Real Insight

Residential

April-June 2023

RESEARCH

01

Real Insight Residential – April-June 2023

TABLE OF CONTENTS

1. Overview

2. Property Market Trends

• New Supply

• Sales

• Price

• Unsold Inventory

• Top Trending Realty Hotspots

RESEARCH

Overview

The global economy is making steady progress in recovering from the challenges posed by the

pandemic and Russia's invasion of Ukraine. China's reopened economy is rebounding, while

supply chain disruptions are gradually unwinding. Simultaneously, most central banks'

synchronized tightening of monetary policy is expected to bear fruit as inflation moves back

towards targets.

Amidst this global context, the outlook for Asia and the Pacific remains dynamic, largely driven

by the optimistic prospects of China and India. Both the countries are expected to be the main

drivers of global growth this year, despite the challenges facing the rest of the world.

According to the International Monetary Fund (IMF), the two countries are expected to

contribute about half of global growth, with the rest of Asia and the Pacific contributing an

additional one-fifth.

This positive trend is reflected in India's leading indicators as well. Both the manufacturing and

services Purchasing Managers' Index (PMI) have surpassed the above-50 mark, reaching 57.8

and 58.5, respectively, in June 2023. The unemployment rate has decreased to 7.7per cent in

May 2023 from the previous month's 8.5per cent. Consumption indicators such as fuel, power,

automobile sales, and Goods and Services Tax (GST) collections have maintained upward

momentum throughout the first half of 2023. Additionally, inflation levels in the country have

remained within Central Bank's target range

This growth in consumption across sectors is mirrored in the property markets, which have

sustained their growth momentum in the first half of the year. The primary residential market

in the top-eight cities has witnessed double-digit growth, with new supply and sales recording

a half-yearly year-on-year increase of 44per cent and 15per cent, respectively.

Mumbai and Pune saw the highest growth among the top-eight cities, with 26per cent each in

H1 2023. On a quarterly basis, there is an 11per cent year-on-year increase in supply, while

sales in the primary market registered an 8per cent increase compared to same period of the

preceding year.

The real estate market is currently witnessing an impressive surge, as sales velocity maintains

its momentum, and new supply exceeds demand. Property prices are experiencing a notable

uptick, with all major metros showing a weighted average year-on-year increase of 6-7 per

cent. Notably, key localities in cities such as Gurugram, Hyderabad, and Bengaluru are also

seeing sharp spikes in prices due to a significant demand-supply mismatch, especially for

ready-to-move-in properties.

Even with successive rate hikes followed by a pause from the Central Bank, the market

sentiment remains buoyed by a renewed interest in home ownership. The evidence of this

sustained demand is clearly reflected in our IRIS index, a prominent indicator of upcoming

property demand in key Indian cities, which has consistently maintained a score of 100 during

Q2 2023.

Taking these prevailing trends into account, we hold a strong belief that both sales and supply

will sustain their momentum in the upcoming quarters.

Real Insight Residential – April-June 2023

02

RESEARCH

03

Real Insight Residential – April-June 2023

ALL-INDIA RESIDENTIAL

REAL ESTATE TRENDS

RESEARCH

04

Real Insight Residential – April-June 2023

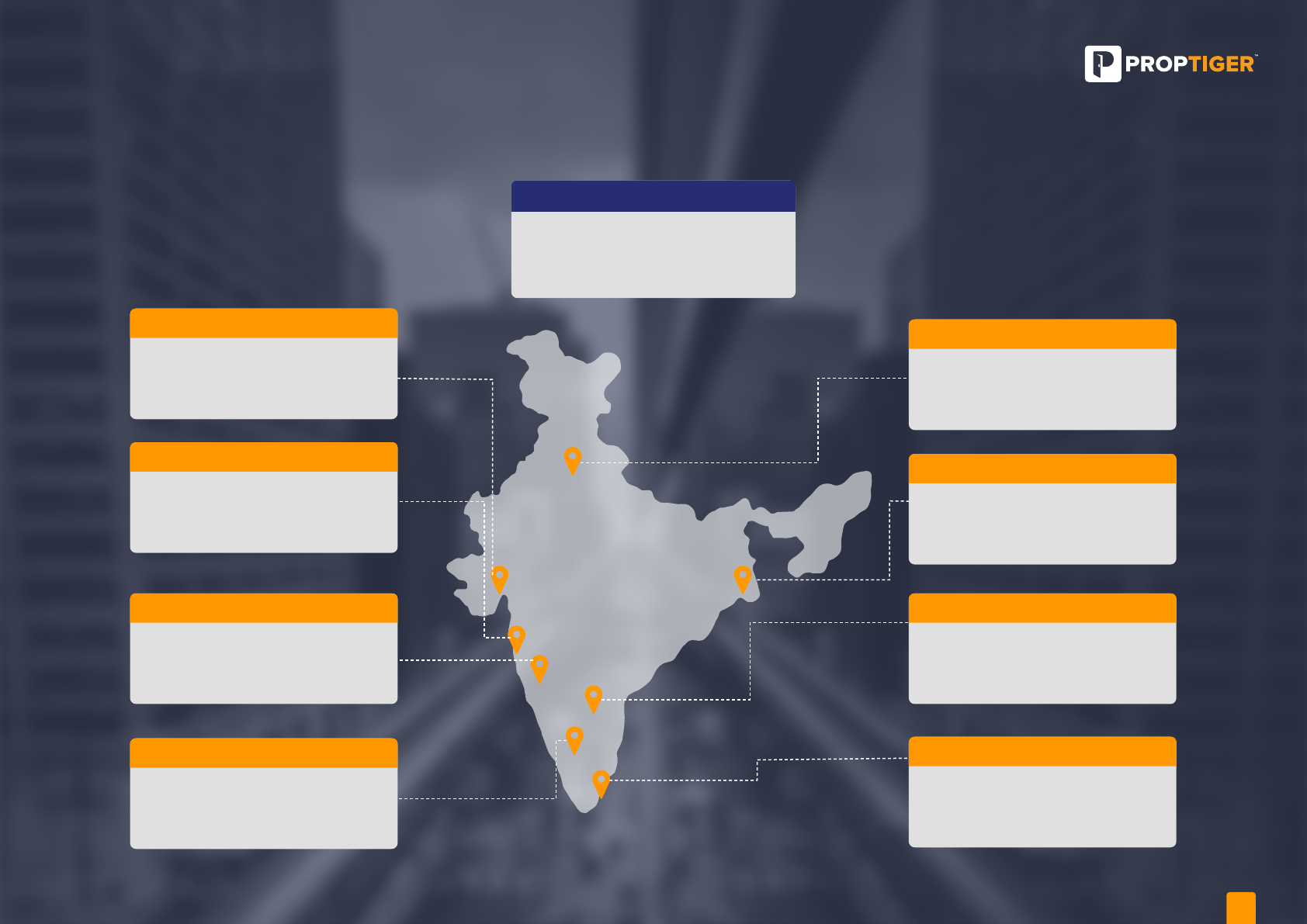

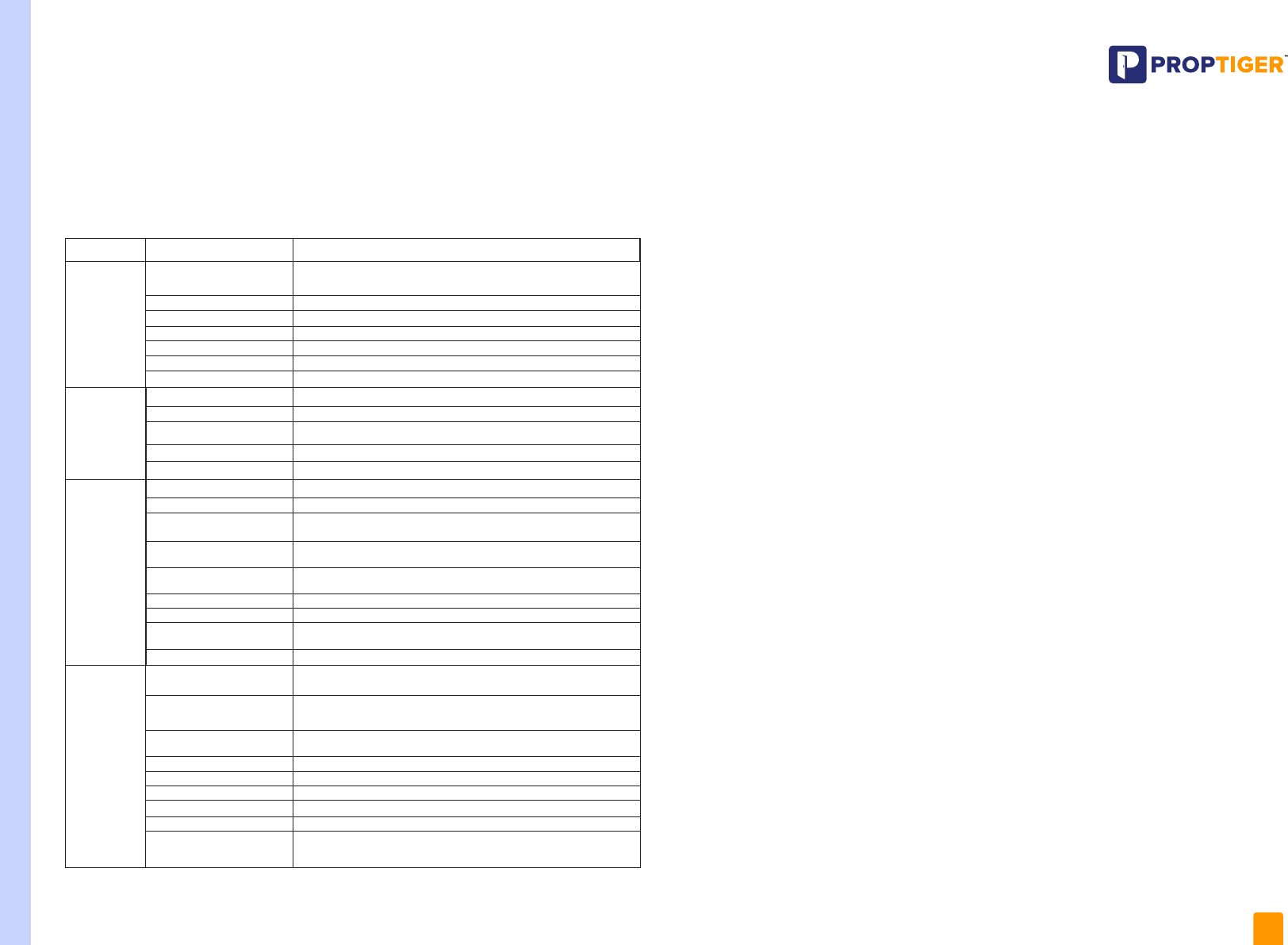

RESIDENTIAL LANDSCAPE Q2 2023

(YoY growth in new supply and demand in Q2 2023)

Source: PropTiger Research

TOP 8 CITIES

New supply

Sales

Inventory overhang

11%

8%

34 months

AHMEDABAD

New supply

Sales

Inventory overhang

126%

17%

33 months

MUMBAI

New supply

Sales

Inventory overhang

-23%

16%

33 months

PUNE

New supply

Sales

Inventory overhang

99%

37%

97 months

BENGALURU

New supply

Sales

Inventory overhang

-37%

-19%

36 months

DELHI NCR

New supply

Sales

Inventory overhang

43%

-28%

72 months

HYDERABAD

New supply

Sales

Inventory overhang

-27%

-3%

39 months

CHENNAI

New supply

Sales

Inventory overhang

-5%

10%

28 months

KOLKATA

New supply

Sales

Inventory overhang

74%

-40%

34 months

RESEARCH

Source: PropTiger Research

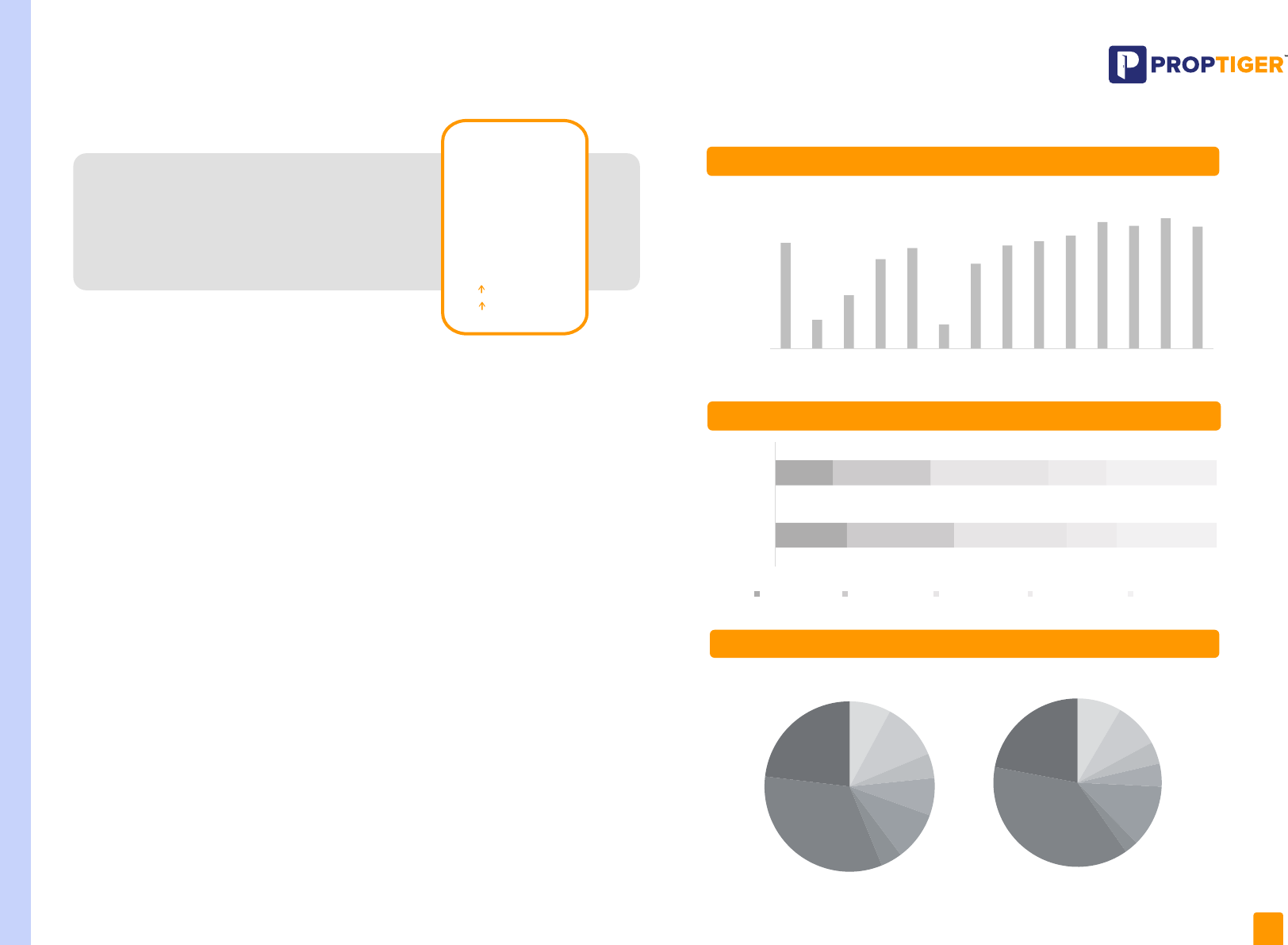

1. New supply

• The new residential supply reached 1.12 lakh units by the end of the April-June 2023

quarter, marking an encouraging year-on-year growth of 11 per cent in Q2 2023 compared

to the same period of the previous year. While there was a sequential drop of 23 per cent,

it's noteworthy that the supply has consistently remained above the 1-lakh mark for five

consecutive quarters. Fuelled by strengthened sentiments for homeownership demand

has kept up pace, instilling confidence in the developers to launch new projects post the

realty downcycle and the pandemic induced lull.

• Mumbai, Pune, and Ahmedabad led the supply tally in the June quarter, accounting for a

significant 72 per cent share from the overall new launches in the top eight cities during Q2

2023. Micro market trends suggest that Thane West and Dombivli in Mumbai and Charholi

Budruk in Pune witnessed maximum new launched in June quarter.

• New supply in the more than INR 45-75 lakh price bracket took the highest share of 33 per

cent, followed by more than INR 1 crore price bracket which accounted a share of 29 per

cent in overall new supply.

• Developers across cities have placed a strong emphasis on the 2 BHK configuration, which

accounted for a 39 per cent share in the total new supply tally, closely followed by the 3

BHK configuration, with a share of 31 per cent. Our consumer sentiment survey indicates a

growing interest in amongst homebuyers for upgrading to larger configurations, likely due

to the work-from-home and hybrid work scenarios across the metros.

• We see developers are placing a strong focus on larger configurations and amenities that

align with evolving consumer preferences post-pandemic. These include healthcare

facilities, safety and security measures, as well as abundant open and recreational spaces.

This shift exemplifies a trend in meeting the changing demands of homebuyers.

Q2 2022

1,02,130

Q1 2023

1,47,790

Q2 2023

1,13,770

11% YoY

-23% QoQ

Ahmedabad, 9%

Bangalore, 12%

Chennai, 2%

Delhi NCR, 3%

Hyderabad, 16%

Kolkata, 2%

Mumbai, 42%

Pune, 13%

Ahmedabad, 19%

Bangalore, 7%

Chennai, 4%

Delhi NCR, 4%

Hyderabad, 11%

Kolkata, 3%

Mumbai, 29%

Pune, 23%

New supply - City-wise share

Source: PropTiger Research

0

50,000

100,000

150,000

Q1 20

Q2 20

Q3 20

Q4 20

Q1 21

Q2 21

Q3 21

Q4 21

Q1 22

Q2 22

Q3 22

Q4 22

Q1 23

Q2 23

Number of units

New supply trend

10%

6%

23%

18%

28%

33%

10%

14%

29%

29%

Q2 2022

Q2 2023

New Supply - Ticket-wise split

< INR 25 lakh INR 25-45 lakh INR 45-75 lakh INR 75-100 lakh > INR 1 crore

Q2 2022

Q2 2023

Note: Units rounded off to nearest thousands.

05

Real Insight Residential – April-June 2023

RESEARCH

2. Sales

• In Q2 2023, property demand across the top-eight cities has sustained its momentum,

witnessing a year-on-year growth of 8 per cent with a total of 80,255 units sold during this

period. However, similar to the new supply, sales experienced a sequential dip of 7 per cent

in the June quarter.

• According to our consumer and market insights, homebuyers are facing challenges in

finding properties that align with their budget and location preferences. For instance, while

58 per cent of the prospective homebuyers are seeking ready-to-move-in (RTMI)

properties, only 19 per cent of the total available options meet this criterion.

• Similar to supply, Mumbai and Pune took the highest combined share of 60 per cent in

overall sales in Q2 2023. Deeper insights indicate that Thane West and Dombivli in

Mumbai and Hadapsar in Pune witnessed maximum traction in the bygone quarter.

• Majority of residential sales in Q2 2023, comprising 27 per cent, were concentrated in the

INR 45-75 lakh price bracket, closely followed by the more than 1 crore price bracket, which

accounted for a 25 per cent share. Notably, this segment has consistently maintained its

share in the overall sales tally post the pandemic and has experienced a growth of 9

percent as compared to the same period in 2019. Mumbai and Pune continued to be the

top contributors to overall sales, jointly accounting for 60per cent of the market share.

• The market is experiencing a complex interplay of factors, with supply surpassing demand,

yet sales velocity struggling to keep up. The impact of consecutive rate hikes varies across

different price brackets, with the lower end facing more challenges. Additionally, the

demand for ready-to-move-in properties is not being met adequately by the current new

supply. All these factors, combined with increased input costs and demand-supply

mismatch, have led to a situation where some homebuyers are currently in a wait and watch

mode about entering the market.

Source: PropTiger Research

Q2 2022

74,320

Q1 2023

85,840

Q2 2023

80,250

8% YoY

-7% QoQ

Note: Units rounded off to nearest thousands.

Ahmedabad, 8%

Bangalore, 11%

Chennai, 5%

Delhi NCR, 7%

Hyderabad, 9%

Kolkata, 4%

Mumbai, 33%

Pune, 23%

Ahmedabad, 8%

Bangalore, 9%

Chennai, 4%

Delhi NCR, 4%

Hyderabad, 12%

Kolkata, 3%

Mumbai, 38%

Pune, 22%

- City-wise split

Source: PropTiger Research

16%

13%

24%

22%

26%

27%

11%

13%

23%

25%

Q2 2022

Q2 2023

Property sales

Property sales

- Ticket-wise split

< INR 25 lakh INR 25-45 lakh INR 45-75 lakh INR 75-100 lakh > INR 1 crore

0

20,000

40,000

60,000

80,000

100,000

Q1 20

Q2 20

Q3 20

Q4 20

Q1 21

Q2 21

Q3 21

Q4 21

Q1 22

Q2 22

Q3 22

Q4 22

Q1 23

Q2 23

Number of units

Property sales

Q2 2022

Q3 2023

06

Real Insight Residential – April-June 2023

RESEARCH

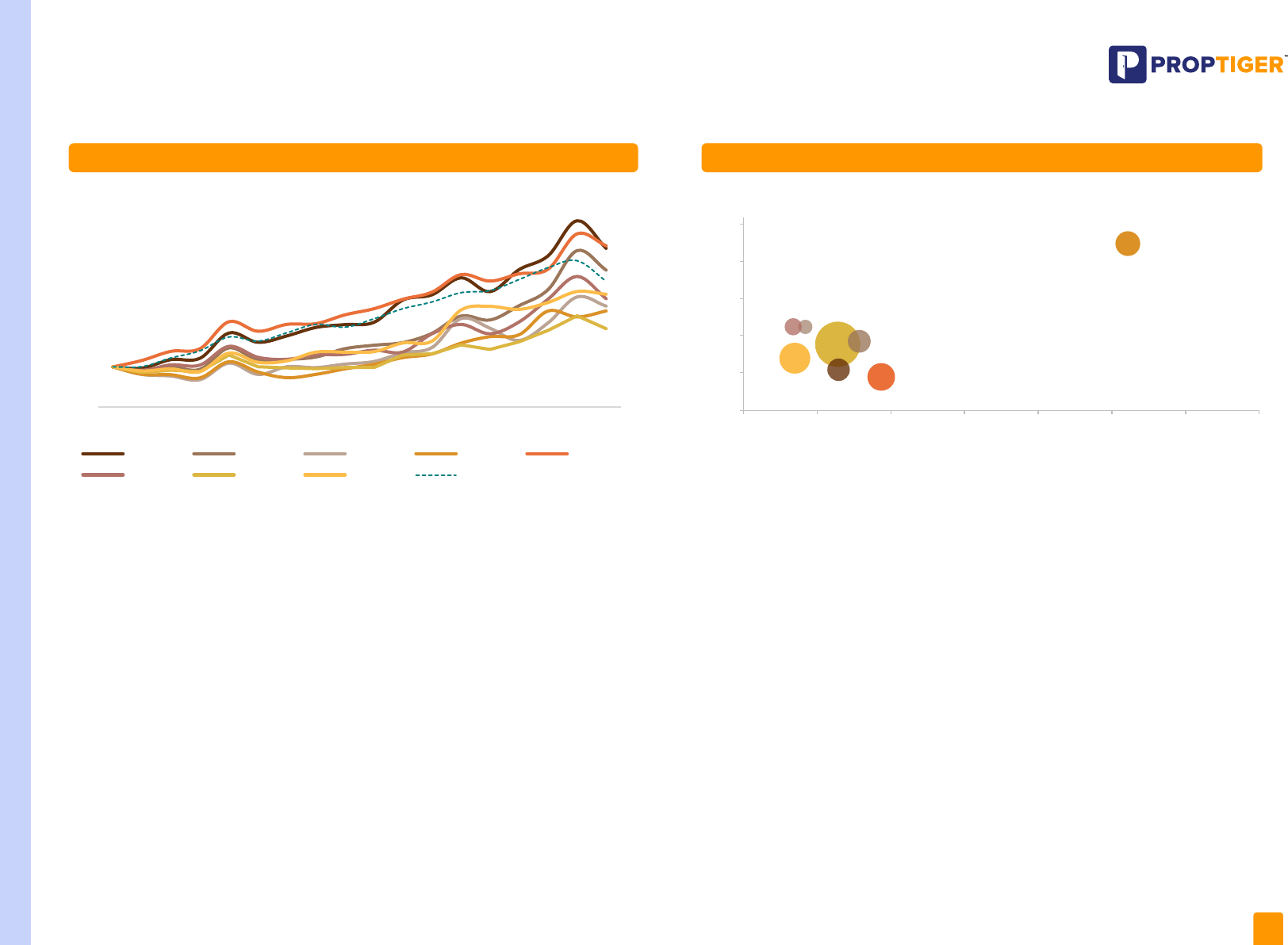

* Weighted average price as per new supply and inventory adjusted to CPI inflation. Base year for index is 2019.

Source: PropTiger Research

3. Price 4. Unsold Inventory

• Property prices for new supply and available inventory in the top eight cities recorded a 6 per

cent YoY uptick in Q2 2023. Partial passing-on the increased input cost on to the

homebuyers, premium attached to the much in demand but limited in supply

ready-to-move-in property and increasing interest rates have all contributed to the post

pandemic spike in property prices across cities.

• Major metros registered a weighted average year-on-year increase of 6-7 per cent, with key

localities in Gurugram, Hyderabad, and Bengaluru witnessing sharp double-digit spikes in

prices due to a demand-supply mismatch, particularly for ready-to-move-in properties.

• Gurugram and Bengaluru emerged as the frontrunners in property price growth in Q2 2023,

boasting a year-on-year 12 per cent and 9 per cent respective increase in capital values.

• The unsold inventory in the top eight cities at the end of March 2023 stood at 9.44 lakh

units, registering concerning a year-on-year increase of 24 per cent in Q2 2023. With the

new supply outpacing sales velocity, unsold inventory levels have been pushed to a

three-year high.

• Despite steady sales, Mumbai, Pune together accounted for a share of 52 per cent in the

overall 9.44 lakh unsold units in the second quarter of 2023.

• Hyderabad recorded the highest uptick of 52 per cent YoY in unsold inventory in Q2 2023

compared to top-eight cities. The city has witnessed significant influx of fresh units post

the pandemic. However, the sales momentum hasn't kept pace with this surge, leading to

an increase in unsold inventory.

• The inventory overhang across the top-eight cities remained unchanged at 34 months at

the end of Q2 2023, same as the corresponding period in the previous year. At the current

sales velocity, it will take at least 2.8 years to liquidate the current primary market unsold

stock staggered across different stages of construction in the top- eight cities.

* Unsold inventory as of June 2023

Source: PropTiger Research

90

100

110

120

130

140

Q1 19

Q2 19

Q3 19

Q4 19

Q1 20

Q2 20

Q3 20

Q4 20

Q1 21

Q2 21

Q3 21

Q4 21

Q1 22

Q2 22

Q3 22

Q4 22

Q1 23

Q2 23

Ahmedabad Bengaluru Chennai Delhi NCR Hyderabad

Kolkata Mumbai Pune CPI

Ahmedabad

Bengaluru

Chennai

Kolkata

Delhi NCR

Hyderabad

Kolkata

Mumbai

Pune

0

20

40

60

80

100

20

30

40 50 60 70 80 90

Age of unsold inventory (Months)

Inventory Overhang (Months)

Weighted average price*

City-wise - Unsold inventory and inventory overhang

07

Real Insight Residential – April-June 2023

RESEARCH

TOP TRENDING REALTY HOTSPOTS

(City-wise top-3 localities ranked as per residentials sales)

Source: PropTiger Research

AHMEDABAD

Nava Naroda

Shela

Gota

INR 3,300-3,500 /sq.ft

INR 4,600-4,800 /sq.ft

INR 4,500-4,700 /sq.ft

MUMBAI

Thane West

Dombivli

Panvel

IINR 10,900-11,100 /sq.ft

INR 6,500-6,700 /sq.ft

INR 6,200-6,400 /sq.ft

PUNE

Hadapsar

Charholi Budruk

Tathawade

INR 6,300-6,500 /sq.ft

INR 5,600-5,800 /sq.ft

INR 5,000-5,200 /sq.ft

BENGALURU

Whitefield

Varthur

Sarjapur

INR 6,200-6,400 /sq.ft

INR 5,400-5,600 /sq.ft

INR 6,500-6,700 /sq.ft

KOLKATA

New Town

Joka

Rajarhat

INR 4,600-4,800 /sq.ft

INR 3,600-3,800 /sq.ft

INR 4,000-4,200 /sq.ft

HYDERABAD

Kollur

Kokapet

Bachupally

INR 4,800-5,000 /sq.ft

INR 7,700-7,900 /sq.ft

INR 5,400-5,600 /sq.ft

CHENNAI

Manapakkam

Sholinganallur

Pallikaranai

INR 5,900-6,100 /sq.ft

INR 5,300-5,500 /sq.ft

INR 5,700-5,900 /sq.ft

DELHI NCR

Sector 1 Noida Extension

(Greater Noida)

Sector 150 (Noida)

Raj Nagar Extension

(Ghaziabad)

INR 3,700-3,900 /sq.ft

INR 5,600-5,800 /sq.ft

INR 3,400-3,600 /sq.ft

* Weighted average price as per new supply and inventory adjusted to CPI inflation.

08

Real Insight Residential – April-June 2023

RESEARCH

Real Insight Residential – April-June 2023

09

New supply:

Sales:

Unsold inventory:

Inventory overhang:

Sales velocity:

Price:

Note:

Analysis in the report includes apartments and villas only. RERA registration

date is considered as day zero for

recording new supply and sales.

Glossary

City Micro market Prominent localities

Ahmedabad Ahmedabad Central Ellisbridge, Paldi, Saraspur, Vasna

Ahmedabad East Bapu Nagar, Nava Naroda, New Maninagar, Nikol, Odhav, Vastral

Ahmedabad North Chandkhera, Gota, Motera, Nana Chiloda, Ranip, Vadsar

Ahmedabad South Vatva, Narol, Narolgam, Isanpur, Changodar

Ahmedabad West Bopal, Ghuma, Shela, Sarkhej, Shilaj, Sanand, Vastrapura

SG Highway Near Nirma University On SG Highway, Near Vaishno Devi circle on SG Highway,

Thaltej, Chanakyapuri

Gandhinagar Urjanagar, Sargaasan, Gift City, Zundal, Rayson

Bengaluru Central Bengaluru Ashok Nagar, Richmond Town, Marathahalli, Bellandur, Frazer Town, Koramangala,

East Bengaluru Whitefield Hope Farm Junction, CV Raman Nagar, KR Puram, Mahadevapura,

Harlur, Sarjapur, ITPL, Varthur, Budigere Cross

North Bengaluru Yelahanka, Doddaballapur, Hebbal, Thanisandra, Jakkur, Kodigehalli, Kannur

North East Bengaluru Horamavu, Devanahalli, Narayanapura, Hennur, Banaswadi, Kalyan Nagar

North West Bengaluru Jalahalli, Yeshwantpur, Nelamangala Town, Rajaji Nagar, Near Peenya Industrial

Area

South Bengaluru Begur, JP Nagar, Bommanahalli, Gottigere, Hosa Road, Padmanabha Nagar,

Hulimavu

South East Bengaluru Electronics City, Hosur, Anekal City, Jigani, Chandapura, Attibele, Bommasandra,

Narayanaghatta, Avalahalli

West Bengaluru Kumbalgodu, Kengeri, Nagarbhavi

Chennai Chennai Central Anna Nagar, Alwarpet, Guindy, Raja Annamalai Puram, Vadapalani

Chennai North Perembur, Madhavaram, Kolathur, Ponneri

Chennai South Perrumbakkam, Mambakkam, Thiruporur

Chennai West Avadi, Koyembedu, Manapakkam, Mangadu, Mogappair, Vanagram, Thirumazhisai,

Mevalurkuppam, Ambattur

ECR Injambakkam, Thiruvanmiyur, Kanathur Reddikuppam

GST Guduvencheri, Perungalathur, Singaperumal Koil, Orgadam, Maraimalai Nagar,

Tambaram, Chromepet

OMR Padur, Perungudi, Sholinganallur, Siruseri, Thalambur, Medavakkam, Kelambakkam,

Tiruporur Near Kelambakkam Vandalur Kelambakkam Road Moolacheri,

Nallambakkam

Delhi-NCR Faridabad Ballabhgarh, Greater Faridabad, Hodal, NH2, Surajkund

Ghaziabad Ghaziabad Central, Indirapuram, Kaushambi, NH 24, NH57, NH58, Sahibabad,

Vaishali, Vasundhara, Bhopura

Greater Noida Noida Extension, Yamuna Expressway (Chi 5, TechZone),Bodaki, Eta, Beta,

Knowledge Park, Omnicron, Pi, Surajpur, Swarn nagari, Zeta

Gurugram Dwarka Expressway (Sector 35-37,84, 88, 89, 99,102-113), Golf Course Extension

Road (Gwal pahari, sector 59 - 63, 65), Gold Course Road (Sector 28, 42, 54),

Gurgaon Central, Manesar, New Gurgaon (Sector 76-82,85-93, 95), Old Gurgaon,

Sohna & Sohna Road (Sector 48,67,68), Southern Peripheral Road (Sector 69 - 72)

Noida Noida Expressway (Sector 45, 94, 104, 108, 110, 128, 135, 143,144, 150 - 152, 168),

Yamuna Expressway (Sector 17, 19, 22A 22D,25) , FNG Expressway (Sector 113, 118,

119, 121 ), Dadri Road (Sector 80, 107), Near City Center (Sector 32, 43, 50, 73 - 79)

Geographical spread of report

RESEARCH

City Micro market Prominent localities

Hyderabad Hyderabad West Hitec City, Gachibowli, Manikonda, Narsingi, Serilingampally, Nallagandla

Gachibowli, Kondapur, Chandanagar, Hafeezpet, Bachupally, Miyapur

Hyderabad North Kompally, Tellapur, Kukatpally, Nizampet, Bolarum, Bahadurpally, Shamirpet

Hyderabad South Saidabad, Kismatpur, Maheshwaram, Shadnagar, Rajendra Nagar

Hyderabad East LB Nagar, Nagole, Hayathnagar, Vanasthalipuram, Uppal Kalan, Saroor Nagar

ORR South Bongloor, Shamshabad, Adibatla, Pocharam

Secunderabad Mallapur, Yapral, Sainikpuri, Alwal, AS Rao Nagar

Hyderabad Central Somajiguda, Ameerpet, Himayat nagar, Jubilee Hills, Begumpet, Banjara Hills

Kolkata Kolkata East New Town, Rajarhat, Salt Lake city, Tangra, Beliaghata

Kolkata North Dum Dum, Madhyamgram, Barasat, Barrackpore, Lake Town, Rishra

Kolkata South Baruipur, Behala, Joka, Garia, Narendrapur, Sonarpur, Uttar Gauripur, Tollygunge,

New Alipore, Mukundapur

Kolkata West Serampore, Howrah, Uttarpara Kotrung, konnagar

Kolkata Central Sealdah

Andheri to Dahisar Andheri, Borivali, Dahisar, Goregaon, Jogeshwari, Kandivali, Malad

MetrWorli to Andheri Bandra, Dharavi, Juhu, Khar, Mahim, Santacruz, Ville Parle

Central Mumbai Bandra Kurla Complex, Bhand up, Ghatkopar, Kanjurmarg, Kurla, Matunga, Mulund,

Powai, Sion, Vikhroli

Mumbai South Colaba, Narimat Point, Dadar, Worli, Byculla, Mahalaxmi, Parel, Lower Parel,

Girgaon, Prabhadevi

Mumbai Harbour Sewri, Wadala, Chembur, Mazegaon, Mira Road and Beyond Mira Road, Vasai,

Virar, Nala Sopara, Bhayandar, Boisar, Naigaon East, Palghar

Navi Mumbai Airoli, Belapur, Kharghar, Taloja, Dronagiri, Ghansoli, Karanjade, Ulwe, Vashi, Warai

Thane Thane East & Thane West

Beyond Thane Ambernath, Badlapur, Bhiwandi, Dombivali, Kalyan, Karjat, Neral, Vangani, Ambivali,

Anjurdive, Ulhas Nagar, Shil phata

Panvel and Beyond Panvel, Khopoli, Rasayani, Khalapur, Kewale, Umroli, Pen, Chowk

Pune PCMC Chikhali, Ravet, Wakad, Tathawade, Moshi, Mamurdi, Jambhul, Pimpri, Rahatani,

Gahunje, Chinchwad

Pune South Dhayari, Kondhwa, Undri, Ambegaon Budruk, Phursungi, NIBM Annex

Mohammadwadi, Handewadi, Shirwal, Shivapur, Baramati, Nasrapur, Katraj,

Bibwewadi

Pune West Hinjewadi, Pirangut, Bavdhan, Mahalunge, Baner, Mugawade, Balewadi, Bhukum,

Kothrud, Kamshet, Bhugaon

Pune North Talegaon Dabhade, Alandi, Chakan, Dhanori, Rajgurunagar, Dehu

Nagar Road Wagholi, Kharadi, Lohegaon, Lonikand, Sanaswadi

Pune Solapur Highway Hadapsar, Manjari, Uruli Kanchan, Loni Kalbhor

Mumbai Pune Bypass Vadgaon Budruk, Sus, Warje, Shivane, Karve Nagar

Pune East Mundhwa, Bakhori, Kedagaon, Daund

Pune Center Sopan Baug, Deccan Gymkhana, Parvati Darshan, Shivaji Nagar

Mumbai

Metropolitan

Region

10

Real Insight Residential – April-June 2023

RESEARCH

IRIS Index

JUNE 2021 Edition

Recent Report Publications

July - September 2022

Real Insight (Residential)

Q3 2022

January-March 2023

Real Insight (Residential)

Q1 2023

Residential Realty Consumer

Sentiment Outlook H1 2022

The Silver Economy -

A perspective on senior

living in India 2022

Investment Check -

Land Vs Built-up 2022

Residential Realty Consumer

Sentiment Outlook H2 2021

Housing Price Index

2021

PropTech - The future of

Real Estate in India 2021

Time for Internal

Globalisation 2020

Bricks to Clicks: Smart Homes

in India - A Luxury No More

PropTiger Research is part of PropTiger.com which is owned by Singapore-based Elara Technologies, which also owns Housing.com

and Makaan.com. The Group advises clients ranging from individual owners and buyers to major developers. Backed by strong

research and analytics, our experts provide comprehensive real estate services that cover advertising, marketing, mandating

business solutions for real estate stakeholders, negotiations, home loans, consulting and post-sales service. Headquartered in

Gurugram, Haryana, we have 14 oces across India. For further details about the Company, please visit www.proptiger.com.

PROPTIGER RESEARCH

PROPTIGER RESEARCH

Renuka Kulkarni

Assistant Manager

Research |Growth & Marketing

Housing.com|PropTiger.com|Makaan.com

Yasir Anjum

Associate Creative Manager

Growth & Marketing

Housing.com | PropTiger.com | Makaan.com

yasir[email protected]

GRAPHICS

Kolkata

Anirban Banerjee

Senior Area Head

9593975075

anirban.banerjee@proptiger.com

Bengaluru

Ritesh Negi

City Head

+91 8197981548

ritesh.negi@proptiger.com

Chennai

Kaushik Chaudhary

City Head

+91 9535963101

kaushik.chaudhary@proptiger.com

Ahmedabad

Kamal Chandani

City Head

+91 9099119933

kamal.chandani@proptiger.com

CONTACT OUR KEY EXPERTS

Delhi NCR

Ankit Khanna

City Head

+91 9999422442

ankit.khanna@proptiger.com

Hyderabad

Manikantha Kumar Avvaru

City Head

8008436168

manikantha.kumar@proptiger.com

Mumbai

Nitin Gautam

Regional Business Head – West

+91 9167977324

nitin.gautam@proptiger.com

Pune

Subrato Raha

Senior City Head

+91 9702656221

subrato.raha@proptiger.com

Disclaimer:

Ankita Sood

Director & Head of Research |Growth & Marketing

Housing.com|PropTiger.com|Makaan.com

ankita.sood@proptiger.com

Research Enquiries

Vikas Wadhawan

Chief Financial Officer

REA India & Business Head

Housing.com | PropTiger.com|Makaan.com

vikas.wadhawan@proptiger.com

Business Enquiries

The analysis presented on real estate trends in India are indicative of

market trends. The data has been tracked and collected across eight

cities for nearly 20,000 projects. Utmost care has been taken to provide

the complete market picture however these trends present the best case

scenario and should not be relied upon in anyway. The data for sales is

collected through primary survey carried out by our field agents and the

data for new launches is as per the projects registered under the Real

Estate Regulatory Act (RERA). The report published is for general

information only. Although high standards have been used for analysis in

this report, no responsibility or liability whatsoever can be accepted by

PropTiger.com for any loss or damage resulting from any use of, reliance

on or reference to the content of this document. As a general report, this

material does not necessarily represent the views of PropTiger.com in

relation to particular properties or projects. Reproduction of this report in

whole or in part is nor allowed without prior written approval of

PropTiger.com to the form and content within which it appears.

Download our reports and presentations

at housing.com/research-reports

For more insights and trends reach

out to research@proptiger.com

OR

FOLLOW US ON

Head oce: Echelon Square, Plot No-25, Sector-32, Gurugram

PIN-122001 (Haryana), India | 0124-4866700

RESEARCH RESEARCH