PropInde

x | Magicbricks

Mumbai

JAN-

MAR 2024

Residentia

l Market Insights

Marke

t Dynamics

Mumbai market post navigating through a dull period, resurrects to a high demand market share

Parameters India Mumbai

Notes:

Above parameters represent QoQ change in Q1 2024 at

India and city level

+ change in volume of propert y searches

++change in volume of act ive list ings

+++ change in the average rate of under-construct ion

(UC) and ready-to-move (RM) properties

Source: M agicbricks Research

RM Rate Change

" RM segment

recorded QoQ price

growth of 4.4%."

Key developers based on active

listings

Note: The above table represents the top

developers by the share of active listings on

Magicbricks website in Q1 2024.

In the News

1. In Q4 2023, Mumbai Metropolitan Region

maintained its strong performance as

India's top residential market with 46,638

transactions totaling Rs 39,170 crore, based

on IGR data.

2. In 2023, residential sales in India's top

seven cities (Mumbai, Delhi NCR,

Bengaluru, Hyderabad, Chennai, Kolkata,

and Pune) reached a record high of 271,818

units, marking a 25% increase over the

previous peak in 2010.

© m agicbricks .com

Page 2

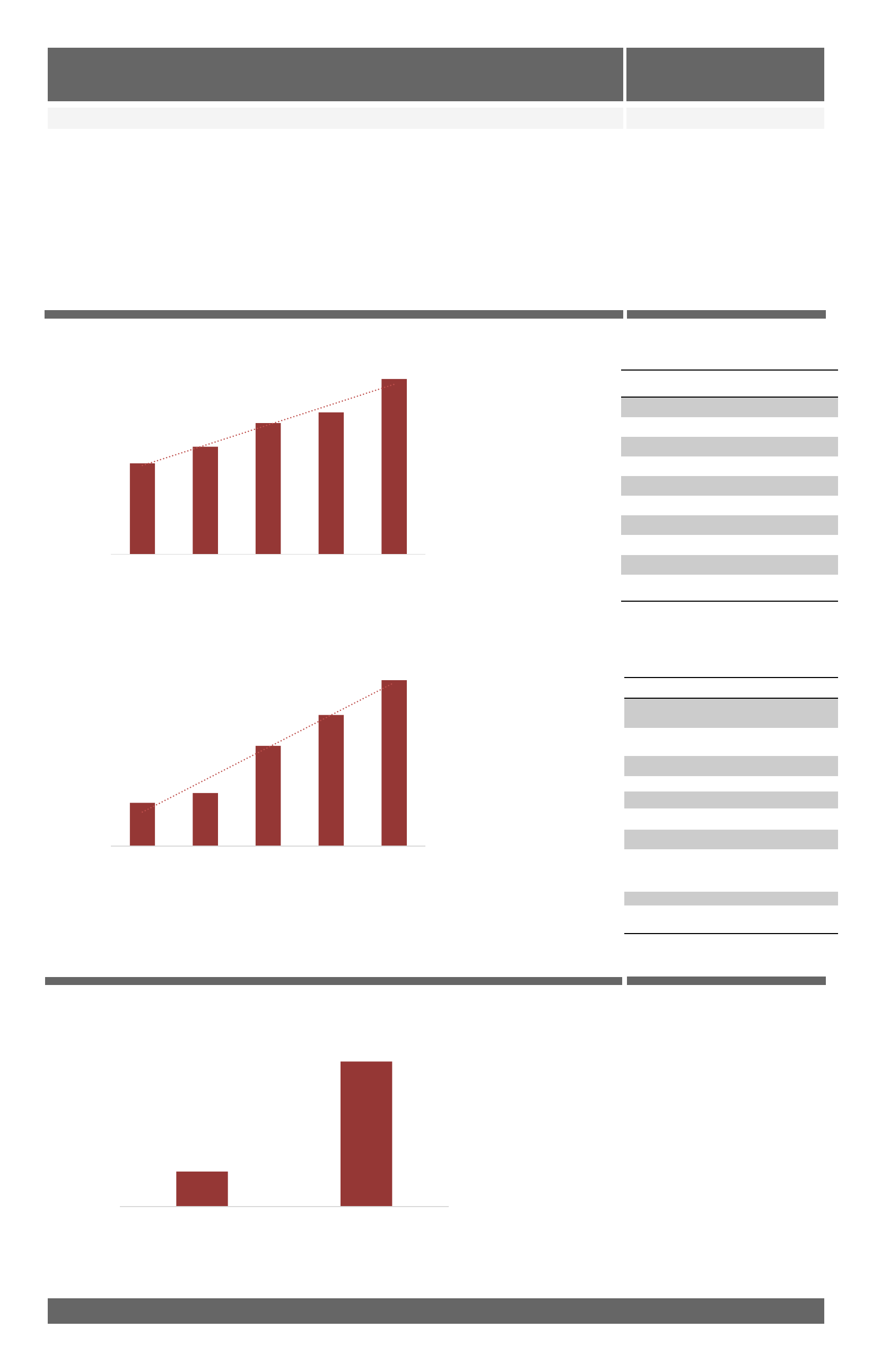

Supply change of RM vs UC properties

" B o t h RM and UC

segment recorded a

QoQ increase of

1.1% and 4.4%

respectively in supply

share.”

1.1%

4.4%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

RM UC

QoQ change in supply

In Q1 2024, the residential market in Mumbai saw a growth of 3.1% QoQ in demand, as reflected in search activity.

However, there was a decline of 1.1% QoQ in residential listings. Prices of residential properties showed a modest 5%

QoQ increase.

Numerous major multinational corporations and prominent players in the entertainment industry have chosen

Mumbai as their base, attracted by its status as the financial hub of India. This city has experienced remarkable

economic expansion, fostering a robust job market and elevating living standards. Consequently, there is a significant

upsurge in demand for residential real estate, promising substantial returns on investment due to the city's flourishing

economy and increasing prosperity. After enduring a period of sluggishness, the Mumbai market experiences a

revival, bouncing back to become a sought-after market with increased demand and a significant share of the market.

Demand+

Supply++

Rate Index+++

6.9%

0.9%

2.9%

3.1%

-1..1%

5.0%

Note:

1. Above table represents the rate changes for RM and UC properties for dominant asset classes in each locality under various rate buckets (INR psf) as of March 2024

Source: Magicbricks Research

UC Rate Change

“ UC segment

recorded QoQ price

growth of 5.7%."

Project

Locality

Lodha Woods

Kandivali East

VKG Krishna

Residences

Chakala

Dotom Isle

Malad West

Auris Serenity

Malad West

Oberoi Springs

Andheri West

Atmiya Centria

Santacruz East

Ruparel Panache

Santacruz West

White City Phase 2

Wing B

Lokhandwala

Township Kandivali

East

Romell Orbis

Andheri East

Lodha Eternis

Chakala

Industrial

Area MIDC

Key Projects and Localities

Notes:

1. RM rate index represents the weighted average rate of completed properties on the Magicbricks website as of March 2024.

2. UC rate index represents the weighted average rate of under-construction properties on the Magicbricks website as of March 2024.

3. The graph represents the average rate of the dominant asset class in each locality of the city.

Source: Magicbricks Research

Note: Above table lists the most searched projects on

Magicbricks website in Q1 2024

Source: Magicbricks Research

Developer

Lodha

Rajesh LifeSpaces

Vijay Khetan Group

Oberoi Realty Ltd.

Ruparel Realty

The Wadhwa Group

L&T Realty

Transcon Developers and Sheth Creators

Cooperative Group Housing Society (CGHS)

Atmiya

Group

Source: Magicbricks Research

20,000

20,500

21,000

21,500

22,000

22,500

23,000

23,500

24,000

24,500

25,000

25,500

26,000

Q1 23 Q2 23 Q3 23 Q4 23 Q1 23

Average Rate (INR

psf)

18,000

18,500

19,000

19,500

20,000

20,500

21,000

21,500

22,000

22,500

23,000

23,500

24,000

24,500

25,000

Q1 23 Q2 23 Q3 23 Q4 23 Q1 24

Average Rate (INR

psf)

2%

21%

47%

26%

4%

1%

Below 500

500-750

750-1,250

1,250-2,000

2,000-3,000

Above 3,000

Supply by Size

Demand by Size

3%

22%

41%

24%

7%

3%

Below 500

500-750

750-1,250

1,250-2,000

2,000-3,000

Above 3,000

Demand-Supply Analysis Mumbai |JAN-MAR 2024

© m agicbricks .com

Page 3

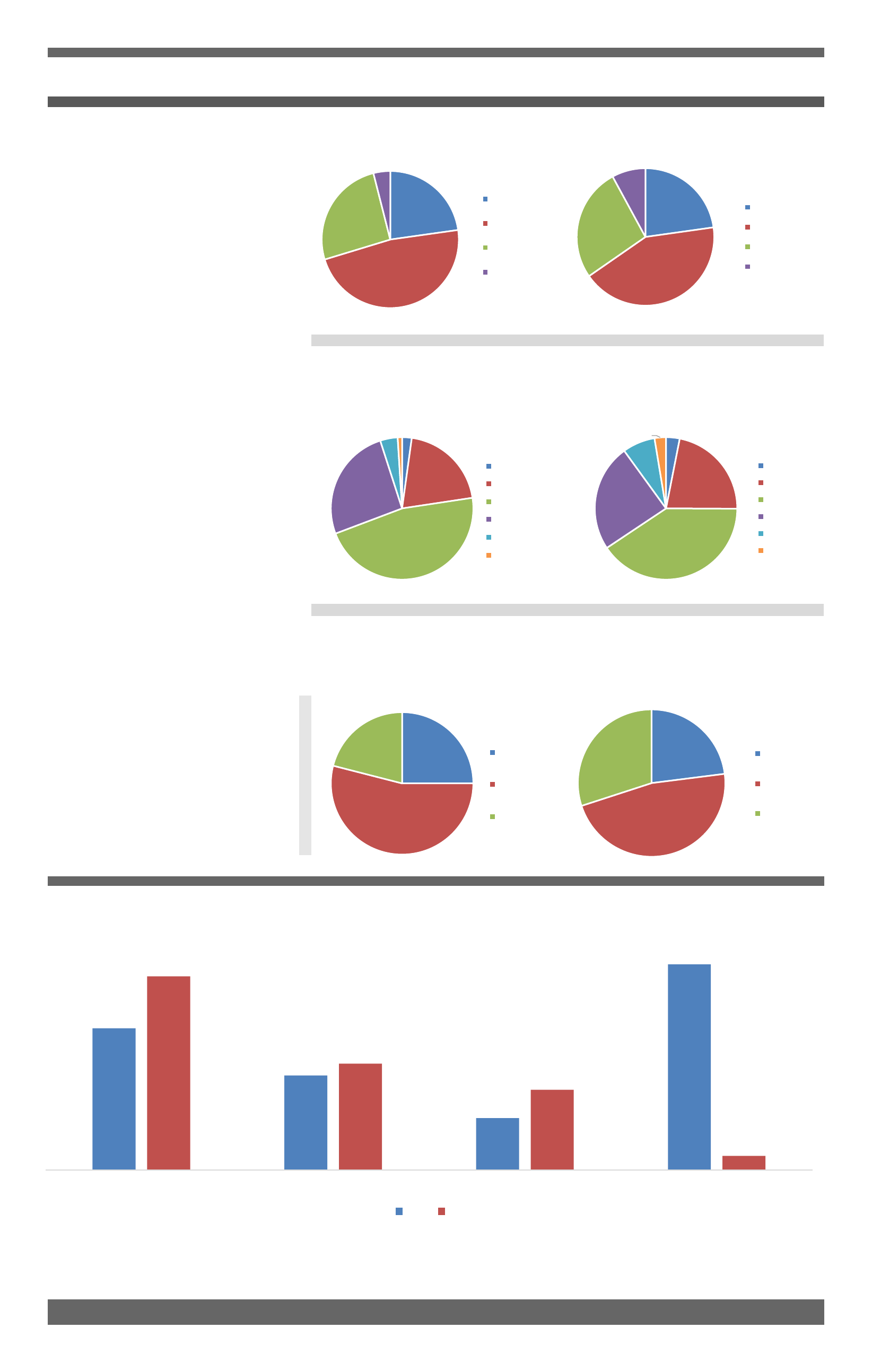

Looking at the quarterly as well as yearly changes, all housing configurations demonstrated growth in rate (INR psf). 1 BHKs showed maximum

growth, across both QoQ and YoY. Compared to larger units, compact units showed higher growth in rate. This suggests a preference among

homebuyers for compact residences amid rising prices and inflation.

BHK wise Average Rate Change (INR psf)

2 BHKs top the charts

across both demand and

supply trends

The demand patterns observed in Mumbai

reveal a clear preference for 2-bedroom, hall,

kitchen (2 BHK) units, which dominate the

market with a significant share of 48%.

Moreover, an in-depth analysis shows that

nearly half of the prospective homebuyers in

Mumbai are inclined towards mid-segment

apartments.

These properties, falling within the area

range of 750 to 1,250 square feet, emerge as

the most coveted categories, capturing 47%

of the total demand. Interestingly, this

demand outstrips the supply share of similar

properties, which stands at 41%.

In Mumbai, homebuyers

searched for mid range

units

The real estate market in Mumbai

demonstrates a strong preference for

properties priced between INR 15,000 to

25,000 psf. This pricing trend highlights the

significant demand from individuals seeking

properties in the mid to high segments of the

market. This indicates a prevalent preference

among buyers for properties that offer

certain amenities or locations associated with

this price range, reflecting the specific tastes

and priorities of Mumbai's property seekers.

23%

48%

26%

4%

1 BHK

2 BHK

3 BHK

Above 3 BHK

23%

43%

27%

8%

1 BHK

2 BHK

3 BHK

Above 3 BHK

Demand by BHK Supply by BHK

Mid segment homes ranging from 750 to 1,250 sf witnessed highest

traction

25%

54%

21%

<15,000

15,000-25,000

>25,000

23%

47%

30%

<15,000

15,000-25,000

>25,000

Demand by Rates Supply by Rates

Highest demand and supply for properties priced between INR 15,000-

25,000 psf

Source: Magicbricks Research

6.0%

4.0%

2.2%

8.7%

8.2%

4.5%

3.4%

0.6%

1 BHK 2 BHK 3 BHK Above 3 BHK

QoQ YoY

Area in sf Area in sf

Rate in INR psf Rate in INR psf

Rate Analysis

© m agicbricks .com

Page 4

Mumbai |JAN-MAR 2024

QoQ Change In Average Rate (INR psf)

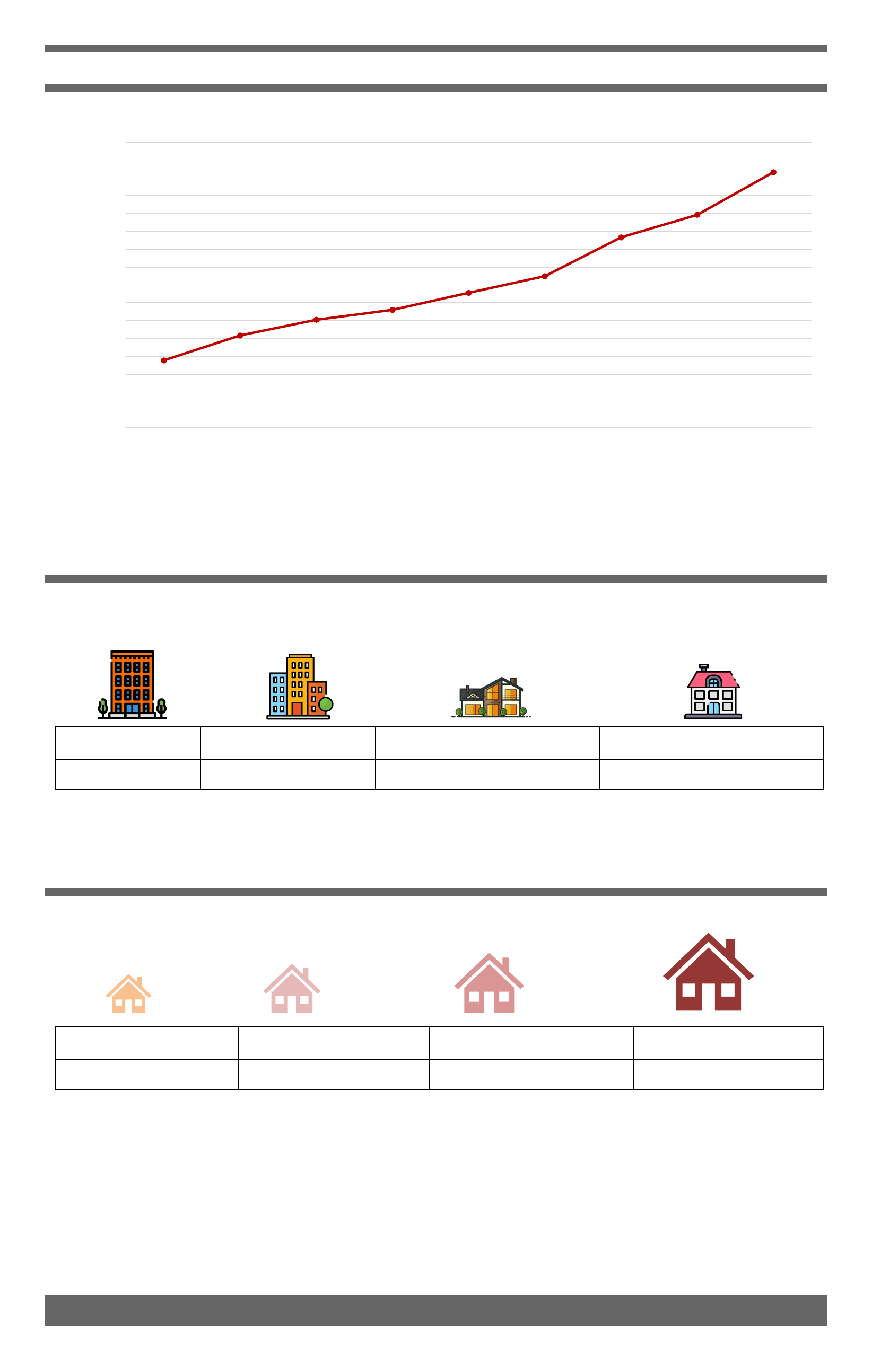

Average Rates (Property Type)

Builder Floor Multistorey Apartment Residential House Villa

10,300 29,600 35,000 42,000

In Mumbai, the real estate market has diverse pricing as builder floors command an average rate of INR 10,300 psf,

multistorey apartments stand at INR 29,600 psf, residential houses at INR 35,000 psf, and luxurious villas are available at a

whopping price of INR 42,000 psf on the cover area.

Due to sustained and robust demand, there has been a consistent upward trajectory in property prices across Mumbai.

Over the span of the last eight quarters, there has been a noteworthy increase in average property rates, showing a steady

growth of approximately 25%. Specifically, from the first quarter of 2022 to the first quarter of 2024, the average price per

square foot surged from INR 19,886 to INR 25,153, reflecting the enduring strength of the real estate market in the city.

Source: Magicbricks Research

Average rates (BHK wise)

In Mumbai, residential properties exhibit a diverse pricing spectrum, ranging from INR 8,000 to 45,000 psf, encompassing

various configurations and typologies. The average rate for 1 BHK residences stands at INR 15,800 psf, while luxury

segments, particularly 3 BHK and above, command an average rate of INR 36,400 psf on the cover area.

1 BHK 2 BHK 3 BHK Above 3 BHK

15,800 20,900 27,700 36,400

19,886

20,583

21,024

21,299

21,776

22,243

23,329

23,961

25,153

18,000

18,500

19,000

19,500

20,000

20,500

21,000

21,500

22,000

22,500

23,000

23,500

24,000

24,500

25,000

25,500

26,000

Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024

Rate (INR

psf)

Micro-Market Statistics Mumbai |JAN-MAR 2024

© m agicbricks .com

Page 5

Top Micro-markets in the City

The western suburbs of Mumbai continue to be the top choice for homebuyers due to their outstanding connectivity to

employment centers and enhanced social and commercial amenities. This trend is underscored by recent data spanning across

four quarters, highlighting neighbourhoods like Malad-Kandivali, which continue to be the leading choices for homebuyers,

alongside other areas such as Andheri East-Jogeshwari East and Borivali-Dahisar. This preference can be linked to their close

proximity to business districts, well-developed retail infrastructure, the presence of Chhatrapati Shivaji Maharaj International

Airport, and excellent access to the Western Express Highway.

Inference

Micro-Markets with Highest Demand Micro-Markets with Highest Supply

Micro

-market Avg. Rate Rank Q1-

24

Rank Q4-

23

Malad

-Kandivali 18,300 1 1

Andheri East

-

Jogeshwari East

19,700 2 5

Andheri West

-

Jogeshwari West

25,400 3 3

Goregaon

20,200 4 6

Borivali

-Dahisar 20,400 5 4

Kurla

-Ghatkopar 19,900 6 2

BKC

29,300 7 7

Bandra West

-Linking

Road

40,700 8 -

Micro

-market Avg. Rate Rank Q1-

24

Rank Q4-

23

Malad

-Kandivali 18,300 1 1

Borivali

-Dahisar 20,400 2 3

Andheri West

-

Jogeshwari West

25,400 3 4

Goregaon

20,200 4 2

Andheri East

-

Jogeshwari East

19,700 5 5

Worli

-Lower Parel 45,100 6 -

Mulund

19,800 7 8

Kurla

-Ghatkopar 19,900 8 7

Notes:

1. Top micro-markets ranked by number of searches on Magicbricks in Q1 2024.

2. Average rate in the micro-market in INR psf.

Notes:

1. Top micro-markets ranked by their active listings on Magicbricks in Q1 2024.

2.Average rate in the micro-market in INR psf.

Note: Map above represents the top preferred micro-markets in the city in Q1 2024. Source: Magicbricks Research

Source: Magicbricks Research

Beyond Mira Rd

Malad-Kandivali

Andheri-Jogeshwari (E)

Goregaon

Andheri-Jogeshwari (W)

BKC

Worli-Lower Parel

Note: This map is not to scale.

Bandra-Worli Sealink

ARABIAN SEA

NAVI

MUMBAI

THANE

Borivali-Dahisar

Kurla Ghatkopar

Mulund