and local county and municipal transportation departments, which rely on

federal, state, and local monies to fund maintenance and operations, the Illinois Tollway

primarily relies on toll revenues collected from its own system. These toll revenues are used to

fund operations, such as Tollway staff costs, snow and ice control, and traffic monitoring and

incident response. Toll revenues are also used to fund the Tollway’s capital expenditures, which

include roadway reconstruction, expansion, and systemwide maintenance. While some toll

revenues fund capital costs directly, the Tollway’s multi-year capital programs – such as their

current 15-year, $14 billion capital program, Move Illinois – are largely funded by proceeds from

bonds that are secured by future toll revenues.

The toll fees upon which the Tollway relies are, in their essence, a true user-based fee: some

users choose to pay for access to faster or more direct routes (tollways), while others choose

alternate routes or means of travel (i.e., non-tolled roadways or transit). Accordingly, tolls serve

an important system demand management role by imposing the true cost of vehicle trips on

drivers using certain roadway assets, incentivizing mode shift and transit ridership, and

reducing congestion. Increasing the cost of tolls would advance these regional priorities and

could be used to provide a sustainable revenue source for transit operations.

If desired and directed by the state, the Illinois Tollway could dedicate a portion of its revenues

to transit, which could be funded by increasing tolls. Increasing tolls by 30% within the RTA

region is estimated to generate an additional $450 million in annual revenue. This revenue

estimate includes increasing tolls paid by freight trucks, which are currently indexed to the

Consumer Price Index (CPI) and adjusted on an annual basis. In general, trucks already shoulder

PART recommendations on

Page 15 of 24 roadway-generated revenues

a disproportionate share of the costs imposed through tolling and the nexus between

commercial vehicles and transit is less straightforward. Therefore, while it is important to

ensure freight trucks continue to pay for their use of the tollways, excluding trucks from a toll

increase for transit would reduce the estimated annual revenues to $180 million. The Illinois

Tollway may consider an initial increase in passenger car rates to bring passenger car and

freight truck rates into better proportion. This could be followed by an annual CPI adjustment

to the rates for passenger cars to maintain future parity with trucks.

Evaluation

Policy

Category

Rating

Rationale

Mobility

Medium

Increasing the costs of operating a vehicle in the RTA region

could help manage congestion on the existing interstate

system and better reflect the true cost of roadway use.

Equity

Medium

Increasing tolls is expected to have a marginal impact on

vulnerable travelers because tolls are not a substantial share of

transportation costs, and higher-income households contribute

a larger share of toll revenues than lower-income households.

7

Revenue

sustainability

High

Toll revenues are stable, and increased tolls have strong

revenue potential in the region. Changes in future tollway

revenues from currently tolled assets could impact the

Tollway’s credit rating and/or bond financing. Accordingly, any

discussions about use of toll revenues from the Tollway system

should include in-depth consultation and partnership with the

Illinois Tollway.

Environment

High

Increasing tolls may result in reductions in greenhouse gas

emissions. While tolls are not a substantial share of

transportation costs, increases will contribute to the overall

cost of driving and may result in some mode shift toward

transit or canceled trips. Some drivers may choose to divert to

local roads, highlighting the long-term importance of a

consistent, comprehensive approach to regional road pricing

(see Option 5 below).

Economy

Low/Medium

Increasing tolls for trucks could further burden freight and

other related industries that transport goods and materials

within and through the region, which could negatively impact

economic growth. If trucks are excluded from increased tolls,

this option will not have as direct an impact on economic

growth.

PART recommendations on

Page 16 of 24 roadway-generated revenues

Regional

benefit

Regional

Additional revenue generated from a toll increase would add

to the region’s contributions to the overall transit funding

strategy.

Process

Category

Rating

Rationale

Administrative

feasibility

High

The Illinois Tollway has the authority to increase tolls and

can rely upon existing toll collection infrastructure. Further

examination of Tollway’s Trust Indenture is required to

better understand the terms in which toll revenue can be

used to support transit. Additional administrative support

will likely be needed by the Illinois Tollway and Illinois

Department of Revenue (IDOR) to facilitate the collection

and distribution of funds for transit.

Political

feasibility

Medium

There would likely be opposition to increasing tolls on freight

trucks but may be some support for increasing tolls on

passenger vehicles given the relatively flat growth of those

rates over time. Tolls could be increased via an Illinois

Tollway Board vote or, if necessary, statutory mandate,

contingent funding, or some other legislative means. The

ILGA would be required to direct a portion of toll revenues to

the RTA region.

Timing

Near-term

Given that the increase relies exclusively on existing capital

infrastructure and revenue collection mechanisms, this

option could be implemented quickly, potentially yielding

additional revenues by the end of 2025.

State span of

control

Medium

While the Illinois Tollway would implement any decision to

increase tolls in the RTA region, the action would require the

ILGA to direct the Illinois Tollway to dedicate a portion of toll

revenues to the RTA region.

Implementation steps

State legislative action

The Illinois Tollway has the authority to increase tolls by itself, but the ILGA would need to

direct the Tollway to dedicate a portion of toll revenues to transit in the RTA region.

State agency action

PART recommendations on

Page 17 of 24 roadway-generated revenues

The Illinois Tollway Board would likely need to vote to increase tolls, unless otherwise

mandated by the ILGA.

Challenges

Given that toll revenues have already been used to secure bond financing for the Illinois

Tollway, increasing toll fees and dedicating tollway revenues to another use (i.e., transit) may

negatively impact the Tollway’s credit ratings. This could impact both their current financing – if

bondholders consider the toll increases risky – and their ability to access financing at favorable

interest rates in the future. Further exploration of this option would benefit from an Illinois

Tollway assessment of its potential impact. Any increases in tolls and diversion of funds to

support transit should be implemented in collaboration with the Tollway to minimize any

negative externalities.

Option 5: Add tolls on existing IDOT expressways within

the RTA region and dedicate a portion of the increment

to transit.

Instead of increasing existing tolls, tolling could be expanded to all the IDOT expressways within

the RTA region that are not currently tolled. Comprehensively expanding tolling to all facilities

would provide the greatest congestion management and revenue generation benefits for the

region, but managed lane and variable pricing strategies could also be considered.

g

Accordingly,

modeling that applies a toll rate of $0.15-0.20 per mile of freeway in the RTA region indicates

this option could raise an additional $1.7 billion in gross annual revenue.

h

The vast majority of revenues generated by tolling the existing IDOT system would need to be

dedicated to rebuilding those facilities over the next thirty years. To support the billions of

dollars needed to reconstruct these aging assets, the region’s Financial Plan for Transportation

identifies tolling IDOT expressways that have been targeted for reconstruction as a “reasonably

expected revenue.”

8

That said, opportunities exist in expanding tolling to introduce an

additional increment that can generate consistent, reliable funding for transit while also

advancing the region’s expressway state of good repair needs.

Currently, tolls are imposed in parts of the RTA region where few alternatives to driving exist.

Conversely, transit-rich areas within the region have fewer tolls, are more likely to experience

congestion, and are in built-up environments where additional roadway expansion poses

significant challenges. Tolling expressways in transit-rich parts of the region (such as the

expressways within Chicago and Cook County (e.g., Interstate 90/94)) would incentivize mode

g

Additional work is needed to determine the costs and benefits of these alternative congestion mitigation

strategies.

h

The $0.15-0.20 per mile input is based on the current toll rate for Illinois Route 390, instead of the Tollway

average, which is $0.06 per mile.

PART recommendations on

Page 18 of 24 roadway-generated revenues

shift to transit, advance congestion management across the highway system, and reduce the

greenhouse gas emissions attributable to the transportation system.

Likewise, expanding tolling in areas of the region that experience high levels of truck congestion

would improve travel times for all users of the roadway system while generating funds to

support the state of good repair needs across the region. Finally, working to ensure parallel

transit service (e.g., Pace’s Bus on Shoulder program) is made available for newly tolled facilities

located in transit-poor areas of the region will be critical to support a coordinated tolling

system that more accurately matches the transportation alternatives available to travelers with

the costs of driving in the region.

Additionally, depending on the nature of the physical and technological investments made, the

tolling system could be sufficiently flexible to adapt to future travel patterns and allow the state

to enact a form of congestion pricing on certain IDOT regional infrastructure.

Evaluation

Policy

Category

Rating

Rationale

Mobility

High

Increasing the cost of driving on highways throughout the

region would reflect the true cost of road use, encourage

transit ridership, and reduce congestion.

Equity

Medium

Adding new tolls is expected to have a marginal impact on

vulnerable travelers. In general, tolls are not a substantial share

of the cost of driving and are less regressive than other existing

transportation revenue sources that rely on motor vehicle fuel

efficiency and flat fees (i.e., motor fuel taxes and vehicle

registration fees). Additionally, higher-income households

contribute a larger share of toll revenues (and peak-period

travel) than lower-income households.

9

Nevertheless, tolling IDOT’s radial facilities would introduce a

more diverse customer base than the Tollway’s current users.

Any discussions about expanding tolling should include in-depth

consultation and partnership with the Illinois Tollway, as well as

support to advance equity and limit negative impacts to the

most vulnerable users.

High

The revenue potential from new tolls is strong, and it would

likely be a stable revenue source.

PART recommendations on

Page 19 of 24 roadway-generated revenues

Revenue

sustainability

Environment

High

New tolls will result in a moderate reduction in greenhouse gas

emissions. Increasing the cost of driving may contribute to

mode shifts toward transit and other non-car modes, while

improvements in congestion management will reduce

greenhouse gas emissions from those users that continue to

drive.

Economy

Medium

The short-term economic impact of expanding tolling is

dependent on the rate at which commercial and private users

are tolled.

The longer-term economic impact of tolling IDOT expressways

is expected to be high as it enables the rebuilding the existing

facilities and substantially support transit.

Regional

benefit

Urban/

Regional

Additional revenue generated from new tolls would increase

the region’s contributions to the overall transit funding

approach.

Process

Category

Rating

Rationale

Administrative

feasibility

Medium

A tolling services agreement between IDOT and the Illinois

Tollway would be needed to ensure that the Tollway’s back-

office could support toll collection on IDOT’s facilities.

Assuming the necessary capital infrastructure can be funded

and installed, new tolls could then be collected by existing

tolling technology and systems.

Waivers may need to be secured from the federal government

to authorize tolling on IDOT expressways. Any approach to

expanding tolling on these roads would require coordination

between state, regional, and federal agencies.

Political

feasibility

Low

Adding tolls to currently untolled assets would shift how

travelers move through the region and would likely face

opposition from existing users. However, within the current

system, most of the untolled assets are in areas with greater

transit access.

PART recommendations on

Page 20 of 24 roadway-generated revenues

Timing

Long-term

Significant capital infrastructure investments are needed to

implement this option. Revenues would not be recognized for

some time.

State span of

control

Medium

The federal government would need to allow IDOT to add tolls

to toll-free assets. These waivers require state support, and

state agencies (IDOT, Illinois Tollway) would need to

coordinate to successfully expand tolling.

Implementation steps

State agency action

IDOT and the Illinois Tollway would implement the toll expansion, if the federal government

provides an exception to existing regulations that prohibit adding tolls to untolled assets. IDOT

and the Tollway would need to be directed to develop a tolling services agreement for the

Tollway to provide back-office services to IDOT.

Challenges

Adding tolls to untolled assets is currently only permitted by the federal government on a

limited basis. To implement this option, the federal government would need to provide an

exception to the region and could consider the region for a pilot program such as the Value

Pricing Pilot Program (VPPP).

10

Option 6: Levy cordon pricing in the Chicago CBD

Cordon pricing is a congestion management and road pricing strategy that imposes a fee on

vehicles entering a defined geographic boundary. Cordons tend to be implemented in CBDs

where vehicle congestion is high, air quality is a concern, and transit is an available alternative.

Implementing cordon pricing in the Chicago CBD provides an opportunity to account for the

negative impacts imposed by driving on the area, like increased congestion, and decreases in

both air quality and traffic safety. At the same time, cordon pricing incentivizes travelers to

mode shift to other means of travel. The Chicago CBD is a strong candidate for cordon pricing

because of its robust transit network, which provides travelers with various low-cost

transportation alternatives through walking, biking, taxi, urban bus and rail (i.e., CTA), or

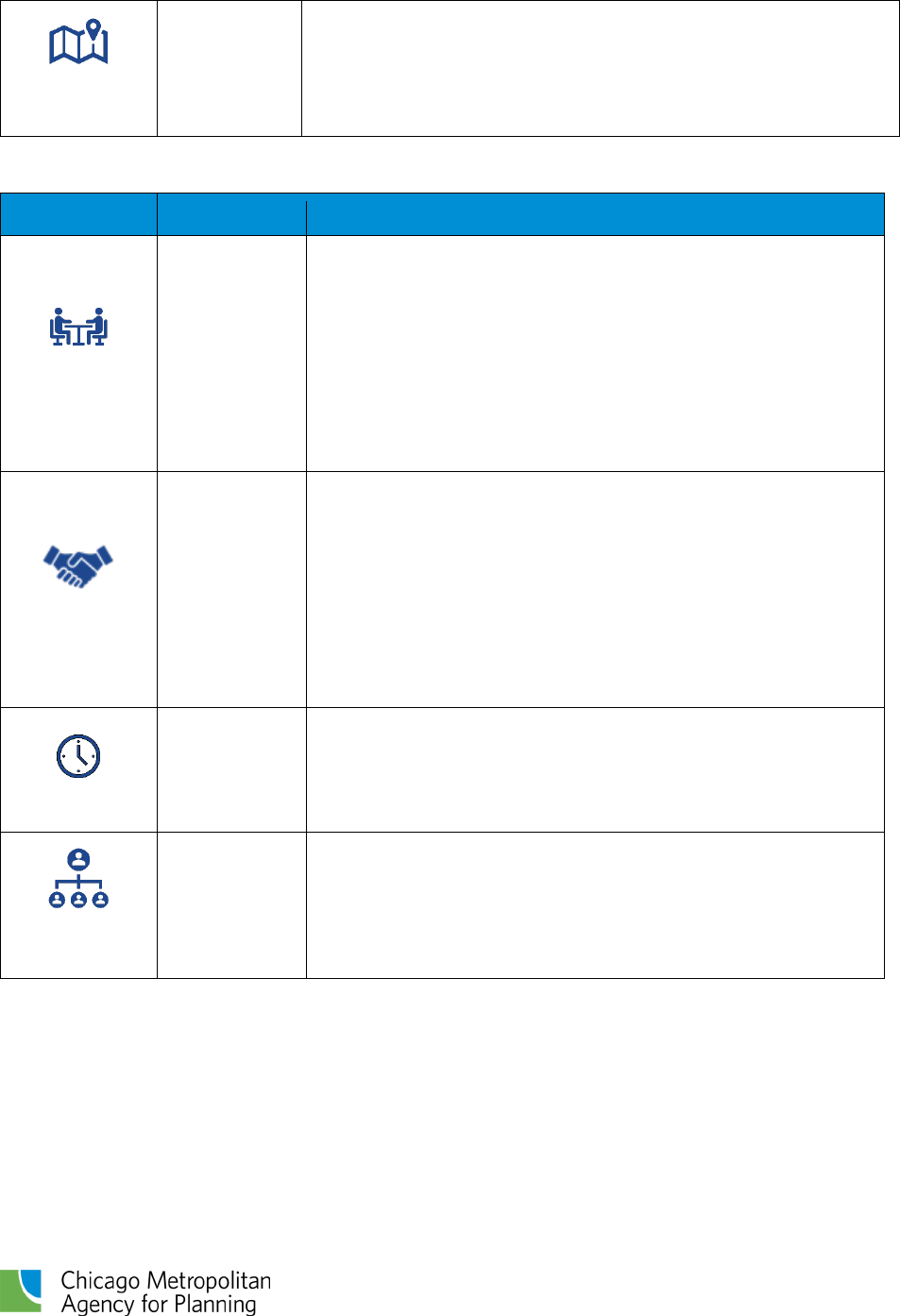

commuter rail (i.e., Metra). Figure 1 shows the Chicago Downtown Surcharge Zone that was

used by CMAP for modeling purposes, which was previously studied by the City of Chicago.

Modeling results show that cordon pricing would generate significant revenue. Based on

cordon pricing characteristics from New York City and London, CMAP estimates annual

PART recommendations on

Page 21 of 24 roadway-generated revenues

revenues of $765 million for a low-fee scenario (comparable to New York City) and $1.3 billion

for a high-fee scenario (comparable to London), beginning in 2030.

i

If it were to be imposed, the cordon would always be in effect, including on weekends, but the

fee could vary by time of day. The fee could also differ by vehicle type (e.g., passenger vehicle,

light- or medium-duty truck, heavy-duty truck). As recommended, crossing the cordon during

peak weekday times costs the most, followed by off-peak weekday times, and then overnight

on weekdays. Table 3 shows cordon charges from the low-fee scenario. The modeled cordon

applied to city roadways in the central business district but not to the highways (Figure 1).

Table 3: Cordon charges could vary based on vehicle type and time of weekday.

Time of day

Automobile

Light/medium trucks

Heavy trucks

Peak weekday

$9

$18

$27

Off-peak weekday

$7

$14

$21

Overnight weekday

$5

$10

$15

Source: CMAP analysis of low-fee scenario, based on draft New York City cordon rates.

Figure 1: The modeled boundary for cordon pricing in the Chicago central business district is

based on the Chicago’s current downtown surcharge zone for Transportation Network

Companies (TNCs).

Source: City of Chicago

i

As modeled, revenues are only collected from drivers entering the cordon, not passing through on interstates.

PART recommendations on

Page 22 of 24 roadway-generated revenues

Evaluation

Policy

Category

Rating

Rationale

Mobility

High

Cordon pricing incentivizes travelers to mode shift to transit for

those trips ending within the cordon, instead of driving. This

would encourage transit ridership and reduce congestion.

Equity

High

A new fee could have some negative equity impacts, although

vulnerable populations are more likely to take transit and

travel during off-peak periods. While it was not included in the

modeling, implementers could consider providing income-

based waivers to residents and/or discounts to employers for

low-wage essential staff (i.e., janitorial staff)

to further mitigate

the impacts of a CBD cordon.

Revenue

sustainability

High Cordon pricing is projected to have a significant revenue yield.

Environment

High

Cordon pricing discourages vehicle trips, therefore reducing

vehicle miles traveled and emissions.

Economy

Medium

A CBD cordon is unlikely to have an impact on economic

growth. Reduced vehicle trips might result in fewer total trips

to the CBD, but improved transit service will offset these

impacts.

Long-term, fewer cars in transit-rich and business-rich areas

would not only make them more friendly to users of active

transportation but may lead to more local tax revenue from

real estate appreciation and business activity.

Regional

benefit

Urban/

Regional

Additional revenue generated from a CBD cordon would

increase the City of Chicago’s contributions to the overall

transit funding strategy.

PART recommendations on

Page 23 of 24 roadway-generated revenues

Process

Category

Rating

Rationale

Administrative feasibility

Low

A cordon would require a new collection mechanism

and administrative capacity.

Political feasibility

Low

A cordon is a

new and different transportation user fee,

which will likely be met with opposition.

Timing

Low Implementation is unlikely until 2030.

State span of control

Medium

Cordon pricing requires authorization from the ILGA

and coordination with state agencies.

Implementation steps

State and regional action

Cordon pricing requires authorization from the ILGA. Implementation will require coordination

from several agencies, including IDOT, the Tollway, the Chicago Department of Transportation,

among others. The charge could ultimately be operated by a public entity such as the Chicago

Department of Transportation or through a public-private partnership, as in London.

Challenges

Implementing cordon pricing requires significant capital investments to charge vehicles

entering the cordon. Tolling infrastructure would be required around the cordon.

Some travelers could change their travel patterns if a cordon is implemented. Distorted travel

patterns could mean increased vehicle miles traveled, as drivers take longer routes to avoid the

cordon boundary. Improving infrastructure that enables faster and more reliable movement

into and throughout the cordon area for transit users, cyclists and pedestrians could mitigate

this challenge.

PART recommendations on

Page 24 of 24 roadway-generated revenues

Endnotes

1

Cook County, “Parking Lot & Garage Operation Tax,” n.d., https://www.cookcountyil.gov/service/parking-lot-

garage-operation-tax; Illinois Department of Revenue, “Parking Excise Tax,” n.d., https://tax.illinois.gov/

research/taxinformation/excise/parking-excise-tax.html.

2

City of Chicago, “Parking Tax,” n.d.,

https://www.chicago.gov/content/city/en/depts/fin/supp_info/revenue/tax_list/parking_tax.html

.

3

Chicago Metropolitan Agency for Planning (CMAP), “Plan of Action for Regional Transit,” https://www.cmap.

illinois.gov/programs/regional-transit-action.

4

CMAP, “Plan of Action for Regional Transit Steering Committee,”

https://www.cmap.illinois.gov/documents/10180/1523087/PART+Steering+Committee+07.19.2023+presentatio

n.pdf/cc5d51d1-c34d-9634-9dd8-00543e7905d8?t=1689870006294.

5

Chicago Metropolitan Agency for Planning, “Improving Equity in Transportation Fees, Fines, and Fares,” April

2021,

https://www.cmap.illinois.gov/documents/10180/1307930/FFF_final_report.pdf/1d74b660-c1c3-a2c0-

dcb0-879d4493a499?t=1617741942903.

6

Alby Gallun, “The Car’s Comeback Is Easing Downtown Parking Garages’ Pain,” Crain’s Chicago Business,

September 24, 2021,

https://www.chicagobusiness.com/commercial-real-estate/downtown-chicago-parking-

garages-gain-customers-cta-metra-lose.

7

U.S. Department of Transportation, Federal Highway Administration, “Income-Based Equity Impacts of

Congestion Pricing—A Primer,” March 26, 2021,

https://ops.fhwa.dot.gov/publications/fhwahop08040/

cp_prim5_03.htm.

8

CMAP, “Financial Plan for Transportation,” October 2022, https://www.cmap.illinois.gov/documents/

10180/1439048/ON+TO+2050+Update+Financial+Plan+for+Transportation+Appendix.pdf.

9

U.S. Department of Transportation, Federal Highway Administration, “Income-Based Equity Impacts of

Congestion Pricing—A Primer.”

10

U.S. Department of Transportation, Federal Highway Administration, “Federal Tolling Programs,” Center for

Innovative Finance Support, n.d.,

https://www.fhwa.dot.gov/ipd/tolling_and_pricing/tolling_pricing/federal_

tolling_programs.aspx.