Quarterly Real Estate Analysis for MUMBAI

Insite

Price Trends

Growth Drivers

Supply Analysis

October - December 2015

99acres Insite

2 3

Navi Mumbai outperforms other zones;

investors pin hopes on

NAINA

City Insite Report

Oct - Dec 2015

Mumbai

0%

Content

City-Highlights:

Price Trend Analysis:

MMR- Central Suburbs, Andheri-Dahisar,

Harbour, South and South West

Navi Mumbai

Thane and Beyond

Supply Analysis:

06

07

08

09

10

Capital Growth

INTRODUCTION

The 99acres.com Mumbai Insite report brings to you

major movements in the real estate market of the city,

in Oct-Nov-Dec 2015 as compared to Jul-Aug-Sep 2015.

The report not only captures the significant trends across

various localities in Mumbai, but also brings to you

the analysis and the insights that will make this report

valuable for investors and end users. The report also

includes an in-depth supply analysis to enable sellers

and buyers determine the direction of the market.

Methodology

We have reported quarterly price movement of capital and

rental values measured in per square feet for the analysis

of Mumbai’s residential market. Effort has been made to

provide comparable and accurate city level data, since

prices and rents are floating and at any point may vary

from the actual numbers.

Kalyan

Navi Mumbai

Kalyan

Navi Mumbai

Kalyan

Navi Mumbai

MMR

0%

Thane

0%

Navi Mumbai

2%

99acres Insite

4 5

Realty Round-up

Delhi NCR

Mumbai

Bangalore

Hyderabad

Kolkata

Chennai

Pune

Capital

Values

Delhi NCR

Mumbai

Bangalore

Chennai

Pune

Hyderabad

Kolkata

Rental

Values

Supply

* Capital values represent quarterly change

* Rental values represent yearly change

* Supply is basis properties listed on 99acres.com

99acres Insite

6 7

MUMBAI

City Highlights

Mumbai Metropolitan Region (MMR) - (Central Suburbs, Andheri-Dahisar, Harbour,

South & South West Mumbai, Mira Road & beyond)

Capital Analysis

Despite announcements of several road and metro projects, Mumbai’s property market plateaued

under the weight of rising construction costs, demand-supply mismatch and snail-paced infrastructural

growth. While keeping buyers at bay, these factors impelled the realty graph of the financial capital to

dip insignificantly from the Jul-Sep quarter to Oct-Dec 2015.

• With the exception of the south west localities, the

property landscape of the Mumbai Metropolitan Region

(MMR) has delineated a downturn, as a result of lofty

price tags.

• Navi Mumbai added yet another feather to its cap with

the City and Industrial Development Corporation (CIDCO)

launching Maharashtra’s first smart city project.

• The frequent policy changes in Thane’s real estate

market and habitual stonewalling of core stakeholders

when drafting vital industry guidelines, dampened

developers’ sentiments.

• Focussed on improving the metro connectivity in

the region, the Maharashtra government announced

completion of the Seepz-Kanjur Marg line by 2018, the

Andheri (E)-Dahisar (E) and Dahisar-DN Nagar lines by

2019, and the Colaba-Bandra-SEEPZ stretch by 2022.

• In addition, the highway infrastructure is set to receive a

massive fillip with the state government planning to pump

Rs 28,000 crore in 21 projects spanning 1,500 km, in 2016.

• Taking a colossal step towards promoting real estate

transparency, the state government would grant new

building permissions and conduct concurrent audits via

e-platform starting January 2, 2016.

• In lieu of slashing property prices, developers condensed

apartment sizes to maintain affordability. Flat sizes in

the city have been reduced by 26.4 per cent between

2010 and 2015.

*The graph represents Q-o-Q change in average capital values in Mumbai

Rental Analysis

• The downhill trajectory from a trifling growth of one per

cent in Jul-Sep 2015, to stagnancy in Oct-Dec 2015, is

attributed to the prodigious gap between a household’s

average annual income in Mumbai (around Rs 7.5 lakh per

annum) and the price of inventory in MMR (Rs 1 crore

and above).

• Vasai Road, a locality beyond Mira Road, saw capital

values clocking a surge of 10 per cent in Oct-Dec 2015, the

highest in MMR. The locality’s growth is being attributed to

the possibility of enhancement in rail infrastructure.

• Vasai Road was followed by another locality beyond

Mira Road, Boisar; and Kanjur Marg (West) in Central

Mumbai suburbs, each of which recorded an average

rise of eight per cent.

• The peripheral industrial town of Boisar enjoyed the

advantage of being a low-cost area. The locality offers

affordable housing inventory from reputed builders.

Properties here are priced around Rs 3,500 per sq ft, vis-à-

vis the five digit price tags in the central locales of Mumbai.

• Kanjur Marg (West) owes its escalating values to the recent

improvement in rail infrastructure and the Mumbai Metro

Rail Corporation (MMRC) prioritising Seepz-Kanjur Marg

Metro corridor.

• Anticipation of a 40 km metro route, connecting Wadala-

Ghatkopar-Thane-Kasarvadavali, infused cheer in Wadala.

However, the persistent delay in infra development led to

the realty graph plummeting by three per cent this quarter.

• The residential rental landscape of MMR had a

successful story to narrate. The average values climbed

by a notable margin of four per cent in Oct-Dec 2015, as

compared to the same quarter in 2014.

• Sakinaka in Andheri East clocked an enormous rise of

17 per cent in rental values, year-on-year, on the back

of metro connectivity. In fact, the Andheri to Sakinaka

metro corridor is one of the most popular routes, which

witnesses an average of over 25,500 commuters per day.

• One of the biggest employment generating locales of

Mumbai, Lower Parel, followed Sakinaka closely, with

a rental appreciation of 16 per cent in the same time

frame. Even capital sentiments in this locality have

lifted due to the Brihanmumbai Municipal Corporation’s

(BMC) endeavour to transform the area into a

smart city.

• Jogeshwari (West), where average rental values in

the last one year escalated to the tune of 14 per cent,

had the connecting bridge between the locale and

Goregaon (East) to thank, which eased traffic flow

greatly and reduced bottlenecks at peak commutation

hours between the east-west regions.

• Rental rates in Chandivali and Powai in the Central

Mumbai suburbs witnessed a decent jump of 12 per

cent between Oct-Dec 2014 and 2015. The growth in

values is attributed to the excellent connectivity to the

east-west suburbs facilitated by the Jogeshwari-Vikhroli

Link Road (JVLR) and the LBS Marg.

Top Performers in MMR (Capital Values)

Top Performers in MMR (Rental Values)

• Competitive rental rates have steered IT firms towards

Navi Mumbai, leaving MMR to be dominated by the

banking, financial services and insurance (BFSI) sector.

In fact, over 75 per cent of Navi Mumbai‘s office

landscape is occupied by IT/ITeS firms.

*Rental values represent yearly change

2%

Jan-Mar’15

Apr-Jun’15

Jul-Sep’15

Oct-Dec’15

1%

0%

1%

KEY INFLUENCERS

Upcoming Navi

Mumbai Airport

Inuence Notied Area

(NAINA)

Demand supply

mismatch in the MMR

Launch of CIDCO’s

smart city project in

Navi Mumbai

Launch of premium

residential projects in

Thane

Bhandup (West)

Powai

Raheja Vihar

Chandivali

Marol

Kanjur Marg (East)

Jogeshwari

(West)

Sakinaka

17%

10%

10%

10%

11%

11%

12%

14%

Lower Parel

16%

Q-o-Q Price Index

Bandra (West)

Charkop

Pali Hill

Byculla

Chembur

(East)

Hiranandani

Gardens - Powai

Vikhroli

(East)

Boisar

Vasai Road

10%

4%

4%

5%

5%

6%

7%

7%

8%

Kanjur Marg

(West)

8%

Kanjur Marg (West)

9%

99acres Insite

8 9

Navi Mumbai Thane & Beyond

Capital Analysis Capital Analysis

Rental Analysis Rental Analysis

• Replicating last quarter’s growth trajectory, the real estate

landscape of Navi Mumbai offered some breather after the

grimness elucidated by MMR. The market clocked a

growth of two per cent in Oct-Dec 2015, vis-à-vis the

preceding quarter.

• In addition to the ongoing Navi Mumbai Airport Influence

Notified Area (NAINA), the city has another achievement to

boast – CIDCO’s smart city project. Maharashtra is slated to

witness its first smart city situated in Navi Mumbai by 2019,

for which the agency has proposed a total investment of

Rs 34,777 crore.

• Although the Navi Mumbai International Airport continues

to remain embroiled in legal controversies with the forest

department at Alibag, it has definitely proffered hope to

the micro-markets of Ulwe, Kharghar and Kamothe. These

localities recorded a spike in average capital values by four

per cent, three per cent and one per cent, respectively.

• Sharing a similar fate as that of the airport, the Navi

Mumbai metro project also features in the list of delayed

and controversial infrastructure projects in Mumbai.

However, this project has sustained realty sentiments in

Kharghar and Taloja, which recorded a growth of four per

cent between the last two quaters of 2015.

• Average capital values in Sector-36, Kharghar, which

houses CIDCO’s affordable residential project under the

Swapnapurti Scheme, plunged by five per cent quarterly.

Despite targeting the Economically Weaker Sections (EWS)

and Low Income Groups (LIG), the agency offered units

at Rs 5,124 per sq ft, which is approximately same as the

ongoing market price (Rs 4,500 - Rs 5,500 per sq ft).

• Despite a slew of infrastructure improvements such as

Wadala-Ghatkopar-Thane metro corridor, Thane’s property

landscape emulated MMR’s story and remained stagnant

in Oct-Dec 2015, after clocking a minimal growth in the

Jul-Sep quarter last year.

• Patlipada’s real estate grew from three per cent in the

previous quarter to six per cent in Oct-Dec 2015. Its

proximity to Hiranandani Estate proves to be an

advantage for the locality.

• Although it continued to hold its position in the

list of top performers in Thane, Kapurbawdi’s capital

sentiments flagged from seven per cent in

Jul-Sep 2015 to five per cent in Oct-Dec 2015.

Bhiwandi and Kolshet Road, too, witnessed property

prices rising by the same margin.

• Kapurbawadi owes its growth to its strategic location and

a number of big ticket projects in the vicinity. Situated at

a convergence from which roads lead to Pokhran Road No.

2, Majiwada registered an average capital rise of three per

cent in Oct-Dec 2015 vs. the preceding quarter.

• Replicating Kapurbawadi’s claim to fame, Bhiwandi, too,

is home to several new project launches, resulting in an

average capital appreciation of five per cent in Oct-Dec as

against the quarter ending September 2015.

• Builder sentiments in Thane were dulled by the frequent

alterations in housing policies. The fraternity complained

of stakeholders being kept in the dark during the

formulation of vital industry guidelines. To this end,

builders sought a digitised process for project approvals.

• A year-on-year study revealed that Navi Mumbai’s rental

market witnessed an unanticipated growth of seven per

cent in Oct-Dec 2015 over the same quarter last year.

A substantial extent of credit for this surge goes to the

presence of IT/ITeS firms, which were instrumental in

attracting workforce, thus increasing demand for

houses on rent.

• Boasting of a rise of 20 per cent, New Panvel contributed

significantly to the landscape’s growth. However, the

surge does not come as a surprise since the region has

strong civic infrastructure and is well-connected to

Mumbai and other parts of the state via a network of

roads, namely, the Mumbai-Pune Expressway and the

Uran-Panvel Road. Since the area is located at an easy

distance of 11 km from the Navi Mumbai Airport, it will

continue being one of the preferred localities of the

tenant community in the city.

• Ulwe recorded a jump of 17 per cent in rental values in

Oct-Dec 2015, vis-à-vis 2014. With the state government

of Maharashtra adopting the ‘Housing for All’ scheme

and aiming to build 19 lakh low-priced houses by 2022,

the comparatively affordable market of Ulwe has come

to the fore. Reasonably-priced properties translate into

lower rentals. The locality is expected to see better

times ahead with the development of three special

economic zones (SEZ) by Reliance Industries.

• Belapur witnessed a rental growth of 16 per cent in

the last one year. The broadening of the Sion-Panvel

Expressway from four to six lanes helped the locality to

become popular among the tenant community.

• Maintaining its growth pace on the rental charts,

Thane clocked an average rise of four per cent

between Oct-Dec 2014 and 2015. The state

government’s endeavour to improve road and

civic infrastructure in the region, coupled with the

affordability quotient, sustained sentiments.

• Anand Nagar’s rental landscape witnessed a

remarkable hike of 10 per cent in Oct-Dec 2015,

vis-à-vis the same quarter last year. The locality

owns its rental demand to its strategic location at

a cross junction road, which facilitates quick travel

to Kolshet Road via the locality. Furthermore, the

Thane Municipal Corporation proposed the

construction of a foot overbridge along the

Eastern Express Highway to ease travel for

cyclists and pedestrians.

• Rents in Pokharan Road recorded a rental hike of 10

per cent in the last one year. The long-pending issue

of broadening Pokharan Road No.1, which will ease

bottlenecks at Vartak Nagar junctions, has added to

the rental flavour of the locality.

• Hiranandani Estate, which saw values escalating by

nine per cent during the tracked time span, draws its

demand from its excellent civic amenities, such as

clean roads and educational facilities. Being easily

accessible via the Ghodbunder Road and housing

the Hiranandani Business Park has proven

advantageous for the locality. Recently, Tata

Consultancy Services rented over two million sq ft

of office space for 15 years.

Top Performers in Navi Mumbai (Capital Values) Top Performers in Thane & Beyond (Capital Values)

Top Performers in Navi Mumbai (Rental Values)

Top Performers in Thane & Beyond (Rental Values)

*Rental values represent yearly change

*Rental values represent yearly change

10%

5%

4%

Seawoods

Nerul

Airoli

Ghansoli

Sanpada

Vashi

Belapur

Palm Beach

New Panvel

20%

5%

5%

5%

5%

8%

8%

16%

16%

Ulwe

17%

Waghbil

Hiranandani Meadows

Adharwadi

Vasant Vihar

Dombivli

(West)

Khopoli

Kolshet Road

Bhiwandi

Patlipada

6%

3%

4%

4%

4%

4%

5%

5%

Kapurbawadi

5%

Manpada

Waghbil

Kasarvadavali

Hiranandani Estate

5%

6%

6%

9%

Pokharan

Road

10%

Anand Nagar

12%

4%

Dronagiri

Airoli

Nerul

Kharghar

Taloja

Kalamboli

Ulwe

Karanjade

Sector 20,

Kamothe

9%

1%

2%

2%

3%

4%

4%

4%

5%

Vichumbe

8%

99acres Insite

10 11

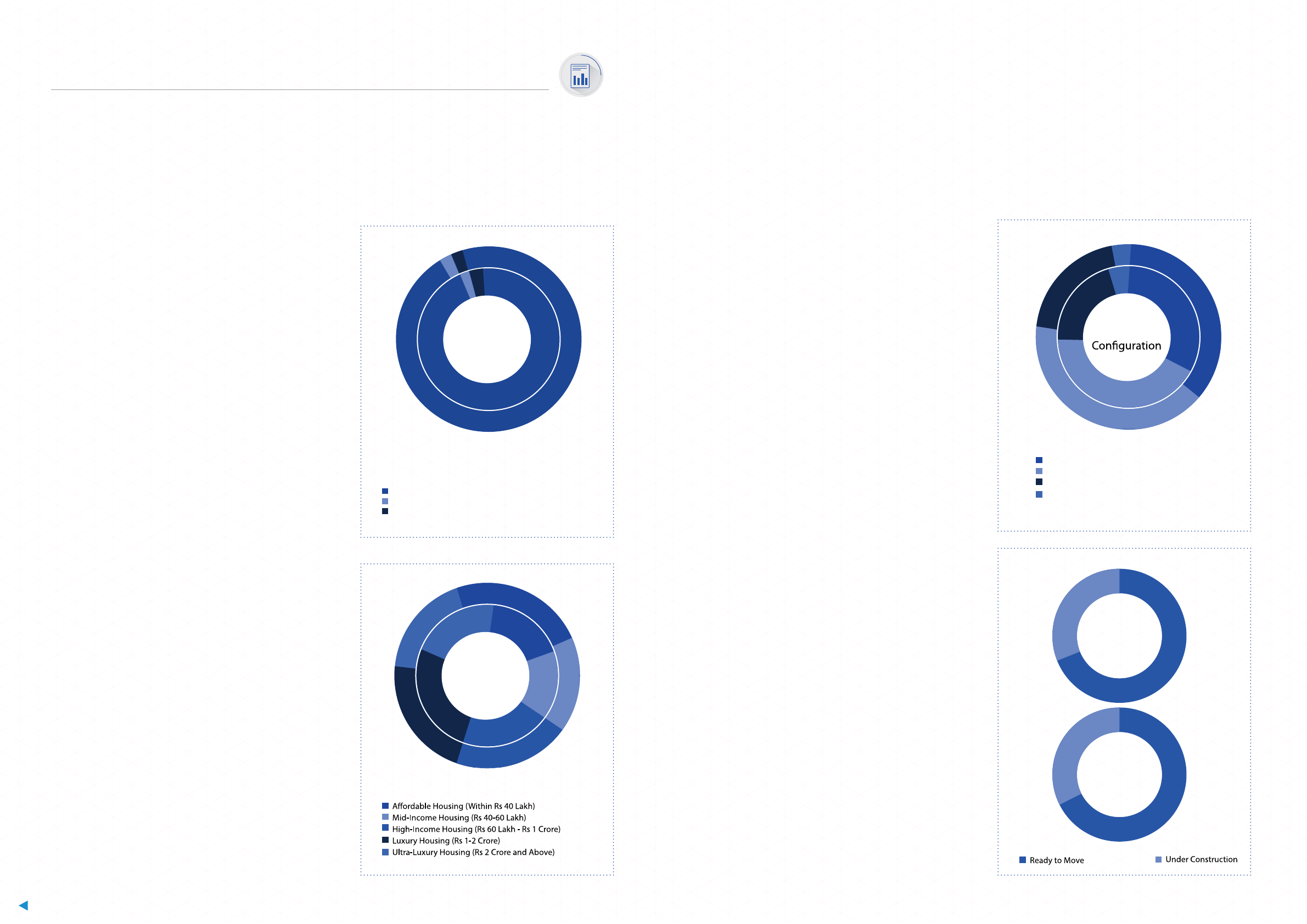

Supply Analysis

While demand in the luxury and ultra-luxury segments continued to remain weak, surging land and

construction costs prevented builders from reducing prices within the MMR. Thanks to the state

government’s endeavour to improve connectivity between Mumbai and its peripheral regions and

low land costs, activity in the affordable segment heightened significantly in Navi Mumbai and

Thane in Oct-Dec 2015.

• As expected, the city which exemplifies vertical growth for

the country, saw residential apartments capturing all, save

three per cent of the market.

•

Boasting of several upcoming and proposed infrastructure

enhancements, Navi Mumbai strode ahead of the other

zones in bagging nearly one-third of the total supply

of apartments.

•

The Andheri-Dahisar region, too, witnessed a considerable

stock of flats; however, it was way behind Navi Mumbai,

capturing less than one-fifth of the total market supply.

•

Of the limited supply of builder floors, Thane had the

greatest bulk of this property type, appropriating a quarter

of the total supply in Oct-Dec 2015. Navi Mumbai, along

with Mira Road and areas beyond followed Thane closely

on its heels.

•

Occupying an insignificant share of the market,

independent houses/villas witnessed maximum takers in

regions beyond Thane. This property type was moderately

popular even in Andheri-Dahisar and Navi Mumbai too.

Availability of Different Property Types

Availability of Property by Budget

•

The prolonged lack of buyers has at last succeeded in

altering the market dynamics of Mumbai. In the Oct-Dec

2015 quarter, the supply of affordable properties, which

comprised properties within the price range of Rs 40 lakh,

ousted luxury (Rs 1-2 crore) and ultra-luxury (above Rs 2

crore) housing categories from their prime positions.

•

While almost a quarter of the market was captured by

affordable properties (houses priced below Rs 40 lakh),

the second largest supply was that of high-income

housing, which includes houses within the price range

of Rs 60 lakh - Rs 1 crore.

• Properties priced above Rs 1 crore captured a considerable

40 per cent of the market share, despite seeing a

downward trending graph of 10 per cent when compared

quarter-on-quarter.

•

Following the usual trend chart, the mid income bracket,

priced between Rs 60 lakh and Rs 1 crore, witnessed the

lowest supply, although the segment’s market share grew

insignificantly by a per cent from the Jul-Sep 2015 quarter

to Oct-Dec 2015.

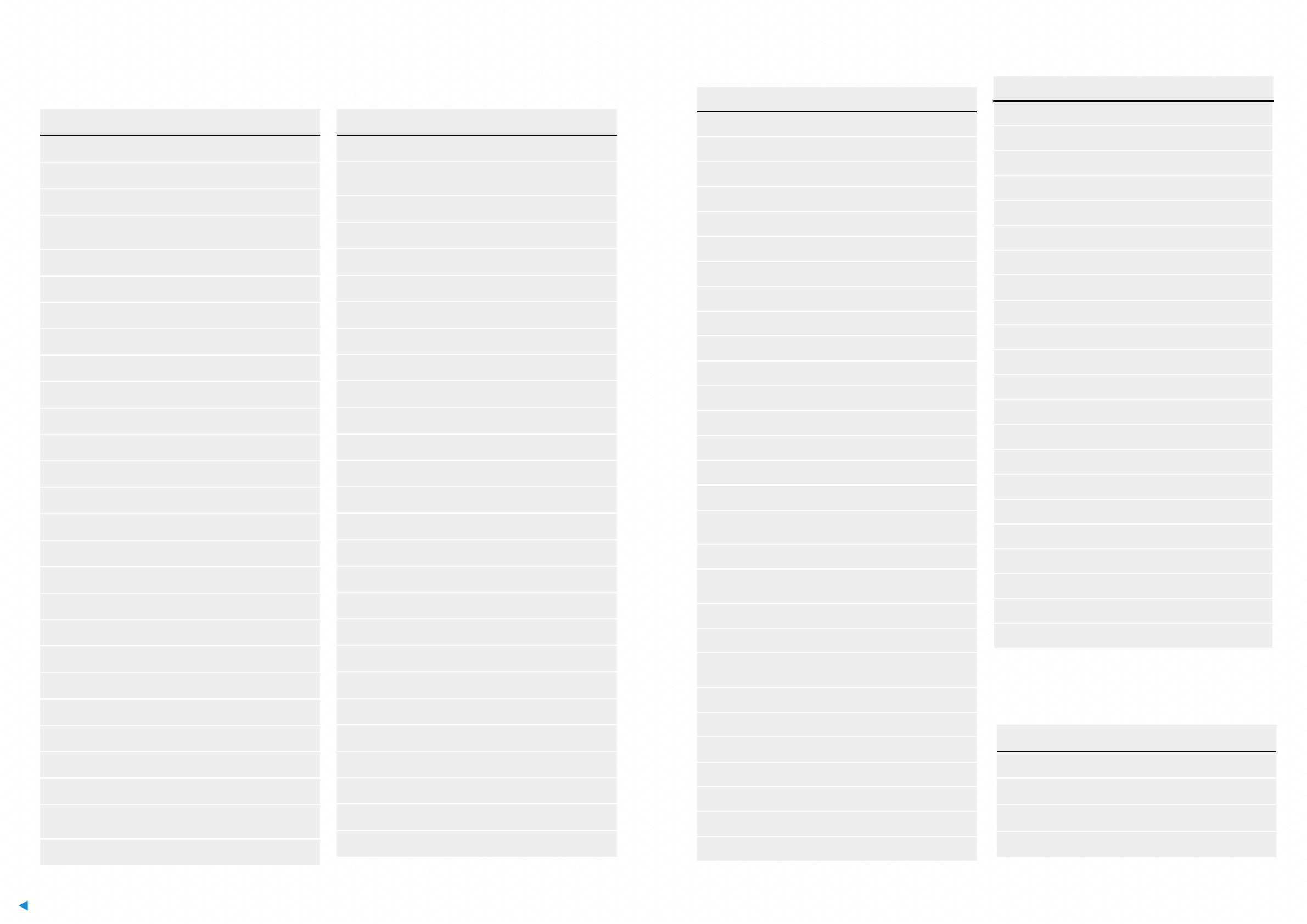

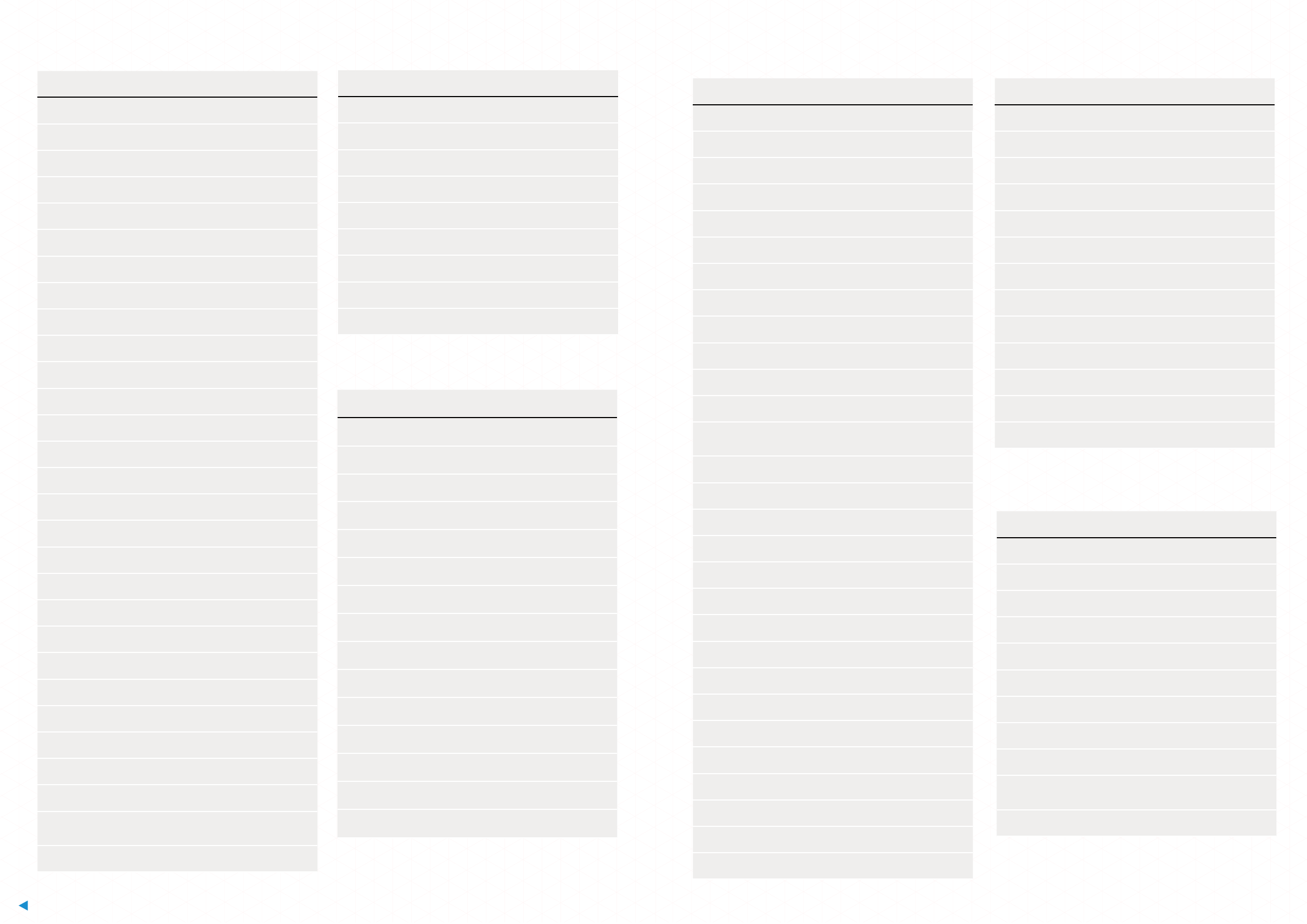

Ready to move vs Under-construction

BHK-wise Distribution of Property

•

High capital rates and inequitable growth in income ensured

that properties congured as 1BHK and 2BHK remained the

most in demand.

•

In fact, Oct-Dec 2015 witnessed a substantial amount of

supply from the 3BHK and 4BHK unit categories spilling over

to the 1BHK bracket, thus leading to a ve per cent growth

in the market share of the latter. Even the 2BHK housing

category saw an insignicant dip in supply from Jul-Sep 2015.

•

Maximum properties congured as 1BHK and 2BHK, were

located in Navi Mumbai, which hosted over one-third of the

market in each category.

•

Andheri led the market in the supply of 3BHK and 4BHK

housing categories, capturing over a fth of the total market

share. South Mumbai, too, had a substantial share of 4BHK

houses.

•

In Thane, 2BHK apartments saw maximum takers, followed by

1BHK, which does not come as a surprise since the city hosts a

lot of properties priced below Rs 25 lakh. Over 60 per cent of

the properties in this region were congured as 1BHK.

•

Thane is the only zone in Mumbai which did not witness

demand for 4BHK units.

•

Quite surprisingly, properties congured as 4BHK units

did not curry favour with any region in Mumbai, although

the category saw decent footfall in South and South West

Mumbai. However, even in these two areas, 2BHK and 3BHK

were the most preferred.

•

Developers in Mumbai were increasingly focussing on

completing existing residential projects, xing their own

businesses and capital ow in a bid to win back homebuyers’

trust and clearing unsold stock that has been troubling them

for long. This trend is evident in the consistently dipping

1BHK

2BHK

3BHK

4BHK

• Not surprisingly, South Mumbai took the lead in

bagging the maximum supply of luxury and ultra-luxury

houses, capturing almost 50 per cent of the total market.

This zone was followed by Andheri-Dahisar which

bagged two-fifth of the properties with a price tag of

Rs 1 crore and above.

• Over 60 per cent of the properties in the affordable

category was situated in Navi Mumbai. Thane, too,

witnessed an almost equal share of reasonably-priced

properties. However, the two zones drew its uniqueness

from the fact that Navi Mumbai featured most properties

within the Rs 25-40 lakh bracket, while most houses in

Thane and areas beyond ranged below Rs 25 lakh.

• Houses priced within Rs 60 lakh and Rs 1 crore were highly

popular in Navi Mumbai, with the city capturing half the

total share of the market.

Residential Apartments

Independent Houses/Villas

Builder Floors

QoQ change in supply by

Property Type

Jul-Sep 2015

Oct-Dec 2015

2%

2%

1%

97%

97%

1%

Oct-Dec 2015

Jul-Sep 2015

24%

15%

13%

22%

27%

14%

22%

21%

23%

19%

QoQ change in supply by

Budget

Oct-Dec 2015

Jul-Sep 2015

38%

33%

42%

20%

5%

41%

18%

3%

QoQ change in supply by

(BHK)

Oct-Dec 2015

63%

37%

Jul-Sep 2015

62%

38%

number of under-construction properties in the last

three quarters, albeit minimally.

• In comparison to all the other areas, South and South

West Mumbai had the highest percentage of completed

homes. Over 70 per cent of the residential realty market

consisted of ready properties.

• While Thane also witnessed two-third of its properties

in the ready-to-move category, more than two-fth of

the market beyond Thane featured properties that are

under-construction.

99acres Insite

12

CAPITAL VALUES-NAVI MUMBAI

CAPITAL VALUES- MMR CAPITAL VALUES- MMR

Locality Oct-Dec 2015 % Change

Andheri (East) 18050 2

Andheri (West) 21950 -1

Bandra (West) 46750 4

Bandra Kurla

Complex 28700 2

Bevarly Park 8100 1

Bhandup (East) 12000 2

Bhayander (East) 7500 -3

Boisar 3500 8

Borivali (West) 16150 0

Breach Candy 61100 0

Byculla 26300 5

Chandivali 19100 -1

Charkop 13800 4

Chembur (East) 17437 6

Colaba 42200 0

Cue Parade 64700 -5

Dadar 36900 -3

Dahisar (East) 10700 -2

Deonar 21643 -5

Ghatkopar (West) 19700 -2

Gokul Township 4700 -3

Goregaon (East) 18000 -1

Jogeshwari (West) 16200 -3

Juhu 39300 2

Kandivali (East) 16300 2

Kanjur Marg

(West) 13500 8

Khar 41800 -2

Locality Oct-Dec 2015 % Change

Kurla (East) 14000 -1

Lokhandwala

Township 15750 1

Lower Parel 36000 1

Mahalaxmi 39850 -1

Mahim (West) 30000 -2

Malabar Hill 66750 -1

Malad (West) 15200 1

Matunga 33300 -5

Mira Bhayandar 8050 3

Mira Road 8350 1

Mulund 15250 -5

Naigaon (East) 4850 1

Palghar 3100 3

Pali Hill 52500 5

Parel 25350 -1

Peddar Road 57600 3

Powai 20750 -2

Prabhadevi 41150 -4

Sakinaka 16750 4

Santacruz (East) 21600 -4

Shivaji Park 41000 3

Vasai 5450 3

Vikhroli (East) 20500 7

Vile Parle (East) 29850 -2

Virar 4650 -2

Wadala 23550 -3

Worli 39200 4

RENTAL VALUES- MMR

RENTAL VALUES- MMR

Locality Oct-Dec 2015 % Change

Altamount Road 126 -9

Andheri (West) 49 4

Bandra (East) 56 -3

Bandra (West) 84 5

Bhandup (West) 34 10

Borivali (East) 31 7

Breach Candy 141 4

Chandivali 42 11

Chembur (East) 36 6

Cue Parade 124 -1

Dadar (East) 64 -2

Dahisar 20 5

Deonar 42 8

Ghatkopar (East) 36 -14

Ghatkopar (West) 39 5

Goregaon (West) 39 5

Hiranandani

Gardens - Powai 67 6

Juhu 71 3

Kanjur Marg

(West) 36 9

Khar (West) 81 5

Kurla (West) 37 6

Lokhandwala

Township 28 0

Lower Parel 81 16

Mahalaxmi 103 -3

Malabar Hill 135 3

Malad (East) 36 -3

Malad (West) 36 3

Marol 41 11

Mindspace 39 5

Locality Oct-Dec 2015 % Change

Mira Bhayandar 15 -6

Mira Road 16 7

Mulund (West) 33 6

Napean Sea Road 127 -2

Parel 73 -1

Peddar Road 126 1

Powai 46 10

Prabhadevi 88 5

Sakinaka 41 17

Santacruz (East) 48 4

Santacruz (West) 72 0

Sewri 81 4

Sion (East) 42 -2

Tardeo 156 1

Tilak Nagar 34 -3

Vakola 45 7

Vikhroli (East) 40 8

Vile Parle (East) 60 3

Vile Parle (West) 59 4

Wadala 51 4

Worli 98 -1

Worli Seaface 97 1

ANNEXURES

*All prices are per sq ft rates

*Capital values represent quarterly change

*Rental values represent yearly change

Locality Oct-Dec 2015 % Change

Airoli 10300 1

Belapur 10100 -3

Dronagiri 4600 2

Ghansoli 10700 0

CAPITAL VALUES-NAVI MUMBAI

99acres Insite

14 15

CAPITAL VALUES-NAVI MUMBAI

CAPITAL VALUES-THANE AND BEYOND

RENTAL VALUES-THANE AND BEYOND

RENTAL VALUES-NAVI MUMBAI

Locality Oct-Dec 2015 % Change

Airoli 22 5

Belapur 22 16

Ghansoli 20 5

Kamothe 11 0

Kharghar 14 0

Koperkhairane 22 0

Nerul 22 5

New Panvel 12 20

Palm Beach 29 16

Panvel 11 0

Roadpali 9 0

Sanpada 26 8

Seawoods 22 5

Ulwe 7 17

Vashi 26 8

Locality Oct-Dec 2015 % Change

Anand Nagar 19 12

Pokharan Road 22 10

Hiranandani Estate 25 9

Kasarvadavali 17 6

Waghbil 19 6

Manpada 22 5

Ghodbunder Road 18 0

Vasant Vihar 24 0

Dhokali 21 0

Hiranandani

Meadows 24 -8

Majiwada 21 -9

Locality Oct-Dec 2015 % Change

Kalamboli 6350 4

Kamothe 6900 1

Karanjade 5350 5

Khanda Colony 7583 2

Khandeshwar 6800 -1

Kharghar 8650 3

Koperkhairane 10000 -3

Kutak Bandhan 7300 -1

Nerul 12850 2

New Panvel 5500 -1

Palghar 3100 3

Palm Beach 18350 -1

Panvel 6150 -2

Roadpali 6750 -3

Sanpada 14150 0

Seawoods 11500 0

Sector 18, Kamothe 7000 1

Sector 19, Kamothe 6750 -2

Sector 20, Kamothe 7600 9

Sector 36, Kamothe 7400 8

Sector 8, Kharghar 10150 10

Sector 10, Kharghar 8850 6

Sector 14, Kharghar 10550 9

Sector 15, Kharghar 9000 2

Sector 19, Kharghar 9550 9

Sector 20, Kharghar 9200 3

Sector 36, Kharghar 7800 -5

Sector 11,

Koparkhairane 11050 1

Sector 2, Ulwe 6000 -2

*All prices are per sq ft rates

*Capital values represent quarterly change

*Rental values represent yearly change

*All prices are per sq ft rates

*Capital values represent quarterly change

*Rental values represent yearly change

Locality Oct-Dec 2015 % Change

Adharwadi 5700 4%

Ambernath 3350 -4%

Anand Nagar 9300 -2

Asangaon 2700 0

Badlapur 3350 0

Balkum 9400 -2

Bhiwandi 4000 5

Dhokali 10600 -2

Dombivli (East) 6300 2

Dombivli (West) 6500 4

G B Road 9550 -2

Hiranandani Estate 12900 1

Hiranandani

Meadows 21500 3

Kalher 3800 -1

Kalyan (East) 4100 3

Kalyan (West) 5650 -2

Kapurbawadi 12950 5

Karjat 2865 2

Kasarvadavali 9100 -2

Kharegaon 7500 1

Khopat 13750 1

Khopoli 3650 4

Kolshet 8700 -2

Kolshet Road 10300 5

Majiwada 11500 3

Manpada 11750 0

Mumbra 3700 3

Naupada 14800 -3

Neral 3000 2

Locality Oct-Dec 2015 % Change

Owale 8450 -2

Panch Pakhadi 13750 1

Parsik Nagar 9550 3

Patlipada 12206 6

Pokharan Road 12550 2

Pokhran-2 12150 0

Shivai Nagar 12800 -2

Teen Haath Naka 14942 0

Titwala 3200 2

Ulhasnagar 4000 -1

Vartak Nagar 11100 1

Vasant Vihar 12800 4

Waghbil 10000 4

CAPITAL VALUES-THANE AND BEYOND

CAPITAL VALUES-NAVI MUMBAI

Locality Oct-Dec 2015 % Change

Sector-8, Ulwe 6600 6

Sector 9, Ulwe 6400 7

Sector 17, Ulwe 6400 8

Sector 19, Ulwe 5850 4

Shilphata 5650 -2

Taloja 5150 4

Taloja Panchanand 4950 0

Vashi 12800 1

Vichumbe 4750 8

Contact Us

0120 308 2248

Monday - Friday

9:30 AM to 6:30 PM IST

Email: [email protected]

Credentials of www.99acres.com

5 Million Unique Visitors a month

9 Million Visitors a month

11 Lakh Residential and Commercial Properties

10 Lakh Searches everyday

1.5 New Projects

20% NRI Visitors

2.5 Million Registered Database

Our Heritage

First Internet Company to be Listed

Info Edge (India) Ltd is India’s premier on-line classieds company in recruitment,

real estate, matrimony and education.

A USD 1.5 Billion listed Indian Internet Conglomerate