URBAN TRANSPORT

UNLOCKING THE REALTY POTENTIAL

MUMBAI METROPOLITAN REGION INFRASTRUCTURE DEVELOPMENT ANALYSIS

RESEARCH

TABLE OF CONTENTS

How does the MMR and Mumbai city compare with each other? 6

Introduction 4

What are the characteristics of the residential micro-markets in the MMR? 6

What drives the MMR residential market? 9

What are the implications of the infrastructure development in the MMR? 11

Metro rail corridors 12

Coastal Road project 14

Mumbai Trans Harbour Link (MTHL) project 20

RESEARCH

4 5

“URBAN TRANSPORT”

UNLOCKING THE REALTY POTENTIAL

Sustaining the country’s rapid urbanisation would require corresponding infrastructure development.

The need for infrastructure development, particularly urban transport, in a megapolis like Mumbai, is

unquestionable. While the benefits of urban transport in terms of enhanced connectivity and an improved

quality of life have been widely recognised, unlocking the realty potential in terms of better development

prospects is also an interesting arena for stakeholders. In fact, the high price gradient of `3,000–100,000

per sq ft for residential property in the MMR makes it even more important to stay ahead of time and

decipher the impact of infrastructure development on property demand and the resultant impact on prices.

With this white paper, we provide an assessment of select urban transport projects that are high on the

state government’s priority list and also have an ambitious yet attainable completion target of 2019, which

is within the term of the present government. Accordingly, an assessment of the metro corridors of Dahisar

West–DN Nagar, Andheri East–Dahisar East, the Coastal Road and the Mumbai Trans Harbour Link has

been presented in the report.

The report is structured in a manner that provides an understanding of the market dynamics of the

residential micro-markets across the MMR, followed by the real estate drivers – employment, physical

infrastructure and social infrastructure. Specifically for the purpose of this white paper, it dwells on physical

infrastructure development and its impact on residential demand and prices.

Introduction

6

How does the MMR and Mumbai city

compare with each other?

What are the characteristics of the

residential micro-markets in the MMR?

The Mumbai Metropolitan Region

(MMR) is spread over an area of 4,355

sq km, which includes 458 sq km of

the Mumbai City district and the rest

comprising regions in the Thane, Palghar

and Raigad districts. The population

of Mumbai increased from 11.9 mn in

2001 to 12.4 mn in 2011 - a decadal

growth rate of 3.9%. The MMR’s growth

was much higher, at 17.8%, taking its

population from 19.3 mn to 22.8 mn

during the same period. With the Arabian

Sea to the west, the MMR consists of

eight municipal corporations and nine

municipal councils.

The Mumbai Metropolitan Region

Development Authority (MMRDA) is the

apex planning body for the MMR. There

are also several municipal governing

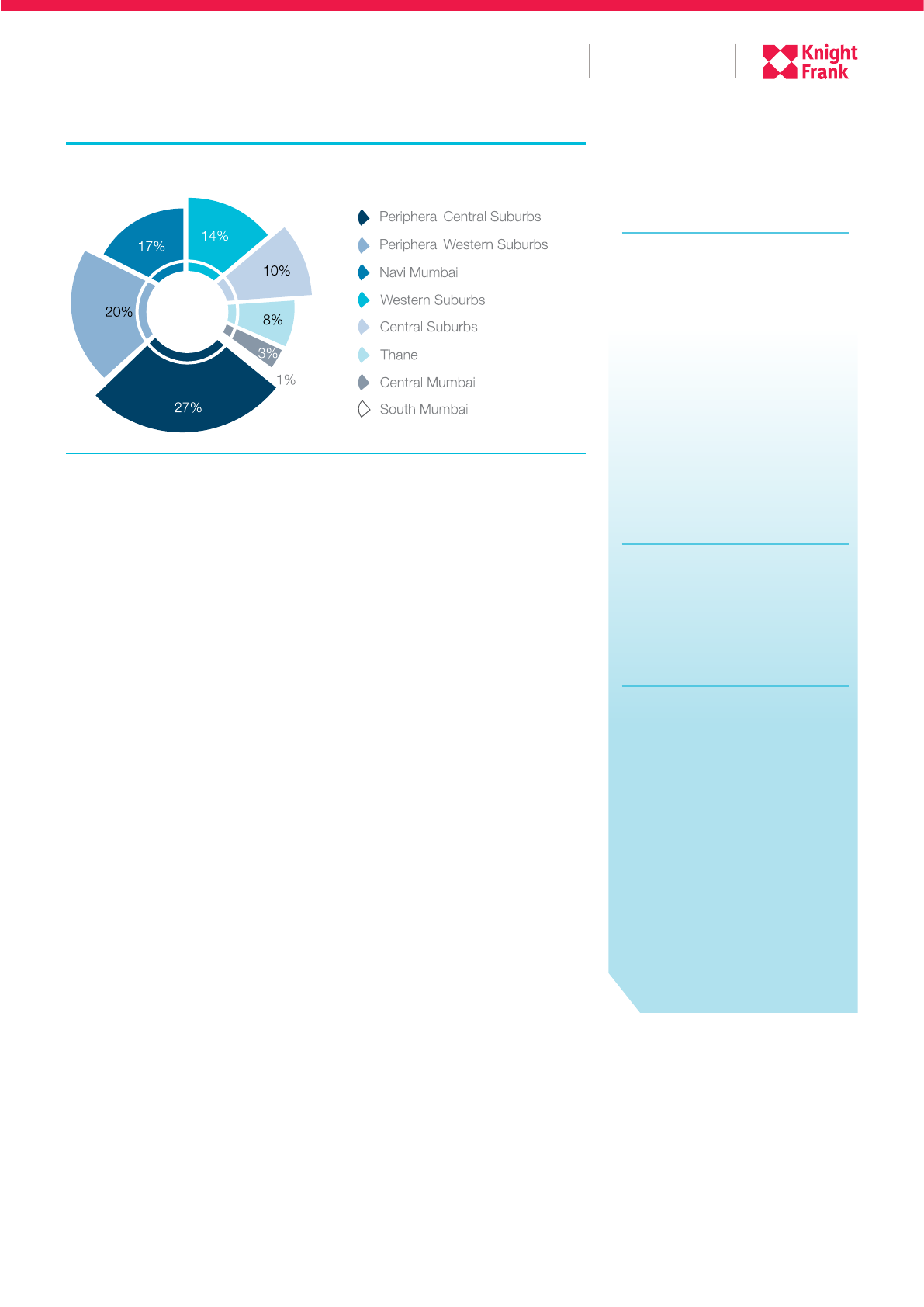

The MMR is divided into smaller micro-markets to understand each locality in terms

of their respective demand drivers - i.e. their occupation profiles, connectivity with

employment hubs, physical and social infrastructure development, and cost of real

estate. Thus, from the residential real estate market perspective, the MMR is divided

into eight micro-markets, as follows:

The Mumbai Metropolitan

Region (MMR) is spread over

an area of 4,355 sq km, which

includes 458 sq km of the

Mumbai City District and the

rest comprising regions in the

Thane, Palghar and Raigad

districts.

The population of Mumbai

increased from 11.9 mn in

2001 to 12.4 mn in 2011 - a

decadal growth rate of 3.9%.

The MMR’s growth was much

higher, at 17.8%

bodies in the MMR, among which the

Municipal Corporation of Greater Mumbai

(MCGM) is the most significant.

Source: MCGM

Chart 1: Population growth

Micro-markets Indicative locations

Central Mumbai

Dadar, Lower Parel, Mahalakshmi, Worli,

Prabhadevi

Central Suburbs

Sion, Chembur, Wadala, Kurla, Ghatkopar,

Vikhroli, Bhandup, Mulund

Navi Mumbai

Vashi, Nerul, Belapur, Kharghar, Airoli, Panvel,

Ulwe, Sanpada

Peripheral Central Suburbs

Kalyan, Kalwa, Dombivli, Ambernath,

Bhiwandi, Mumbra, Karjat

Peripheral Western Suburbs

Vasai, Virar, Boisar, Palghar, Bhayandar,

Nalasopara

South Mumbai

Malabar Hill, Napean Sea Road, Walkeshwar,

Altamount Road, Colaba

Thane

Naupada, Ghodbunder Road, Pokhran Road,

Majiwada, Khopat, Panchpakhadi

Western Suburbs

Bandra, Andheri, Goregaon, Kandivali, Borivali,

Santacruz, Vile Parle, Dahisar

11.9

19.3

12.4

22.8

RESEARCH

7

“URBAN TRANSPORT”

UNLOCKING THE REALTY POTENTIAL

South Mumbai

This zone houses the city’s central

business district (CBD), comprising

Nariman Point, Colaba, Cuffe Parade,

Fort and Ballard Estate. Mumbai is the

business capital of the country, and

the CBD is home to a large number of

corporate headquarters. The Bombay

Stock Exchange (BSE)—the oldest

stock exchange in Asia—and some of

the biggest Indian companies, such

as Reliance Industries Limited, State

Bank of India and Larsen & Toubro,

operate from their headquarters here.

The residential pockets in this zone,

such as Cuffe Parade, Napean Sea

Road and Malabar Hill, are among the

most expensive in the country. With the

Arabian Sea on three sides and a lack

of land availability, there is limited scope

for horizontal expansion in this zone, and

the only way for large-scale real estate

development is by going vertical.

Central Mumbai

Central Mumbai has emerged as a

prominent residential market on the

back of exceptional office and social

infrastructure developments in the last

decade. This micro-market is now a

premium office market for occupiers

from the Banking Financial services and

Insurance (BFSI) front office segment and

corporate headquarters of companies in

the manufacturing, media and consulting

sectors. The Mumbai Monorail will pass

through this micro-market once its

second phase, connecting Wadala and

Source: Knight Frank Research

Chart 2: Zone-wise split of under-construction residential units

Central Mumbai has emerged

as a prominent residential

market on the back of

exceptional office and social

infrastructure developments in

the last decade. This micro-

market is now a premium office

market for occupiers from the

Banking Financial services and

Insurance (BFSI) front office

segment and corporate

headquarters of companies in

the manufacturing, media and

consulting sectors.

With the Mumbai Metro

becoming operational in the

Central Suburbs, the MRTS

connectivity to the Western

Suburbs has improved.

The region from Bandra to

Dahisar towards the north of the

city is identified as the Western

Suburbs. It houses the Bandra

Kurla Complex (BKC), which is

a planned commercial hub that

has the country’s largest stock

exchange—the National Stock

Exchange (NSE)—and

important offices, such as the

Consulate General of the United

States and the British Deputy

High Commission.

Jacob Circle (11.2 km), is operational by

2016. This will increase the attractiveness

of this market even further and ease

the burdened traffic conditions in the

densely-populated locations of Dadar,

Parel and Lower Parel.

Central Suburbs

The Central Suburbs extend from Sion to

Mulund. This zone has good social and

physical infrastructure, and the presence

of several organised retail options on LBS

Road has added to the appeal of the

residential developments in the region.

the Mumbai Metro becoming operational

in the zone, the MRTS connectivity to the

Western Suburbs has improved.

Western Suburbs

The region from Bandra to Dahisar

towards the north of the city is identified

as the Western Suburbs. It houses the

Bandra Kurla Complex (BKC), which is

a planned commercial hub that has the

country’s largest stock exchange—the

National Stock Exchange (NSE)—and

important offices, such as the Consulate

General of the United States and the

British Deputy High Commission. BKC

is now considered the new CBD of the

MMR. The other significant office stock

in this area is on the Andheri Kurla Road

and along the Western Expressway up

to Malad. Bandra and Juhu are the most

sought-after locations for residential

development and command the highest

property prices here. This zone has a

vibrant social infrastructure, with the

8

presence of quality retail, education,

entertainment and healthcare options.

Property prices decline as one goes

north from Bandra. While employment

and social infrastructure are the drivers

up to Malad, locations further north

are driven by connectivity, primarily by

the suburban railway network and the

Western Express Highway.

Peripheral Western Suburbs

The markets extending from Mira-

Bhayandar to Boisar have been classified

as the Peripheral Western Suburbs.

Although localities such as Palghar

and Boisar are not part of the MMR,

they have been considered from an

analytical perspective on account of the

improving suburban train connectivity

over the last decade. Other than some

industrial setup in locations such as Vasai

and Palghar, there is no employment

driver in this zone. National Highway

8 (NH-8) provides road connectivity to

Mumbai, while the Western line of the

Mumbai Suburban Railway lends MRTS

connectivity. However, the daily road

commute to the employment hubs is

not a feasible option due to the distance

and time involved, and hence, the MRTS

connectivity is the only driver in this zone.

Thane

After being considered a poor cousin

of Mumbai’s suburbs for a long time,

Thane is now earning a reputation for its

quality residential developments on the

back of its improving physical and social

infrastructure. Ghodbunder Road has

developed as an arterial road connecting

the eastern and western express

highways. The Thane MIDC is the oldest

of over 200 industrial development

corporations (IDCs) in the state. However,

with manufacturing activities diminishing

in the urban centres, it is no longer

the biggest driver in the region. The

employment hubs in Mumbai are the

primary employment drivers. Further,

with IT/ITeS giants evincing interest in

Ghodbunder Road, Thane is witnessing

an increase in office space development

as well. Residential properties in localities

such as Naupada, Panchpakhadi, along

the Eastern Express Highway (EEH) and

Pokhran Road No. 2 are sought after and

command relatively higher prices than

the rest of the market.

Peripheral Central Suburbs

This zone extends to localities such as

Bhiwandi, Kalyan, Kasara and Karjat.

From the real estate development

perspective, the most critical factor

is connectivity, primarily through the

suburban railway network. While these

distant suburbs provide affordable

housing options, they are not self-

sustainable with respect to employment

opportunities. With the absence of

employment hubs in this zone, residents

have to travel to employment hubs in

Mumbai, and are thus dependent on the

rail network.

Navi Mumbai

Developed as a planned satellite city

of Mumbai, this zone is emerging as

a self-sustained real estate market on

account of the presence of employment

opportunities, primarily in the IT/ITeS

sector. While CBD Belapur has been

planned as an office development hub,

the other significant office micro-markets

are Vashi and Thane–Belapur Road

(Trans Thane Creek). This zone has

several options for quality education and

retail, with Vashi and Palm Beach Road

forming the most prominent micro-

market and commanding the highest

property prices in this zone. Connectivity

is mainly through the suburban rail

network, which also connects this zone

with the island city and the Central

Suburbs. Road connectivity is supported

by the Thane–Belapur Road and Palm

Beach Road.

RESEARCH

9

“URBAN TRANSPORT”

UNLOCKING THE REALTY POTENTIAL

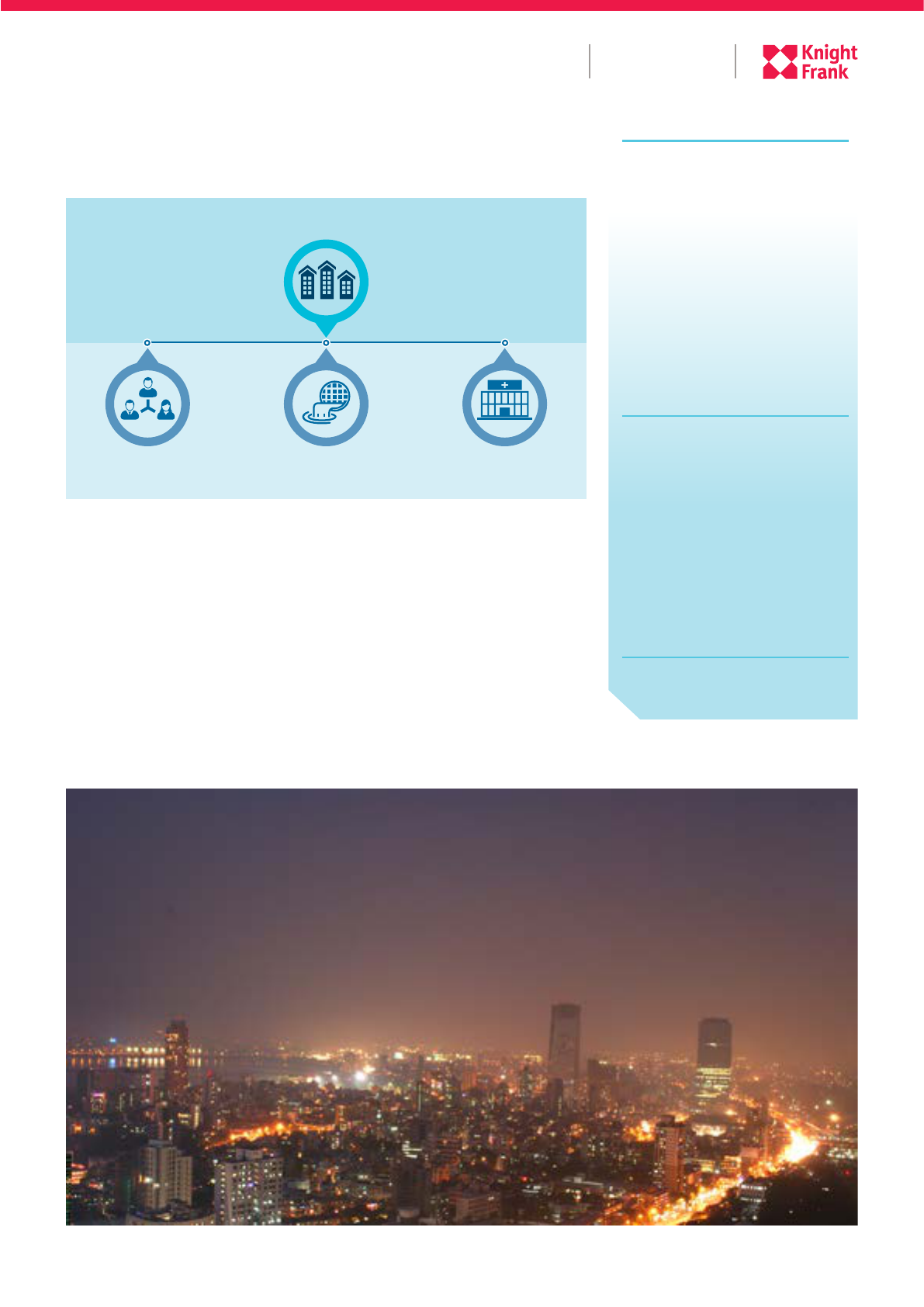

What drives the MMR residential market?

As an extension of the 458 sq km of

Mumbai city, the Mumbai Metropolitan

Region (MMR) is spread over 4,355 sq

km. In the last decade, the population

growth rate of Mumbai was 3.9%, and

40.3% for the rest of the MMR. By

contrast, 80% of the 118 mn sq ft of

the region’s office space is in Mumbai.

These dynamics make the long commute

to work and back inevitable for a large

section of the workforce in the MMR,

and shape the real estate market as well.

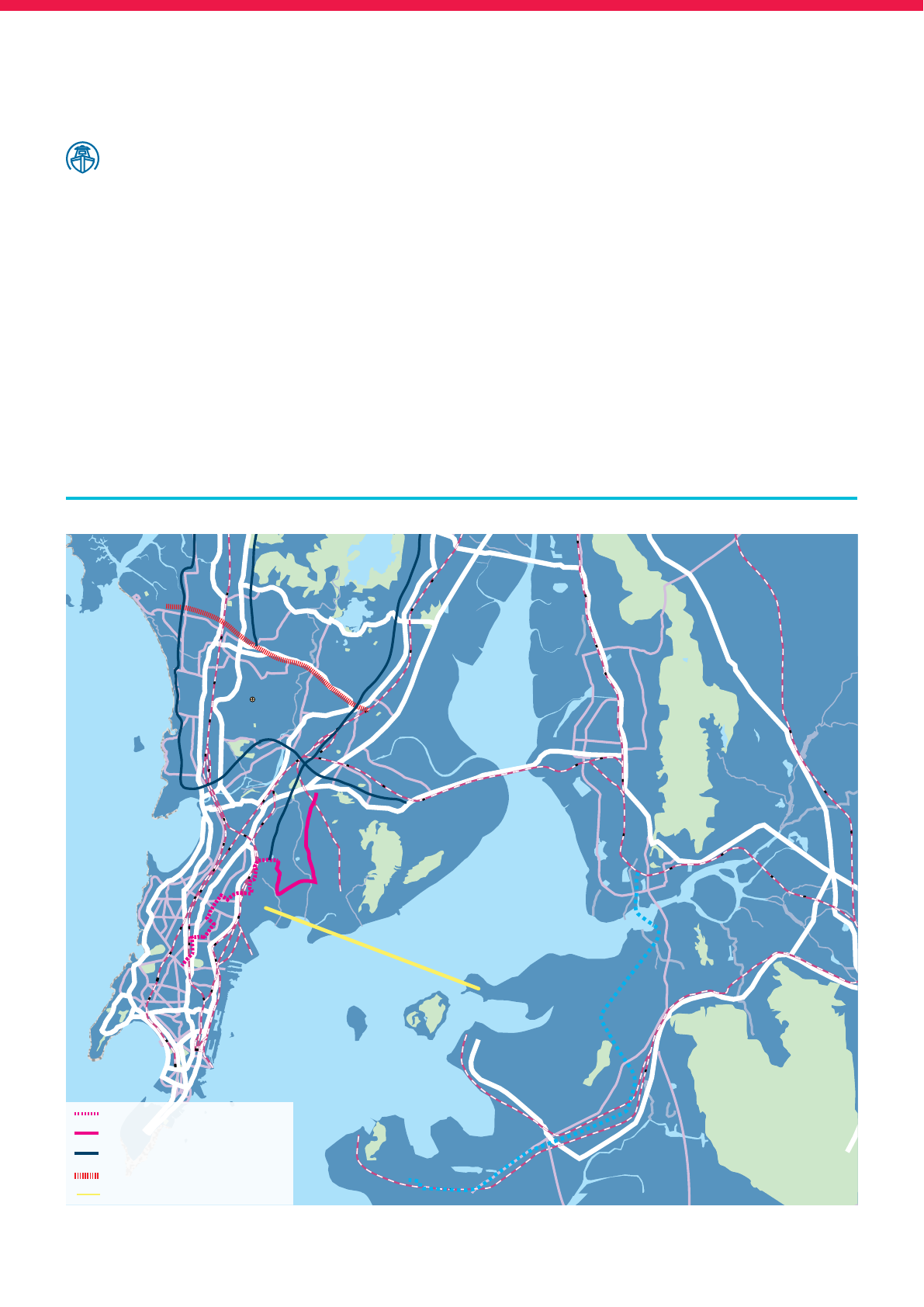

This is also reflected in the high price

gradient of the residential properties in

the region, which varies from `3,000–

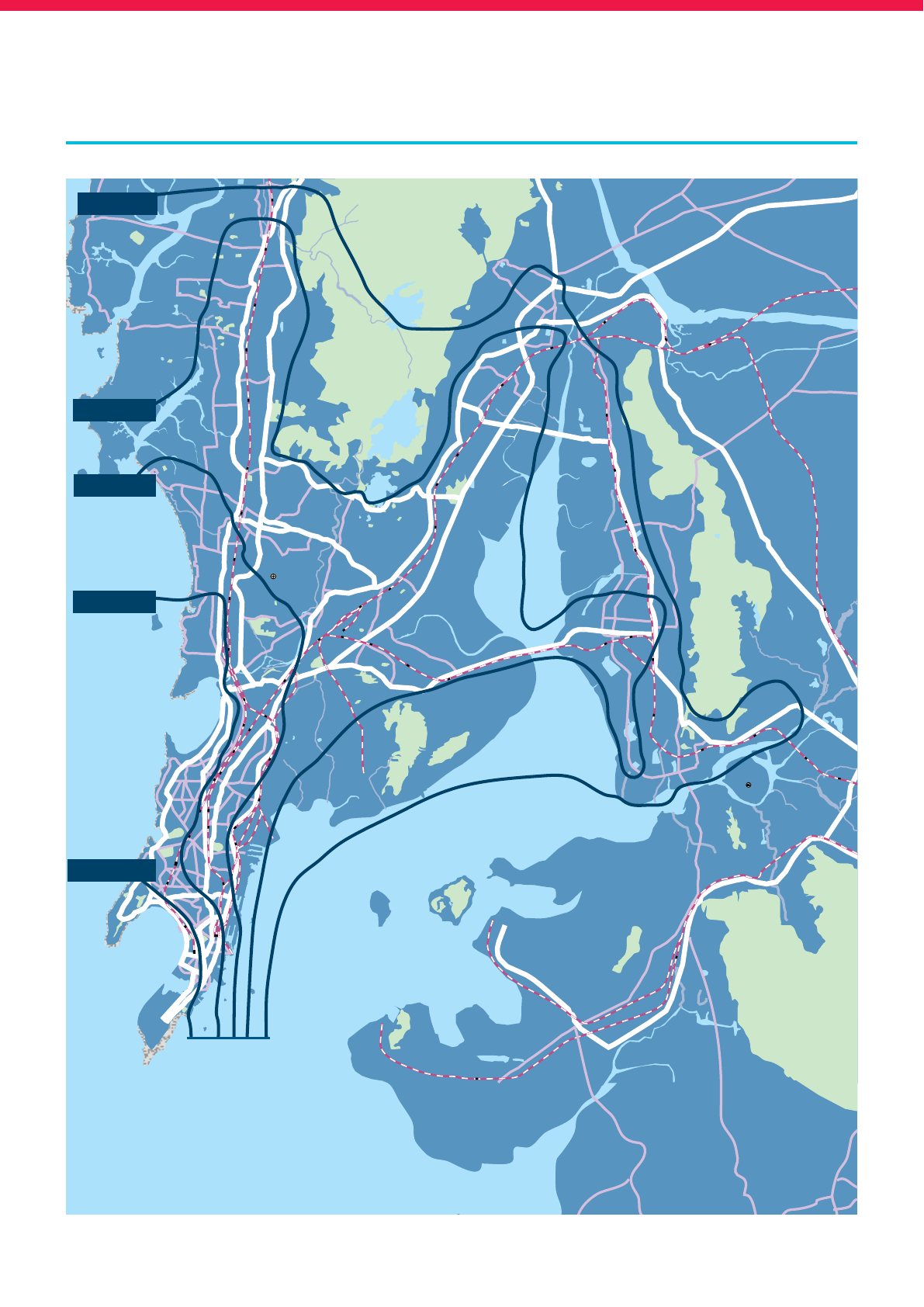

100,000 per sq ft (refer Map 1: City map

with price contours). Such a huge price

variation arises on account of multiple

factors – commuting time to employment

hubs and other places of importance,

access to education, healthcare and

entertainment avenues, location profile

and gentry, etc. These factors vary

across localities, and so does the

property price.

MMR residential market drivers

Employment Physical

infrastructure

Social

infrastructure

In the last decade, the

population growth rate of

Mumbai was 3.9%, and

40.3% for the rest of the MMR.

By contrast, 80% of the 118 mn

sq ft of the region’s office space

is in Mumbai. These dynamics

make the long commute to

work and back inevitable for a

large section of the workforce

in the MMR, and shape the real

estate market as well.

A huge price variation in

residential segment arises

on account of multiple

factors – commuting time to

employment hubs and other

places of importance, access

to education, healthcare and

entertainment avenues, location

profile and gentry.

10

Kharghar

Diva

Kalwa

Mankhurd

Sewri

Ghatkopar

Andheri

Kandivali

Borivali

Dahisar

Dadar

Proposed

International

Airport

Mumbai Airport

NH 4

NH 4

THANE

Nariman

Point

Cuffe

Parade

Malabar

Hills

Lower

Parel

Prabhadevi

Worli

Wadala

Chembur

Sion

Kalina

Juhu

Versova

Madh

Manori

Borivali West

Powai

Kasarvadavali

CBD Belapur

Seawoods

Panvel

Ulwe

JNPT

Airoli

Marve

Colaba

Kurla

Bandra

East

Bandra

West

Santacruz

West

Jogeshwari

West

Malad

West

Malad

East

Goregaon

West

Goregaon

East

Vikhroli

East

Bhandup

West

Mulund

Vashi

NHAVE

SHEVA

Uran

Vile Parle

East

Kanjurmarg

East

Map1: City map with price contours

Source: Knight Frank Research

12,000 `/sq.ft

15,000 `/sq.ft

25,000 `/sq.ft

40,000 `/sq.ft

80,000 `/sq.ft

RESEARCH

11

“URBAN TRANSPORT”

UNLOCKING THE REALTY POTENTIAL

What are the implications of the

infrastructure development in the MMR?

Considering the high price gradient

of `3,000–100,000 per sq ft, the

concentration of office space in Mumbai

whereas high population growth in the

rest of MMR, the role of infrastructure

development, specifically urban transport

projects, is significant.

The suburban rail network has been the

primary mode of commuting to work in

the MMR. Spread over a 319 km route

across the Central, Western and Harbour

corridors, a total of 2,813 train services

are operated daily. The city’s suburban

rail network ferries more than eight million

passengers daily, which is likely the

highest in any urban centre in the world.

An astounding 0.60 mn passengers

travel during the busiest morning rush

hour from 9 to 10 a.m. Similarly, 0.59

mn passengers travel during the busiest

evening peak hour from 6 to 7 p.m. Such

a high traffic flow to employment centres

places great importance on staying

closer to the office markets. Accordingly,

regions in the MMR that enjoy good

However, of the host of infrastructure

projects announced by the government,

we believe that the following ones will

have a significant impact on the way

people commute, and consequently, on

the city’s real estate market.

• Metro rail corridor of Dahisar West – DN Nagar

• Metro rail corridor of Andheri East – Dahisar East

• Coastal Road

• Mumbai Trans Harbour Link (MTHL)

connectivity (travel time and frequency)

have witnessed flourishing property

development.

The Mumbai Metro, considered to be an

efficient and comfortable urban transport

system, has now been integrated into

the development plan for the Mass Rapid

Transit System (MRTS). According to

the 2004 Mumbai Metro Master Plan,

146 km of metro rail network has been

envisaged for the city. Another 106 km is

envisaged for the Navi Mumbai region. At

present, a 11.40 km metro corridor has

been operational since 2014.

We analyse the impact of the operational

metro route and draw expectations for

the subsequent metro route that will be

operational in the next five years.

The city’s suburban

rail network ferries more than

eight million passengers daily,

which is likely the highest

in any urban centre in the

world. An astounding 0.60 mn

passengers travel during the

busiest morning rush hour from

9 to 10 a.m. Similarly, 0.59

mn passengers travel during

the busiest evening peak hour

from 6 to 7 p.m. Such a high

traffic flow to employment

centres places great importance

on staying closer to the

office markets. places great

importance on staying closer to

the office markets.

Considering the high price

gradient of `3,000–100,000 per

sq ft, the concentration of office

space in Mumbai whereas high

population growth in the rest of

MMR, the role of infrastructure

development, specifically urban

transport projects, is significant.

12

What was the need for this metro route?

Metro rail corridors

Operational route: Mumbai Metro Line 1

[ Versova - Andheri - Ghatkopar (VAG) ]

Mumbai is a peninsular city, with the CBD at its southern tip and residential markets growing in the northern suburbs. The city saw

its north–south connectivity develop as office markets such as Nariman Point and Fort got connected with the suburbs through the

suburban rail network.

However, the east–west connectivity lagged behind, and long detours through interchanges at locations such as Dadar and CST are

required. The growing population in the suburbs led to the need for enhanced east–west connectivity.

Kharghar

Mankhurd

Sewri

Ghatkopar

Andheri

Dadar

Proposed

International

Airport

Mumbai Airport

NH 4

Lower

Parel

Prabhadevi

Worli

Wadala

Chembur

Sion

Kalina

Juhu

Versova

Madh

Powai

CBD Belapur

Seawoods

Panvel

Ulwe

Airoli

Kurla

Bandra

East

Bandra

West

Santacruz

West

Jogeshwari

West

Goregaon

West

Goregaon

East

Vikhroli

East

Bhandup

West

Mulund

Vashi

NHAVE

Vile Parle

East

Kanjurmarg

East

Source: Knight Frank Research

Map 2: Versova - Andheri - Ghatkopar Metro corridor

Source: Knight Frank Research

Chart 3: Business district-wise share of MMR office stock

BKC & Off

Central Mumbai

PBD

SBD Central

SBD West

Metro rail - operational

RESEARCH

13

“URBAN TRANSPORT”

UNLOCKING THE REALTY POTENTIAL

How did the project progress?

What was the project’s impact on the residential market?

Timelines

In 2000, the CBD had an office stock of 14 mn sq ft, which was almost 72% of the city’s total stock. The share of the SBD West

business district, which is the primary influence area of the VAG metro corridor, was just 8%. A feasibility study of the VAG corridor

was undertaken that year.

In 2004, the state government approved the metro plan. With frenetic office space development in SBD West, its share in the MMR

office stock increased to 23%. Construction commenced four years later, in 2008, and by that time, the share increased to 33%.The

corridor was opened for public use in 2014, by which time, the share stood at 35%. In 2015, more than a year after the project was

opened for public use, SBD West had an office stock of 40 mn sq ft spread across micro-markets such as Andheri, Jogeshwari,

Goregaon and Malad. By contrast, the share of the CBD has shrunk to 13% at present.

Andheri East is a prominent micro-market

and believed to be favourably impacted

by the VAG metro corridor. We take a

case of a residential property in Andheri

East and draw parallels between the

metro project progress and prices in this

micro-market. We will do this assessment

in two stages, as follows:

Stage 1: Between the state

government’s approval of the project

plan and construction commencement

The state government approved the

project plan in 2004, and after several

delays, the construction commenced

four years later, in 2008. Till this time

nothing changed on the ground as far

as the desired benefits of this project

were concerned. However, during this

Note: SBD West comprises localities such as Andheri, Goregaon and Malad

* All prices mentioned here are average prices

Period VAG metro milestone

MMR office stock

(mn sq ft)

Share of SBD West in

the MMR office stock

Andheri East

residential (`/sq ft)*

2000 Feasibility study 19 8% 2,100

2004

State government

approves the plan

27 23% 2,800

2008

Construction

commencement

47 33% 8,000

2014 Ready for public use 112 35% 15,500

2015 118 34% 16,500

period, the Andheri East residential

property appreciated by 185%, moving

from `2,800 per sq ft to `8,000 per

sq ft. A favourable property market

cycle, coupled with the expectation of

the benefits that would accrue to the

residents, translated into a significant

appreciation in the property prices in

Andheri East.

Stage 2: Between construction

commencement and being ready for

public use

The construction phase lasted six

years, from 2008 to 2014. During this

period,the ground situation remained

the same as far as the project objective

was concerned, and construction-related

issues affected the quality of life for the

residents. However, during this six-year

period, residential property in Andheri

East appreciated by 94%, from `8,000

per sq ft to `15,500 per sq ft.

At present, the VAG metro corridor aligns

predominantly with the office markets

of Saki Naka, Marol, Chakala and the

Andheri-Kurla Road. The 11.4 km metro

route has enhanced the much-needed

east–west connectivity through an MRTS,

and reduced the journey time between

Versova and Ghatkopar from 71 minutes

to 21 minutes. The subject micro-market

of Andheri East witnessed a price

growth of 638% between 2000, when

the feasibility study was undertaken,

and 2014, when the VAG corridor was

opened for public use.

14

What is the need for these planned metro routes?

What are the upcoming metro routes?

With the traffic flow from north to south, i.e. residential markets such as Mira Road, Bhayandar, Dahisar and Borivali, towards offices

in Malad, Goregaon and Andheri, the Western Express Highway and the suburban rail network witness traffic woes. The alignment

of these corridors has been designed to reduce the traffic burden on the heavily-congested Western Express Highway as well as the

Western Railway section of the Mumbai Suburban Railway.

A. Mumbai Metro (part of Line 2) Dahisar West-DN Nagar

This 18.5 km corridor is prioritised by the state government, considering the traffic congestion in the western suburbs. Witha budget

of `6,410 cr, construction is expected to begin in 2016 and be complete in 2019.

B. Mumbai Metro (part of Line 7) Andheri East-Dahisar East

This 16.5 km corridor is prioritised by the state government, considering the traffic congestion in the Western Suburbs. With a

budget of `6,208 cr, construction is expected to begin in 2016 and be complete in 2019.

Andheri East

Kandivali

East

Borivali

Charkop

Dahisar West

Dahisar East

Juhu

Versova

DN Nagar

Madh

Manori

Borivali West

Powai

Kasarvadavali

Marve

Jogeshwari

West

Malad

West

Malad

East

Goregaon

West

Goregaon

East

Bhandup

West

Mulund

Vile Parle

East

Kanjurmarg

East

Source: Knight Frank Research

Map 3: Metro route map

Planned routes:

Metro rail - operational

Metro rail - planned

RESEARCH

15

“URBAN TRANSPORT”

UNLOCKING THE REALTY POTENTIAL

What is the likely impact of the upcoming metro routes on the real estate market?

Akin to the first metro corridor of the city, i.e. VAG, we believe that the upcoming corridors will accrue similar benefits for the

residential pockets in their influence zones. However, the intensity of the impact will vary across the corridors and depend on a host

of factors, such as residential pricing, social and physical infrastructure, and employment opportunities.

In the case of the Dahisar West-DN Nagar metro corridor, a comparison of four en route micro-markets, namely Andheri West,

Goregaon West, Charkop and Dahisar West, has been presented here. The comparison indicates that residential prices are

average at `18,000 per sq ft in Andheri West and decline as we move north. We believe that Charkop and Dahisar West will benefit

immensely on account of this incremental infrastructure that will reduce the commuting time to South and Central Mumbai. In

comparison to Andheri West, residential property in Charkop and Dahisar West is at a discount of 28% and 33%, respectively. While

the discount is on account of several factors (discussed earlier), it will narrow down in line with the progress of the metro project.

Due to this differential pricing, Charkop and Dahisar West will be the biggest beneficiaries of this metro corridor and are likely to

witness a price appreciation in the residential segment.

Price variation across markets on the Dahisar West-DN Nagar metro corridor

Price variation across markets on the Andheri East–Dahisar East metro corridor

Markets likely to benefit from the upcoming Dahisar West-DN Nagar metro corridor

Markets that are likely to benefit from the upcoming Andheri East–Dahisar East metro corridor

Micro-market Approx. distance from Andheri West

Residential prices (`/sq ft)*

Andheri West 0 km 18,000

Goregaon West 4 km 16,000

Charkop 9 km 13,000

Dahisar West 17 km 12,000

Micro-market Approx. distance from Andheri East

Residential prices (`/sq ft)*

Andheri East 0 km 16,000

Goregaon East 4 km 14,000

Kandivali East 9 km 15,000

Dahisar East 17 km 11,000

Influence zones Current price discount from Andheri West

Charkop 28%

Dahisar West 33%

Influence zones Current price discount from Andheri West

Dahisar East 31%

* All prices mentioned here are average prices

* All prices mentioned here are average prices

16

Coastal Road project

Major completed road projects

In the case of the Andheri East-Dahisar East metro corridor, a comparison of four en route micro-markets, namely Andheri East,

Goregaon East, Kandivali East and Dahisar East, has been presented here. The comparison indicates that residential prices average

at `16,000 per sq ft in Andheri East and decline as we move north. We believe that Dahisar East will benefit immensely on account

of this incremental infrastructure that will reduce the commuting time to South and Central Mumbai. In comparison to Andheri East,

residential property in Dahisar East is at a discount of 31%. While the discount is on account of several factors (discussed earlier),

it will narrow down in line with the progress of the metro project. Due to this differential pricing, Dahisar East will be the biggest

beneficiary of this metro corridor and is likely to witness a price appreciation in the residential segment.

The project:

Extending from Kandivali in the Western Suburbs to Nariman Point in South Mumbai, the proposed

35.6 km Coastal Road will ease the traffic congestion in the Western Suburbs. The `12,000 cr

project has secured the forest and CRZ clearances. The bidding process will begin in June 2016

and the project is expected to be completed in 2019.

Santacruz Chembur Link Road (SCLR)

Completed in 2014, the 6.5 km SCLR was among the most awaited arterial roads that enhanced the east-west road connectivity

in the city. The road connects the crucial Western Express Highway to the Eastern Express Highway at Santacruz and Chembur

respectively. En route is the premium office hub of Bandra Kurla Complex (BKC). Earlier, the vehicular movement between the

two markets was heavily dependent on the Sion–Dharavi route, leading to traffic woes. Navigating over the Central Railway tracks

near Kurla station, the SCLR has enabled seamless connectivity between Santacruz and Chembur, reducing the commute time

significantly. A resultant positive impact on property prices has been witnessed in Chembur.

Eastern Freeway

The 16.8 km controlled access Eastern Freeway is an elevated road project in Mumbai connecting P D’Mello Road in South Mumbai

to the Eastern Express Highway at Ghatkopar. Completed in 2014, it serves as a high-speed road corridor connecting the Central

and Eastern suburbs to South Mumbai. The presence of the CBD office markets of Nariman Point, Fort, Colaba and Cuffe Parade

makes South Mumbai an important location in the city. The enhanced connectivity to these office markets through the Eastern

Freeway benefited markets such as Chembur and Wadala in terms of better demand and pricing for residential properties. In fact,

peripheral markets such as Mulund, Thane and Kalyan have also benefited from this enhanced connectivity to the CBD.

Jogeshwari Vikhroli Link Road (JVLR)

The 10.6 km Jogeshwari Vikhroli Link Road has been developed as a crucial arterial road providing east–west connectivity to the

city. The road widening work was completed in 2012 to serve the increased vehicular traffic needs by connecting Vikhroli on the

Eastern Express Highway to Jogeshwari on the Western Express Highway. The office markets in the influence zone are those

of Andheri East, Powai, Goregaon and Malad. Residential micro-markets such as Powai, Kanjurmarg, Bhandup, Mulund and

Thane have benefited on account of the improved connectivity to the listed office hubs in the western zone. Powai, which lacked

MRTS connectivity, has seen significant improvement in residential demand and prices on account of the JVLR during the project

implementation period.

Highlighting the experience of these completed road projects, we draw expectations for the planned projects of Coastal Road and

the Mumbai Trans Harbour Link.

RESEARCH

17

“URBAN TRANSPORT”

UNLOCKING THE REALTY POTENTIAL

What is the need for a coastal road?

The localities across this project’s alignment along the western coastline of the city are densely populated. The road traffic

emanating from residential catchments such as Borivali, Kandivali, Malad and Jogeshwari and moving southwards to the office hubs

of Central and South Mumbai utilises the Western Express Highway, leading to traffic snarls.

The Coastal Road will reduce the road traffic congestion on the overly-burdened Western Express Highway. Running along the

city’s coastline, this road will be the first of its kind. This controlled-access highway will provide high-speed connectivity between the

Western Suburbs and South Mumbai. Although not an MRTS project, the intention is similar to the upcoming metro route of Dahisar

West-DN Nagar.

18

Kharghar

Diva

Kalwa

Mankhurd

Sewri

Ghatkopar

Andheri

Kandivali

Borivali

Dahisar

Dadar

Proposed

International

Airport

Mumbai Airport

NH 4

Thane

Nariman

Point

Cuffe

Parade

Napean

Sea Road

Lower

Parel

Prabhadevi

Worli

Wadala

Chembur

Sion

Kalina

Juhu

Versova

Madh

Manori

Borivali West

Powai

Kasarvadavali

CBD Belapur

Seawoods

Panvel

Ulwe

JNPT

Airoli

Marve

Charkop

Colaba

Kurla

Bandra

East

Bandra

West

Santacruz

West

Jogeshwari

West

Malad

West

Malad

East

Goregaon

West

Goregaon

East

Vikhroli

East

Bhandup

West

Mulund

Vashi

NHAVE

SHEVA

Uran

Vile Parle

East

Kanjurmarg

East

Map 4: Coastal Road route map

Coastal road-planned

Metro rail - operational

Metro rail - under construction

Metro rail - planned

Mono rail - operational

Mono rail - under construction

Source: Knight Frank Research

RESEARCH

19

“URBAN TRANSPORT”

UNLOCKING THE REALTY POTENTIAL

What is the likely impact of the Coastal Road on the real estate market?

Price variation across markets

Markets that are likely to benefit from the upcoming Coastal Road

Micro-market Approx. distance from Colaba

Residential prices (`/sq ft)*

Colaba 0 km 50,000

Napean Sea Road 10 km 75,000

Worli 13 km 35,000

Bandra West 24 km 45,000

Andheri West 34 km 18,000

Goregaon West 39 km 16,000

Charkop 46 km 13,000

Influence zones Current price discount from Napean Sea Road

Goregaon West 79%

Charkop 83%

Residential prices along the alignment of the Coastal Road range between `13,000 per sq ft in Charkopand `75,000 per sq ft

in Napean Sea Road. The variation in real estate drivers, such as access to the office markets, and the social and physical

infrastructure of the micro-market, explains this vast difference in the prices. Among these driving factors, the Coastal Road project

will change the access to the office markets significantly. It will alter the connectivity of these markets significantly, such that the

travel time and distance between the listed markets and other places of importance will see a significant reduction.

While markets such as Colaba, Napean Sea Road, Worli and Bandra West also have premium characteristics, markets such as

Andheri West, Goregaon West and Charkop are driven predominantly by access to the employment hubs in South and Central

Mumbai. In comparison to the most expensive micro-market of Napean Sea Road on this corridor, Goregaon West and the Charkop

residential markets trade at a discount of 79% and 83%, respectively. With the upcoming Coastal Road, the commute time will

shrink significantly along the route and price gaps will narrow down. We foresee markets such as Charkop and Goregaon West to

be the major beneficiaries of this project, and expect a price upside for these markets.

In a similar Knight Frank research titled ‘Residential Investment Advisory Report 2016’, Madh-Marve, nestled between the

Arabian Sea to the west and Malad Creek to the east, was identified as a top investment destination in the MMR. At present, this

destination can be reached via the Malad-Marve road or the ferry service from Versova, Andheri West. Considering the incremental

infrastructure in terms of the upcoming Coastal Road and the Versova-Madh sea bridge, this destination will emerge as a preferred

residential market, leading to a price appreciation from the prevailing `13,500 per sq ft to `26,200 per sq ft – an appreciation of

94% during a five-year time horizon till 2020.

Going forward, the government also plans to extend the Coastal Road up to Mira Road. However, the extension plan, its cost and

route will be estimated once the construction work begins on the existing alignment.

* All prices mentioned here are average prices

20

Mumbai Trans Harbour Link (MTHL) project

The project:

At an estimated cost of `11,000 cr, this 22.5 km, six-lane proposed sea bridge will connect Sewri

in Mumbai to Nhava Sheva in Navi Mumbai. The project has secured the environment clearance,

and the work order will be issued by November 2016, with its completion slated for 2019.

What is the need for the Mumbai Trans Harbour Link?

As a satellite city, Navi Mumbai was envisaged decades ago to decongest Mumbai. In the last two decades, the traffic flow between

Navi Mumbai and Mumbai has increased significantly on account of the growing residential and office developments in the Navi

Mumbai region. This increase in the traffic flow between these twin cities has created a need to enhance the road connectivity,

which is primarily via the Sion Panvel Expressway at present. Further, the existing Mumbai airport has a capacity of 40 mn

passengers, which is almost saturated. Thus, the state government is aggressively pushing the upcoming Navi Mumbai International

Airport, which will handle 10 mn passengers in its first phase, going up to 60 mn passengers by 2030. Phase I of this airport is

expected to be operational by 2019.

Kharghar

Mankhurd

Sewri

Ghatkopar

Andheri

Dadar

Proposed

International

Airport

Mumbai Airport

NH 4

Nariman

Point

Cuffe

Parade

Malabar

Hills

Lower

Parel

Prabhadevi

Worli

Wadala

Chembur

Sion

Kalina

Juhu

Versova

Madh

Powai

CBD Belapur

Seawoods

Panvel

Ulwe

JNPT

Airoli

Colaba

Kurla

Bandra

East

Bandra

West

Santacruz

West

Jogeshwari

West

Goregaon

West

Goregaon

East

Vikhroli

East

Bhandup

West

Mulund

Vashi

NHAVE

SHEVA

Uran

Vile Parle

East

Kanjurmarg

East

Dronagiri

Map 5: MTHL route map

MTHL - planned

Metro rail - operational

Metro rail - planned

Mono rail- operational

Source: Knight Frank Research

Mono rail - under construction

RESEARCH

21

“URBAN TRANSPORT”

UNLOCKING THE REALTY POTENTIAL

What is the likely impact of the MTHL on the real estate market?

Price variation across markets

Price variation across markets

Markets that are likely to benefit from the upcoming MTHL

Micro-market Approx. distance from Sewri

Residential prices (`/sq ft)*

Sewri 0 km 30,000

Nhava Sheva 50 km No organised residential projects

Micro-market Approx. distance from Nhava Sheva

Residential prices (`/sq ft)*

Dronagiri 10 km 3,500

Influence zones Current price discount from Sewri

Dronagiri 88%

Residential prices in Sewri and Nhava Sheva vary by a huge margin. In the Nhava Sheva region, residential project development

has been few and far between, on account of its poor connectivity. A few residential projects by local developers have come up

in Drongiri—a micro-market approximately 10 km from Nhava Sheva—commanding `3,500 per sq ft. By contrast, the host of

premium projects in Sewri offer residential apartments at an average of `30,000 per sq ft.

The 22.5 km MTHL will connect Sewri in Mumbai to Nhava Sheva in Navi Mumbai – an existing route of 50 km through the Sion-

Panvel Highway. Going forward, the planned MTHL project will serve as a critical urban transport project to support the increased

traffic requirements. It will also open up land parcels in the relatively cheaper Uran section of Navi Mumbai for new development.

The prime beneficiary of this incremental infrastructure will be the Dronagiri residential market, which is at an 88% price discount

compared to Sewri. As a result of the MTHL, micro-markets such as Dronagiri and other neighbouring localities in the Nhava Sheva

region are likely to witness an appreciation as the price gap narrows down between the two markets.

Conclusion

With 80% of the employment opportunities based in Mumbai and a high population growth in the rest of the MMR, a long commute

to work is inevitable for a large section of the workforce living in the MMR. With a premium attached to living close to work, this

situation has created a high price gradient of residential properties in the region, which varies from `3,000 per sq ft to `100,000 per

sq ft. This also makes the role of urban transport projects increasingly critical. The upcoming city development plan for Mumbai is

likely to place great importance on transit-oriented development, with a view to align real estate development with the infrastructure

of the larger MMR. In light of such a situation, the upcoming infrastructure projects would provide a fresh lease of life to citizens,

while also benefiting the residential markets, not just in terms of enhanced connectivity to places of importance but also in price

appreciation in the influence zones of these upcoming projects.

* All prices mentioned here are average prices

* All prices mentioned here are average prices

2016

2016

Residential Investment

Sentiment Index

Jan - Mar 2016

VelocitaBrand.com

India Real Estate

July - December 2015

Advisory Report 2016

Viral Desai

National Director - Ofce

Vivek Rathi

Vice President, Research

Mudassir Zaidi

National Director - Residential

mudassir[email protected]

RESIDENTIAL

OFFICE