Better Roads Ahead

July 18, 2016

Frank Manzo IV

Policy Director

BETTER ROADS AHEAD

Vote YES on the Illinois Transportation Funds Amendment

BETTER ROADS AHEAD: VOTE YES ON THE ILLINOIS TRANSPORTATION FUNDS AMENDMENT

i

Executive Summary

The Illinois Transportation Funds Amendment would constitutionally protect– or “lockbox”– all revenue contributed

by drivers through motor fuel taxes, tollways, licenses, and vehicle registration fees and require that the money is used

solely for transportation purposes. Revenue generated by those who use transportation infrastructure would only be

allowed to be spent on public highways, roads, bridges, mass transit systems, commuter rail, airports, and other forms

of transportation.

This amendment to constitutionally protect transportation funds is a common-sense measure. As a multi-modal

transportation hub of America, Illinois needs high-quality transportation infrastructure. Motor fuel taxes, licenses, and

vehicle registration fees have always been intended to fund transportation infrastructure. A recent ballot initiative in

neighboring Wisconsin demonstrates that voters want their user fees to go to their intended purposes.

The Illinois amendment has strong bipartisan support from Republicans and Democrats. The Illinois House voted

98-4 in favor and the Illinois Senate voted 55-0 in favor of the constitutional amendment. Local governments, private

businesses, the Chamber of Commerce, labor unions, transportation associations, and regional planning organizations

have endorsed passage of the constitutional amendment.

Experience has shown that voters should not trust Illinois politicians to use transportation revenues on

transportation expenditures. Despite the fact that motor fuel taxes, licenses, and vehicle registration fees are all

intended for transportation funding, lawmakers have diverted about $6.8 billion from transportation funds since 2002.

An amendment to the constitution would prohibit lawmakers from creating new potholes and unsafe infrastructure over

the long run to close other, short-term budget holes.

The total cost of these diversions has been a $3.2 billion loss in economic output. Over the past decade and a half,

diversions out of the Road Fund, the State Construction Account, and other transportation funds have resulted in 4,747

fewer jobs in Illinois and a significant economic loss of $3.2 billion. A constitutional lockbox on transportation funds

would protect these jobs, boost the economy, and improve economic efficiency in Illinois.

Illinois politicians have wasted tax dollars on bureaucracy and mismanagement for too long. By requiring all

money from transportation-related taxes to be spent on transportation, the Illinois Transportation Funds Amendment

would increase funding for roads and bridges in Illinois. The lockbox amendment, if passed, would also increase funding

for safety inspections of roads, bridges, and commuter rail lines.

The Illinois Economic Policy Institute (ILEPI) urges the public to vote Yes on the constitutional amendment.

BETTER ROADS AHEAD: VOTE YES ON THE ILLINOIS TRANSPORTATION FUNDS AMENDMENT

ii

Table of Contents

Executive Summary

i

Table of Contents

About the Authors

Photo Credits

ii

ii

ii

Introduction

1

Why User Fees Should Be Protected

The Wisconsin Case Study

2

3

The Cost of Previous Diversions

4

In Their Own Words: Bipartisan Support in Illinois

5

The Economic Cost of Not Having a Lockbox

Concluding Remarks

6

8

Sources

10

About the Author

FRANK MANZO IV, MPP is the Policy Director of the Illinois Economic Policy Institute (ILEPI). He specializes in

labor market policies, economic development, infrastructure investment, the construction industry, and public finance.

He earned a Master of Public Policy from the University of Chicago Harris School of Public Policy and a Bachelor of

Arts in Economics and Political Science from the University of Illinois at Urbana-Champaign. He can be contacted at

Photo Credits

Cover: “Illinois State Route 126” © Creative Commons Flickr user Doug Kerr (left) and “Construction of the

Clybourn Avenue curb-separated bike lane” © Creative Commons Flickr user Steven Vance (right).

Page 2: “Chicago (ILL) Willis Tower ( Ex. SEARS Tower ) 1974, Near West Side, expressways 290 W.

Eisenhower, 94, 90. ‘ traffic ’” © Creative Commons Flickr user (vincent desjardins).

Page 4: “19681109 08 Dan Ryan L construction near Cermak Rd.” © Creative Commons Flickr user David

Wilson.

Page 6: “Interstate 55 - Illinois” © Creative Commons Flickr user Doug Kerr.

Page 8: “Amtrak Chicago Incoming” © Creative Commons Flickr user Loco Steve.

BETTER ROADS AHEAD: VOTE YES ON THE ILLINOIS TRANSPORTATION FUNDS AMENDMENT

1

Introduction

This November, Illinois voters will vote on a constitutional amendment that would prevent politicians in Springfield

from raiding transportation funds to address other budget shortfalls. The Illinois Transportation Funds Amendment,

HJRCA0036, would constitutionally protect– or “lockbox”– all revenue contributed by drivers through motor fuel taxes,

licenses, and vehicle registration fees and ensure that the money is used solely for transportation purposes. Revenue

generated by those who use transportation infrastructure would only be allowed to be spent on constructing, maintaining,

and repairing roads, bridges, mass transit systems, rail, airports, and other forms of transportation. The changes would

only apply to transportation-related fees (Reboot Illinois, 2016).

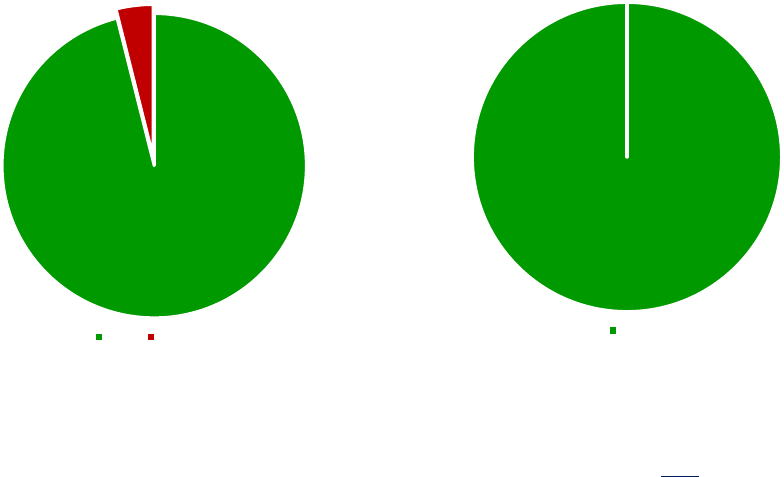

The constitutional amendment passed the Illinois General Assembly with nearly unanimous bipartisan support (Figure

1). On April 22, 2016, the House voted 98-4 in favor of the bill (96.1 percent). The bill was subsequently sent to the

Senate, where it was approved by a vote of 55-0 (100.0 percent) on May 5, 2016. The across-the-aisle support is

encouraging during this prolonged period of partisan gridlock in Illinois.

FIGURE 1: ILLINOIS GENERAL ASSEMBLY VOTES ON THE ILLINOIS TRANSPORTATION FUNDS AMENDMENT, APRIL-MAY 2016

Source(s): Ballotpedia, 2016a.

The Illinois Transportation Funds Amendment, or the “Illinois Lock Box Amendment,” will be decided upon by the

voters of Illinois. The Illinois Economic Policy Institute (ILEPI) urges the public to vote Yes on the constitutional

amendment, ensuring that the whimsical lawmakers of Illinois are prohibited from using transportation funds for

anything other than their stated purpose. The remainder of this ILEPI Policy Brief presents the economic rationale for

protecting user fees, discusses a similar constitutional amendment that passed in Wisconsin in 2014, examines the

previous sweeps and diversions from Illinois’ transportation funds, and assesses the economic costs of not having a

lockbox on transportation funds in Illinois. The report concludes by recapping key findings.

98

96.08%

4

3.92%

Illinois House Votes on Transportation

Funds Amendment (2016)

Yes No

55

100.00%

0

0.00%

Illinois Senate Votes on Transportation

Funds Amendment (2016)

Yes

BETTER ROADS AHEAD: VOTE YES ON THE ILLINOIS TRANSPORTATION FUNDS AMENDMENT

2

Why User Fees Should Be Protected

A “user fee” is simply a price paid by individuals for a government-provided good or service. Whereas a tax is levied

on the general population, a user fee is only charged when an individual uses a good or service. In transportation, user

fees are based on the principle that those who drive on the roads should pay for the roads. Motor fuel taxes, tolls, and

registration fees are examples of user fees that Illinois motorists pay in exchange for high-quality public infrastructure.

User fees have many advantages compared to general taxation. First, they promote taxpayer fairness. Infrastructure

investment is paid for by those who actually use the roads, bridges, and mass transit systems instead of being subsidized

by people who do not. Simply put, motorists get what they pay for. Second, road user fees give public bodies flexibility

to adjust revenues and expenditures to meet economic conditions. If a toll road becomes more congested, the Illinois

State Toll Highway Authority can raise the rate to generate more revenue, alleviate traffic, and improve the environment.

Finally, user fees eliminate the “free-rider” problem. While anyone can voluntarily choose to drive on public roads in

Illinois, constructing and maintaining the infrastructure is not free. User fees help to prevent overuse of public

infrastructure. Motor fuel taxes, tolls, and registration fees improve motorist awareness on the costs of driving on the

roads (Summers, 2005).

When Illinois’ residents pay road and mass transit user fees, there is a reasonable expectation that the money they

contribute will actually go to fund transportation infrastructure. However, state legislators have continually diverted

money in transportation funds to other purposes many times over the past decade and a half years. Only about 73 percent

of all spending from the Road Fund is on direct transportation expenditures (Manzo, 2014). From 2002 to 2015, an

estimated $6.8 billion was diverted away from the transportation funds to pay for general government, state police,

Department of Natural Resources, health insurance, workers compensation, and other costs (TFIC, 2016). Additionally,

in 2015, lawmakers decided to sweep $1.3 billion from special funds to close the state revenue gap– including $250

million from the Road Fund (The State Journal-Register, 2015).

BETTER ROADS AHEAD: VOTE YES ON THE ILLINOIS TRANSPORTATION FUNDS AMENDMENT

3

Illinois motorists deserve better. Most states have constitutional language designating how transportation revenues are

to be used; 19 have specific “trust funds,” or lockboxes. The future population of Illinois deserves high-quality

transportation infrastructure. Road Fund revenues should be used to close potholes created by vehicles, not close other

budget holes created by state politicians.

The Wisconsin Case Study

In 2014, voters in Wisconsin approved a comparable constitutional amendment called the “Wisconsin Transportation

Fund Amendment.” The amendment was “put on November 4, 2014 ballot to ensure that revenue generated from

transportation-related fees and taxes would be protected from diversion to non-transportation programs outside of the

Wisconsin Department of Transportation’s jurisdiction” (TIAC, 2014). In February 2013, the resolution passed the

Assembly by a vote of 82-13 (86.3 percent) and the Senate by a vote of 25-8 (75.8 percent).

Proponents of a constitutionally-protected transportation fund argued that it was a common-sense measure. In

Wisconsin, nearly $1.4 billion was diverted from transportation funds to other sources over a decade. Note that this is

significantly less than the $6.8 billion that has been diverted from Illinois’ Road Fund since 2002. Included in the 50-

organization coalition to lockbox Wisconsin’s transportation funds were local chambers of commerce, labor unions,

businesses, and transportation associations. This bipartisan, broad-based coalition was essential to garnering public

support for the constitutional amendment (TIAC, 2014).

The Wisconsin State Journal urged voters to approve the constitutional amendment. “State motorists deserve a

guarantee,” the newspaper wrote in an October 3, 2014 editorial. The state needed to get serious about paying for

transportation, the article continued. “Yet both major political parties, when in charge, have failed to raise as much

money in transportation revenue as they’ve spent on transportation projects. … Voters this fall can help steer state

leaders in the right direction by insisting the transportation fund is protected” (Wisconsin State Journal, 2014). The

Editorial Board of the Green Bay Press-Gazette concurred on October 15, 2014. The newspaper contended, “If those in

the State Capitol can’t stop themselves from taking money from designated funds and using it for unrelated expenses,

then maybe it’s time for a constitutional amendment to do that” (Ballotpedia, 2016b).

On November 4, 2014, 79.9 percent of Wisconsin residents voted Yes to the constitutional amendment compared to

20.1 percent voting No (Figure 2). With four-fifths of voters approving the measure, the amendment passed. Voters in

Illinois should do the same.

FIGURE 2: WISCONSIN TRANSPORTATION FUND AMENDMENT, QUESTION 1 – NOVEMBER 4, 2014 POPULAR VOTE

Election Result

Number of Votes

Percentage

Yes

1,733,101

79.94%

No

434,806

20.06%

Source(s): Ballotpedia, 2016b.

BETTER ROADS AHEAD: VOTE YES ON THE ILLINOIS TRANSPORTATION FUNDS AMENDMENT

4

The Cost of Previous Diversions

Opponents of the constitutional amendment are concerned that a lockbox on transportation funds would create budget

inflexibility at a time when Illinois needs to balance budgets. By specifically protecting transportation funds, politicians

could argue that other non-protected funds will be plundered to make up general budget shortfalls. Though valid, these

are generally weak arguments.

First, during the recent budget impasse in Illinois that lasted for over a year, the Illinois Department of Transportation

was nearly forced to shut down $2 billion in planned and ongoing public infrastructure projects. Politicians in Illinois

nearly halted spending on transportation– even though the revenue had already been generated through motor fuel taxes,

licenses, and other fees– because they could not find enough revenue to fund other services. Politicians should not be

able to suspend vital transportation investments and freeze taxpayer dollars that have already been paid by motorists

because they cannot find common ground to solve other revenue problems (The State Journal-Register, 2016a).

Lawmakers have not allocated transportation revenues wisely in the past. Since 2002, nearly $6.8 billion has been

diverted away from Illinois’ transportation funds to pay for other items. Less than three-quarters of the revenue paid by

Illinois’ drivers in motor fuel taxes, licenses, and vehicle registration fees was actually spent on direct transportation

expenditures from 2002 to 2012 (Manzo, 2014).

Illinois’ lawmakers should not be allowed to balance the General Fund in one year by taking surpluses from the Road

Fund that are intended for use in future years. Transportation fund diversions place an indirect cost on future generations,

who will have to pay to fix inadequate roads, bridges, and mass transit systems that have been underfunded. Driving on

roads in need of repair already costs Illinois motorists $441 per year in extra vehicle repairs and operating costs

(ISASCE, 2014). Diversions away from infrastructure investment have only increased this personal cost. An amendment

to the constitution would prohibit lawmakers from creating these new potholes in order to close other unnecessary

budget holes.

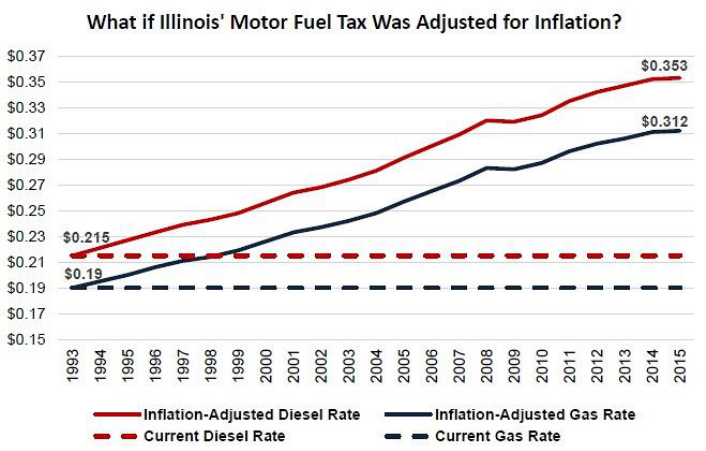

The costs of inaction on transportation funding have been substantial. Previous underinvestment, diversions, and

political decisions have resulted in a $43 billion transportation deficit in Illinois (MPC, 2016). In addition to political

BETTER ROADS AHEAD: VOTE YES ON THE ILLINOIS TRANSPORTATION FUNDS AMENDMENT

5

diversions, the failure by lawmakers to simply adjust motor fuel taxes for inflation has cost the state another $10 billion

since the 1990s (Figure 3).

FIGURE 3: ILLINOIS’ MOTOR FUEL TAX RATES IF THEY WERE ADJUSTED FOR INFLATION, MANZO & MANZO (2016)

Source(s): Manzo & Manzo, 2016.

The Illinois Transportation Funds Amendment promotes both government accountability and business confidence. By

providing a lockbox, Illinois residents can be assured that the money they pay to use the roads will actually go towards

the roads. Illinois residents want better infrastructure, and may be willing to pay slightly more in taxes or fees if they

know for certain that the money will go to improve roads and bridges. At the same time, contractors would be assured

that the state will have the necessary funds to continue investing in public infrastructure. Business confidence would

rise as transportation networks are modernized, making the flow of goods and people more efficient in Illinois.

The Economic Cost of Not Having a Lockbox

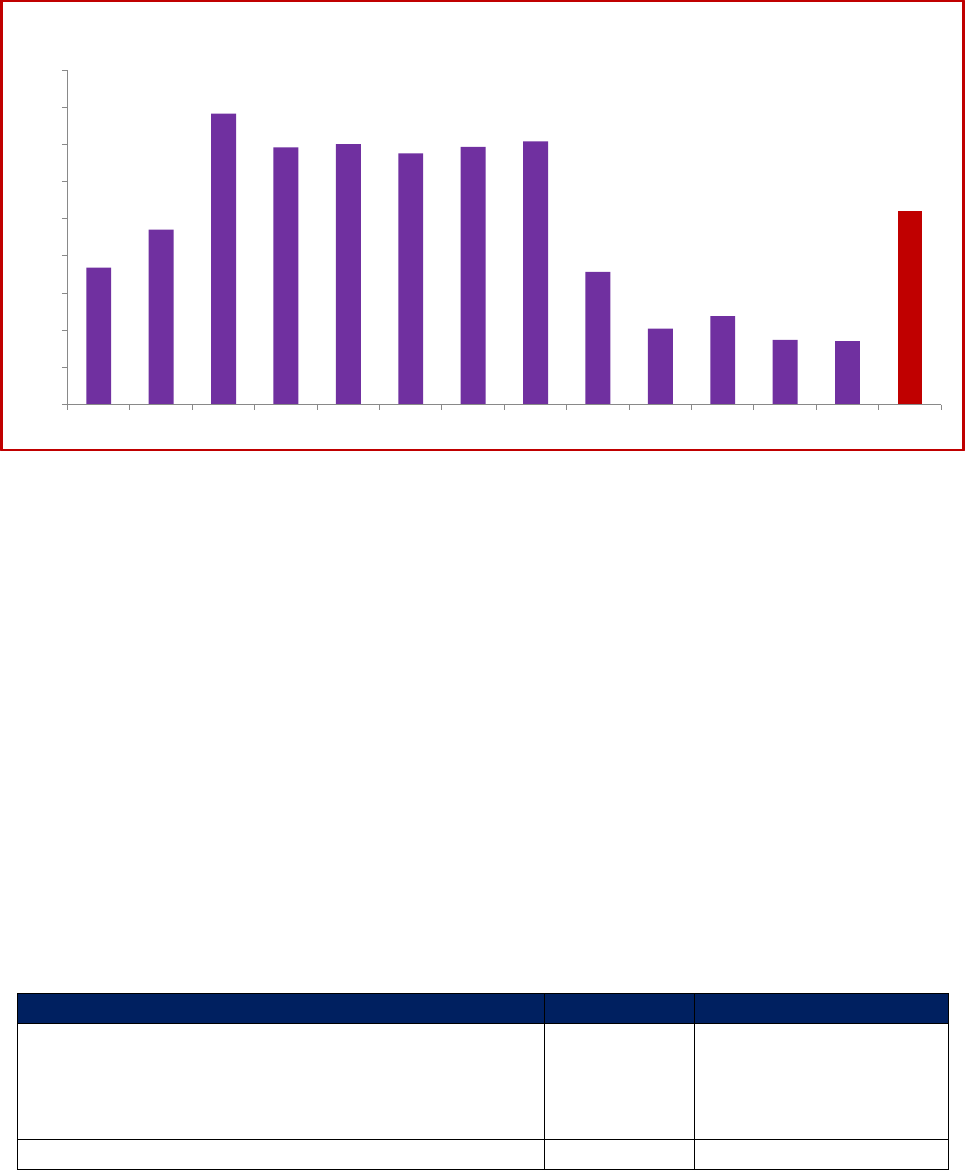

Over the past fourteen years, a total of $6.8 billion has been diverted from the Road Fund, the State Construction

Account, and other transportation funds for other purposes (Figure 4). These diversions represent about one-fifth of the

total revenue that was deposited into the accounts since 2002. Transfers to other funds ranged from $172 million to

$783 million per year. Most recently, politicians swept $522 million in transportation funds to close other budget holes

in 2015. The Illinois Transportation Funds Amendment would establish a firewall and prevent these diversions going

forward.

This section utilizes the IMPLAN (IMpact analysis for PLANning) software to measure the impact of these diversions

on total employment and economic activity in Illinois. IMPLAN is an input-output software that estimates the ripple

effect, or multiplier, of changes in industry spending. The input-output model investigates inter-industry relationships

in the Illinois economy based on Census data, specifically measuring market transactions between industries and

households. IMPLAN is considered the “gold standard” for economic impact modeling.

BETTER ROADS AHEAD: VOTE YES ON THE ILLINOIS TRANSPORTATION FUNDS AMENDMENT

6

IN THEIR OWN WORDS: BIPARTISAN SUPPORT IN ILLINOIS

Illinois Senate Republicans: “The constitutional amendment passed with

overwhelming support from both parties in the Legislature” (Illinois Senate GOP, 2016).

Illinois Democratic State Senator Bill Haine of Alton: “This is historic in the sense

that it will preserve the road fund from being raided for non-transportation, non-road

or bridge use” (Alton Daily News, 2016).

Illinois Democratic State Representative Brandon Phelps of Harrisburg: “It’s

important to have this lockbox amendment in place because it will leave more money

in transportation infrastructure, which will create more jobs” (The State Journal-

Register, 2016b).

Todd Maisch, President and CEO of the Illinois Chamber of Commerce:

“Together with lawmakers, the Illinois Chamber will spend the next six months

explaining to local chambers, business owners, laborers, and taxpayers that the

amendment will honor the promise that infrastructure projects will be sole beneficiary

of the Road Fund. … This will lead to a better transportation network, more jobs, and a

growing economy” (The State Journal-Register, 2016b).

Marc Poulos, Executive Director of the Indiana, Illinois, Iowa Foundation for

Fair Contracting, a labor-management group: “A thank you to 98 Representatives

and 55 Senators for protecting our transportation fees through a constitutional

amendment. Next up: voter approval on the November ballot” (Poulos, 2016).

BETTER ROADS AHEAD: VOTE YES ON THE ILLINOIS TRANSPORTATION FUNDS AMENDMENT

7

FIGURE 4: TOTAL DIVERSIONS FROM ILLINOIS’ TRANSPORTATION FUNDS BY YEAR, 2002-2015, IN MILLIONS OF DOLLARS

Source(s): Author’s analysis of TFIC, 2016 information.

Economic impact analyses produce three distinct effects: direct effects, indirect effects, and induced effects. The direct

effect is the impact on government as a result of the diversions. For instance, the diversions directly reduce the number

of blue-collar construction workers employed in Illinois because there are fewer dollars available to construct and

maintain transportation infrastructure. The indirect effect measures inter-industry purchases that occur, or fail to occur,

as a result of the diversions. As diversions reduce the investment in transportation construction projects, contractors

purchase less materials and machinery from other sectors in the Illinois economy. This is an indirect effect. Finally, the

induced effect is the broader consumer spending impact by those who are affected by the direct and indirect effects.

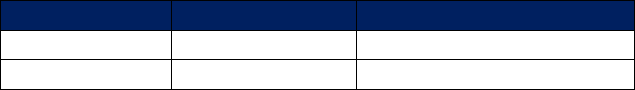

The economic cost of not having a lockbox on Illinois’ transportation funds has been significant (Figure 5). Since 2002,

diversions from transportation funds have cost more than 49,700 construction workers and transportation employees

their jobs. Estimates suggest that the diversions saved nearly 56,500 jobs at other state and local government agencies.

However, the cumulative indirect and induced effects have resulted in 11,500 jobs lost in other sectors of the Illinois

economy. In total, the economic cost of not having a lockbox on transportation funds has been a loss of 4,747 jobs in

the Illinois labor market since 2002.

FIGURE 5: ECONOMIC IMPACT ANALYSIS ON THE EFFECT OF TRANSPORTATION DIVERSIONS IN ILLINOIS, 2002-2015

Impact Type

Employment

Economic Output

Direct Effect: Construction and Transportation Workers

-49,736

-$6.16 billion

Direct Effect: State and Local Government Employees

+56,489

+$6.17 billion

Indirect Effect

-17,672

-$4.11 billion

Induced Effect

+6,172

+$0.93 billion

Total Effect

-4,747

-$3.17 billion

Source(s): Author’s analysis using IMPLAN, 2015.

The diversions also have had a negative impact on Illinois’ gross domestic product (GDP). Since 2002, not having a

lockbox on transportation funds has resulted in a $3.2 billion decline in economic activity throughout Illinois. The

$368

$471

$783

$692

$701

$676

$694

$708

$357

$204

$238

$174

$172

$522

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Diversions from Illinois Transportation Funds from 2002-2015 (in Millions)

BETTER ROADS AHEAD: VOTE YES ON THE ILLINOIS TRANSPORTATION FUNDS AMENDMENT

8

diversions from the Road Fund, the State Construction Account, and similar funds result in an overall loss of jobs and

a drop in economic output in Illinois. Therefore, this accounting gimmick by politicians is economically inefficient

(Figure 5).

Concluding Remarks

The Illinois Transportation Funds Amendment would constitutionally protect– or “lockbox”– all revenue contributed

by drivers through motor fuel taxes, tollways, licenses, and vehicle registration fees and require that the money is used

solely for transportation purposes. Revenue generated by those who use transportation infrastructure would only be

allowed to be spent on public highways, roads, bridges, mass transit systems, commuter rail, airports, and other forms

of transportation.

This amendment to constitutionally protect transportation funds is a common-sense, bipartisan measure. As a multi-

modal transportation hub of America, Illinois needs high-quality transportation infrastructure. Motor fuel taxes,

licenses, and vehicle registration fees have always been intended to fund transportation infrastructure. The Illinois House

voted 98-4 in favor and the Illinois Senate voted 55-0 in favor of the constitutional amendment. Local governments,

private businesses, the Chamber of Commerce, labor unions, transportation associations, and regional planning

organizations have endorsed the constitutional amendment.

Experience has shown that voters should not trust Illinois politicians to use transportation revenues on transportation

expenditures. Despite the fact that motor fuel taxes, licenses, and vehicle registration fees are all intended for

transportation funding, lawmakers have diverted about $6.8 billion from transportation funds since 2002. An

amendment to the constitution would prohibit lawmakers from creating new potholes and unsafe infrastructure over the

long run to close other, short-term budget holes.

The economic cost of these diversions has been significant. Since 2002, diversions from transportation funds to other

purposes have resulted in 4,747 fewer jobs in Illinois and a loss of $3.2 billion in cumulative economic output. A

BETTER ROADS AHEAD: VOTE YES ON THE ILLINOIS TRANSPORTATION FUNDS AMENDMENT

9

constitutional lockbox on transportation funds would protect these jobs, boost the economy, and improve economic

efficiency in Illinois.

Illinois politicians have wasted tax dollars on bureaucracy and mismanagement for too long. By requiring all money

from transportation-related taxes to be spent on transportation, the Illinois Transportation Funds Amendment would

increase funding for roads and bridges in Illinois. The lockbox amendment, if passed, would also increase funding for

safety inspections of roads, bridges, and commuter rail lines.

The Illinois Economic Policy Institute (ILEPI) urges the public to vote Yes on the constitutional amendment.

BETTER ROADS AHEAD: VOTE YES ON THE ILLINOIS TRANSPORTATION FUNDS AMENDMENT

10

Sources

Alton Daily News. (2016). “Senate Approves Lockbox Amendment.” Article by Doug Jenkins, WBGZ Radio.

Ballotpedia. (2016) (a). “Illinois Transportation Funds Amendment (2016).” The Encyclopedia of American Politics.

Ballotpedia. (2016) (b). “Wisconsin Transportation Fund Amendment, Question 1 (2014).” The Encyclopedia of American

Politics.

HJRCA0036. (2016). “CON AMEND-REVENUE-ROAD FUND.” 99

th

General Assembly. Illinois General Assembly.

Illinois Senate GOP. (2016). “Voters Will See Measure to Protect Road Funds on November Ballot.” Illinois Senate Republicans.

IMPLAN. (2015). IMPLAN Group, LLC, IMPLAN System (data and software).16740 Birkdale Commons Parkway, Suite 206,

Huntersville, NC 28078. Available at: www.implan.com.

ISASCE. (2014). “Roads.” 2014 Report Card for Illinois’ Infrastructure. Illinois Section of the American Society of Civil

Engineers

Manzo IV, Frank. (2014). Off-Roading? Analyzing Diversions from Illinois’ Road Fund. Illinois Economic Policy Institute.

Manzo IV, Frank and Jill Manzo. (2016). A $10 Billion Loss: Illinois’ Motor Fuel Tax Should Have an Inflationary Adjustment.

Illinois Economic Policy Institute.

MPC. (2016). Illinois Has a $43 Billion Transportation Deficit. Metropolitan Planning Council.

Poulos, Marc. (2016). Twitter post on 5 May 2016. Indiana, Illinois, Iowa Foundation for Fair Contracting.

Reboot Illinois. (2016). “Illinois Road Fund ‘Lockbox’ Only Constitutional Amendment to Make It Out Alive.” Article by Kevin

Hoffman, Reboot Staff.

The State Journal-Register. (2016) (a). “Stalemate Threatens $2B in Road Projects.” Article by John O’Connor, The Associated

Press.

The State Journal-Register. (2016) (b). “Illinois Road Construction Funds Get Swept.” Article by Doug Finke, State Capitol

Bureau.

The State Journal-Register. (2015). “Road Fund Bill the Only Constitutional Amendment to Pass Both Chambers.” Article by

Drew Zimmerman, State Capitol Bureau.

Summers, Adam. (2005). Funding the National Park System: Improving Services and Accountability with User Fees. Reason

Foundation.

TFIC. (2016). “Diversion Tracker” data from the Illinois Department of Transportation and State of Illinois Comprehensive

Annual Financial Reports. Transportation for Illinois Coalition.

TIAC. (2014). “Wisconsin Transportation Fund Amendment (2014) Case Study.” Transportation Investment Advocacy Center.

Wisconsin State Journal. (2014). “Vote ‘Yes’ on Transportation Amendment.” Article by the Wisconsin State Journal editorial

board.